Planning your retirement

Planning your retirement is about turning your goals into a clear, workable plan.

This section brings together practical guides to help you estimate how much income you’ll need, set realistic savings targets, and understand the options that can make your super go further.

You’ll also find tailored advice for different life situations – whether you’re approaching retirement, facing an early exit from work, or exploring lifestyle changes like retiring overseas.

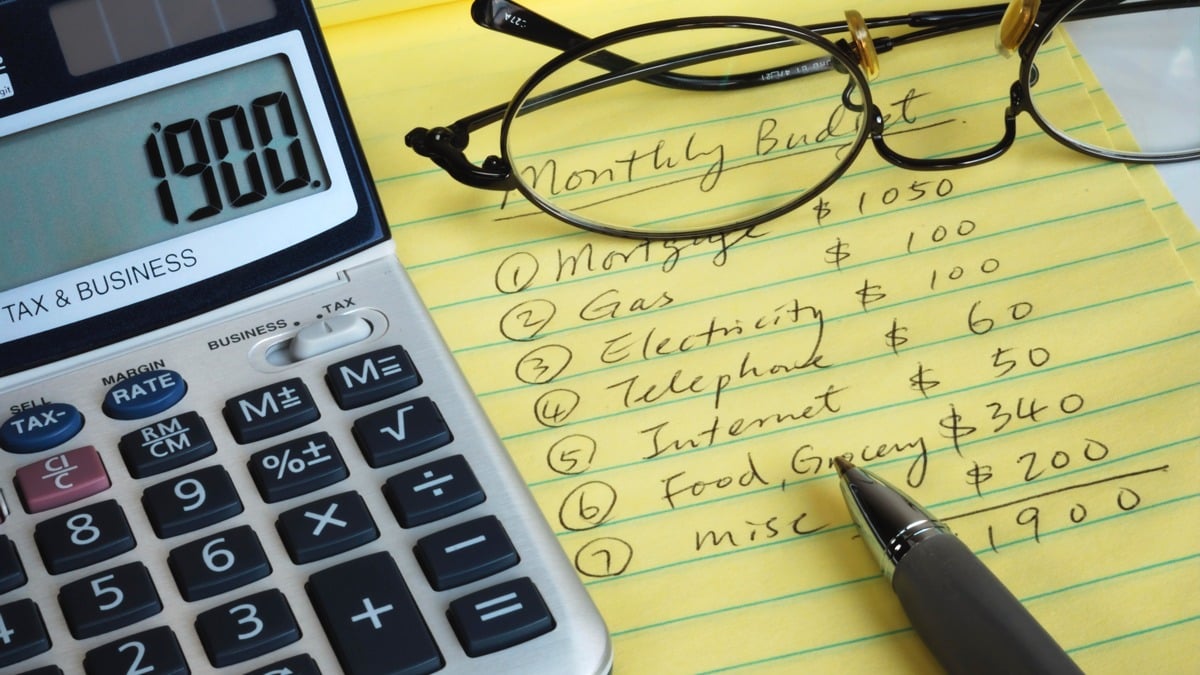

Get clear on your goals and income needs

Building your retirement savings

Planning for different life situations

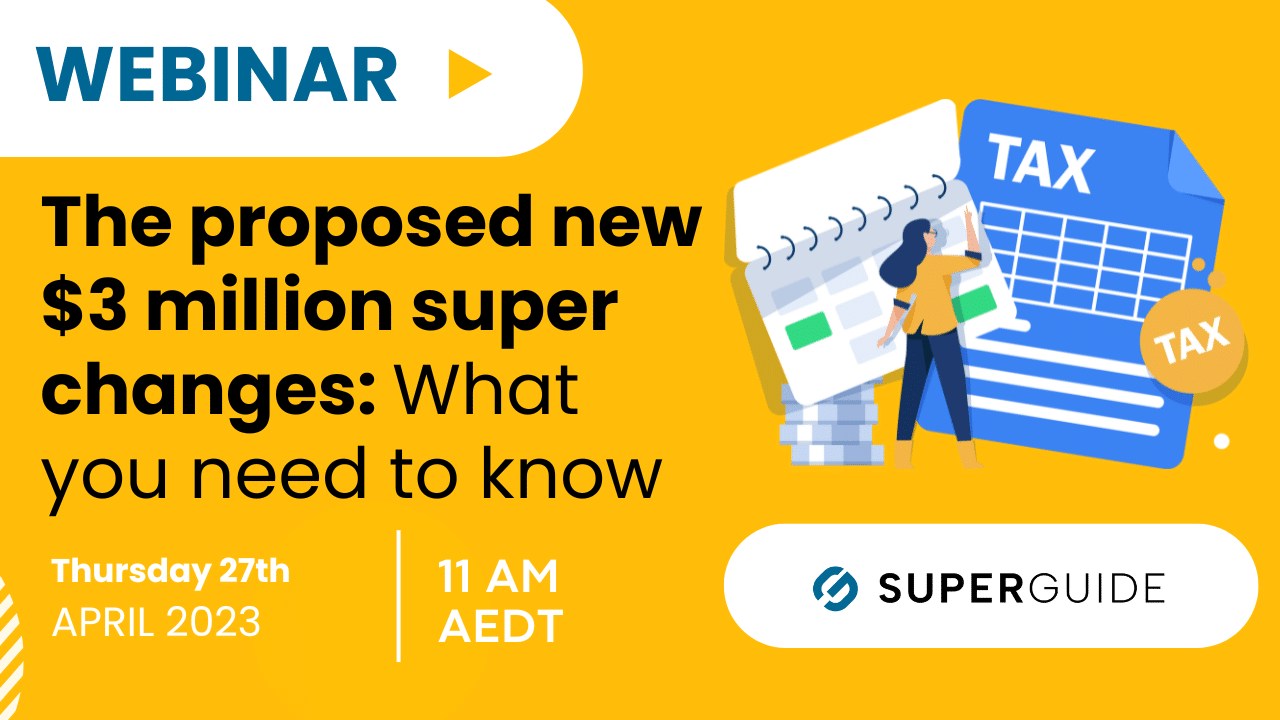

Additional strategies to consider

Try our step-by-step guides

It’s always easier to make progress when there are simple steps you can follow. Our step-by-step guides will give you clarity over what you can do to transform your super, as well as plan, prepare for and start retirement.