Member testimonials

What our members say

Choose a membership for your stage of life

Super booster

Retirement planner

Retiree

5 reasons to become a member today

Small changes can make a big difference

Our straightforward guides can show you quick and easy ways to save tax and boost your super or your income in retirement. If you can set aside just ten minutes, you could add thousands to your retirement savings.

Get guidance from independent experts

SuperGuide’s team of experts have your best interests at heart. We’re completely independent so you get up-to-date unbiased information that you can trust.

Retirement doesn’t just happen

Planning your retirement can be exciting, but also feel overwhelming, and it’s hard to know where to start. We can give you clarity to get your plans moving, all the way through to preparing for and starting your dream retirement.

Make more informed decisions

Even if you’ve retired, you still have a lot of important decisions to make, whether it’s how to spend your super, estate planning or aged care. The choices you make can have a big impact so it pays to be informed.

Membership pays for itself

SuperGuide is great value and can save or earn you money, whether it’s better returns in retirement or understanding the concessions available to seniors. We also negotiate member discounts for complementary businesses.

Benefits

What makes SuperGuide different

We’re independent

We’re experts

We’re comprehensive

What’s included in your SuperGuide membership?

Step-by-step guides

Planning your retirement just got easier. Follow our step-by-step guides and checklists to make your hard-earned super work hard for you.

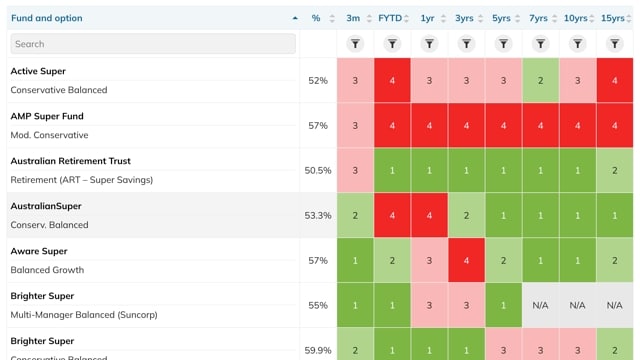

Super fund rankings

Make sure your super fund is a top performer. Benchmark your fund with up-to-date super and pension fund performance rankings.

Interactive tools and calculators

Take control of your retirement. Our intuitive tools and calculators give you the power to plan and make your retirement goals a reality.

Webinars and newsletters

Monthly webinars and newsletters keep you on top of the current rules, understand a topic in detail, and ask questions of our experts.

Tips and strategies

Experts provide tips and strategies to grow your super, plan your retirement, manage your SMSF and boost your income in retirement.

Up-to-date rules

Stay on top of all the rule changes – simplified and in one place.

Frequently asked questions

If you have any further questions, please get in touch.

What is included in a SuperGuide membership?

SuperGuide is Australia’s most trusted superannuation and retirement planning platform, providing up-to-date analysis and insights on super, SMSFs, retirement planning and the Age Pension.

Expect hundreds of fact-checked resources, practical strategies, checklists, case studies, Q&As, interactive tools and our monthly members-only newsletters and webinars.

How much does SuperGuide cost?

SuperGuide has three different plans which are designed for three different lifestages.

Super booster – $60 per year

- When retirement is a long way off and you just want to grow your super

- This includes access to the Super booster section

Retirement planner – $120 per year

- When you are starting to plan your retirement, through to the first years of retirement

- This includes access to the Super booster, Retirement planning and Retiree sections

Retiree – $80 per year

- When you have already retired and want to boost your income in retirement

- This includes access to the Super booster and Retiree sections

SMSFs

If you have an SMSF or are interested in starting one you can also purchase access to our SMSF section as an optional add-on to any of the above plans for an additional $75 per year.

This means the pricing per plan including SMSFs access is as follows:

- Super booster + SMSF = $135 per year

- Retirement planner + SMSF = $195 per year

- Retiree + SMSF = $155 per year

How do I cancel my SuperGuide membership?

You can login into your account and cancel at any time. Your account access will still be available until your current subscription period ends.

Can I claim my membership as an SMSF expense or get a tax deduction?

The ATO allows for general deductions as part of the expenses of running an SMSF, to the extent that:

- it is incurred in gaining or producing assessable income

- it is necessarily incurred in carrying on a business for the purpose of gaining or producing assessable income.

Subscriptions are included as examples of these expenses.

If you are planning to claim a tax deduction for your SuperGuide membership, you will need to confirm your personal tax situation with your accountant or the ATO.

The ATO also allow you to claim an immediate deduction up to $300 for books, periodicals and digital information that are “used predominantly for earning assessable income that is not income from carrying on a business”.