Super investing

Dive into the investing side of super – your guide to building long-term growth and smart decision-making.

In this section, you’ll learn the fundamentals of how super investing works, understand your risk profile, and explore the investment options available to you.

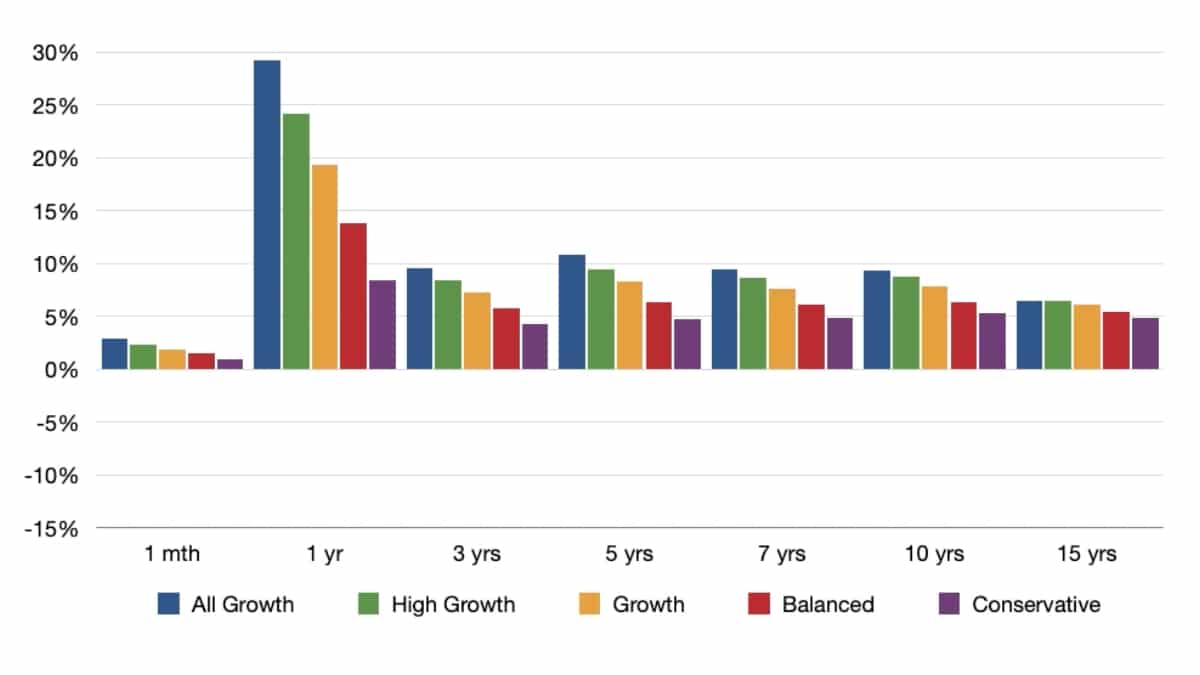

Alongside this, you’ll get insights into how funds perform – so you can assess which ones consistently deliver results and why it matters for your retirement.