Posts

-

How to budget for retirement

Unsure whether you have enough saved to retire? First you need to work out how much you are likely to spend. Luckily, there are tools for that.

-

The cost of residential aged care

In the name of fairness and sustainability, the way you pay for residential aged care, and the amount, has changed.

-

Understanding My Aged Care: What it does and how to use it

If you or a loved one needs Government-subsidised aged care support, at home or in a purpose-built facility, your first port of call is My Aged Care.

-

Need care at home? We look at where to find it and what it costs

Aged care reforms are changing the ways in-home care is provided to older Australians, and how much they will pay for services.

-

What type of people have SMSFs?

If you think SMSFs are just for old wealthy Australians, think again. Increasingly, younger people and women are also embracing the self-managed ethos.

-

Protecting your super from cyber attacks and scams

Super scams are increasingly sophisticated and on the rise so it pays to learn how to detect and avoid them.

-

How do ETFs compare to LICs/LITs and managed funds?

Managed investments offer instant diversification, but there are important differences between the types of funds on offer – from cost to legal structure.

-

Lifecycle super funds: What they are and how they perform

Lifecycle funds are designed to reduce risk as you near retirement without sacrificing returns; recent research shows many do just that but you need to know what to look for.

-

Super news for October 2025

Changes announced to Div 296 and LISTO, few super funds get retirement tick of approval; Taxing times for $3m funds; Rest, Macquarie in regulator’s sites; Aware Super/TelstraSuper merger.

-

How LISTO works (Low Income Superannuation Tax Offset)

The Low Income Super Tax Offset is a government rebate that can help boost your super and make saving for retirement a little easier.

-

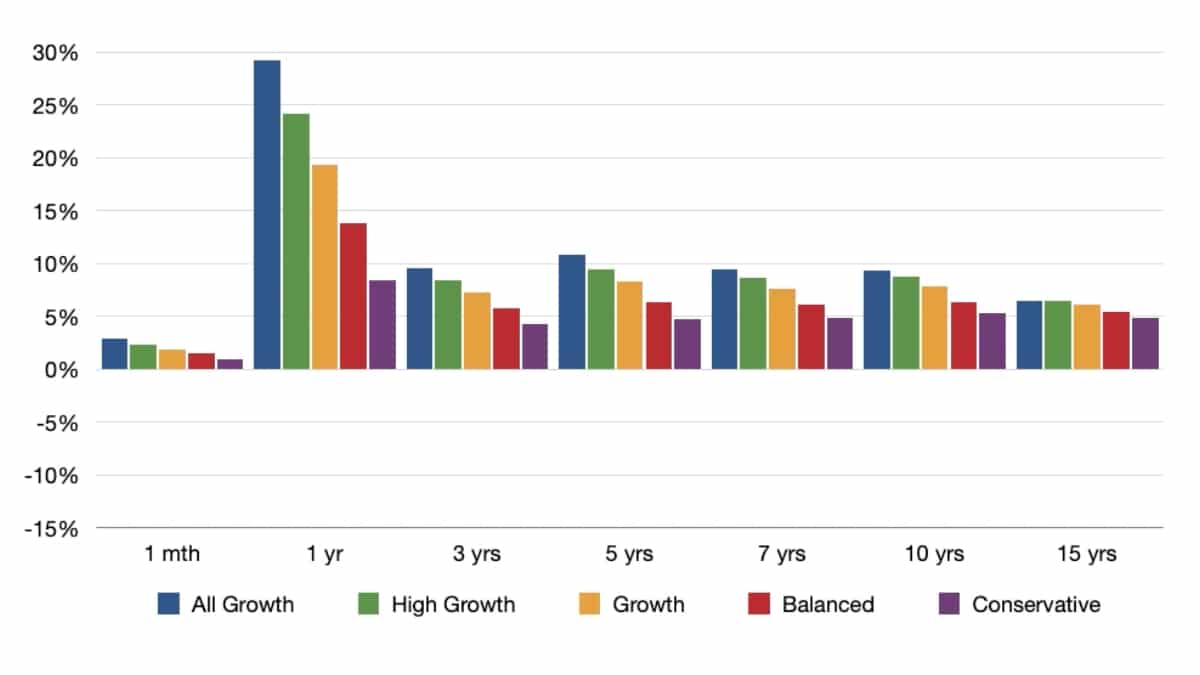

The big picture: Focus on super’s long-term returns

They say a picture is worth a thousand words, so we’ve created a visual representation of super’s value in the long run.

-

How can I top up my super pension?

Contributions can’t be added directly, so how do you get additional savings across into a pension? Find out your options and what to consider.

-

Investing in retirement: Balancing risk, income and longevity

In this video interview we’re tackling one of the biggest challenges facing retirees – how to invest once you’ve stopped working and started drawing down on your savings.

-

Getting financial advice? What your adviser needs to provide

Financial advice is strictly regulated, so it pays to understand what you can and can’t expect from an adviser before you set up your first meeting.

-

The sprint finish: How to boost your super before retirement

If you are ready to retire but your super balance isn’t, don’t despair. Here are some handy strategies to give your super a last minute cash injection.

-

Why financial literacy is vital for a good retirement

In an increasingly complex world, understanding finance and financial products can make a wealth of difference to your future health and happiness.

-

Can I live or stay in my SMSF property?

Direct property investing is popular with SMSFs, but do you know the rules around staying or living in your SMSF owned property? What about the rules when you retire?

-

SMSF investing: 20 most popular LICs/LITs

Listed investment companies and trusts are facing stiff competition from cheaper ETFs and passive index funds, but have a place in many SMSF portfolios.