In this guide

There comes a point, generally in your mid-50s or early 60s, when retirement beckons. You may be wondering if you can afford to retire at 60, delay for a few years, or perhaps keep working part time for a while.

Getting the timing right is not only a financial decision but also a matter of the lifestyle you hope to enjoy throughout your retirement years. Even so, before deciding, it’s important to consider the financial viability of your choice.

For Australians with superannuation but few other investments, the size of their super balance, perhaps combined with a part Age Pension, will determine their retirement income.

In this case study, we use the Moneysmart Retirement Planner calculator to look at three different scenarios to consider potential retirement dates for a couple in their 50s.

Case study: John and Mary

John and Mary are both 55 and are considering whether they can afford to retire at age 60. If not, they are willing to work until age 65 but would also like to see the financial impact of delaying retirement until age 70.

| John’s current income | $150,000 per year plus super |

| Mary’s current income | $100,000 per year plus super |

| John’s current super balance | $550,000 |

| Mary’s current super balance | $400,000 |

| Non-financial assets (cars, furniture, etc.) | $25,000 |

For simplicity, let’s assume they are homeowners and do not have any other financial assets outside super. The Retirement Planner calculator’s other default assumptions apply.

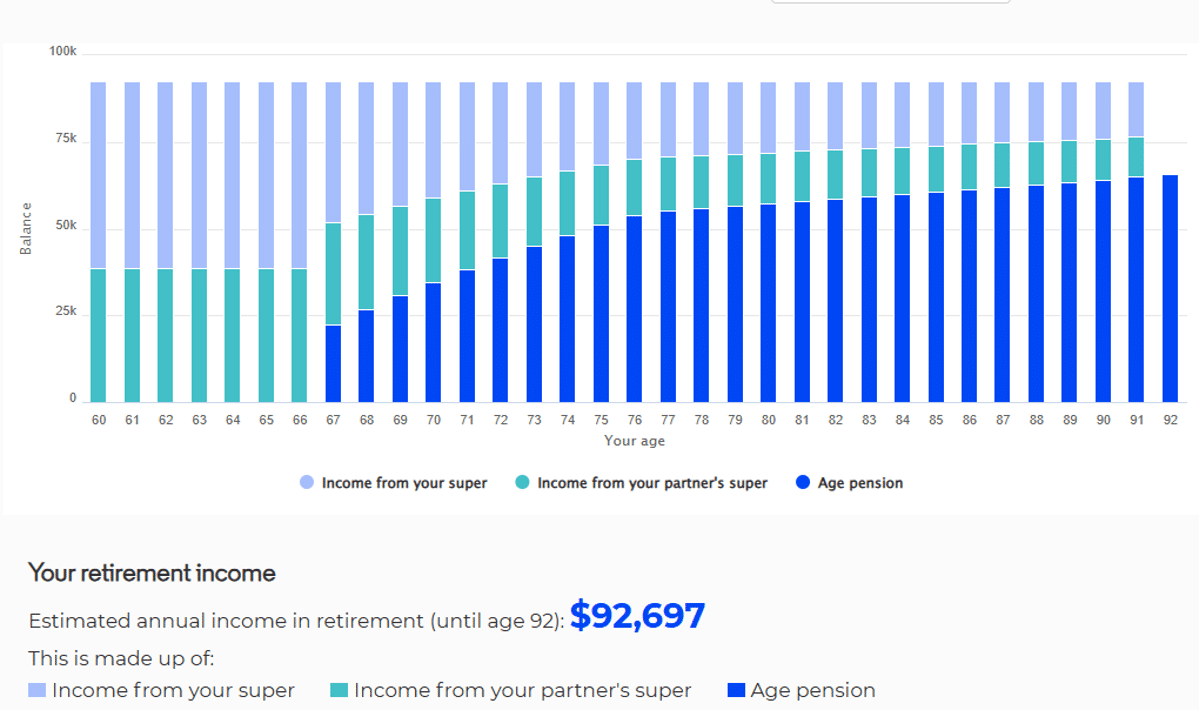

Scenario 1: Retire early at age 60

Estimated super balance

| John | $704,924 |

| Mary | $507,209 |

Estimated combined retirement income

Based on the above super balances and assuming they want their savings to last until age 92, the estimated annual income in retirement for John and Mary is $92,697 per year. This is made up of income from super in the early retirement years and supplemented with the Age Pension from age 67, as you can see in the graph below.

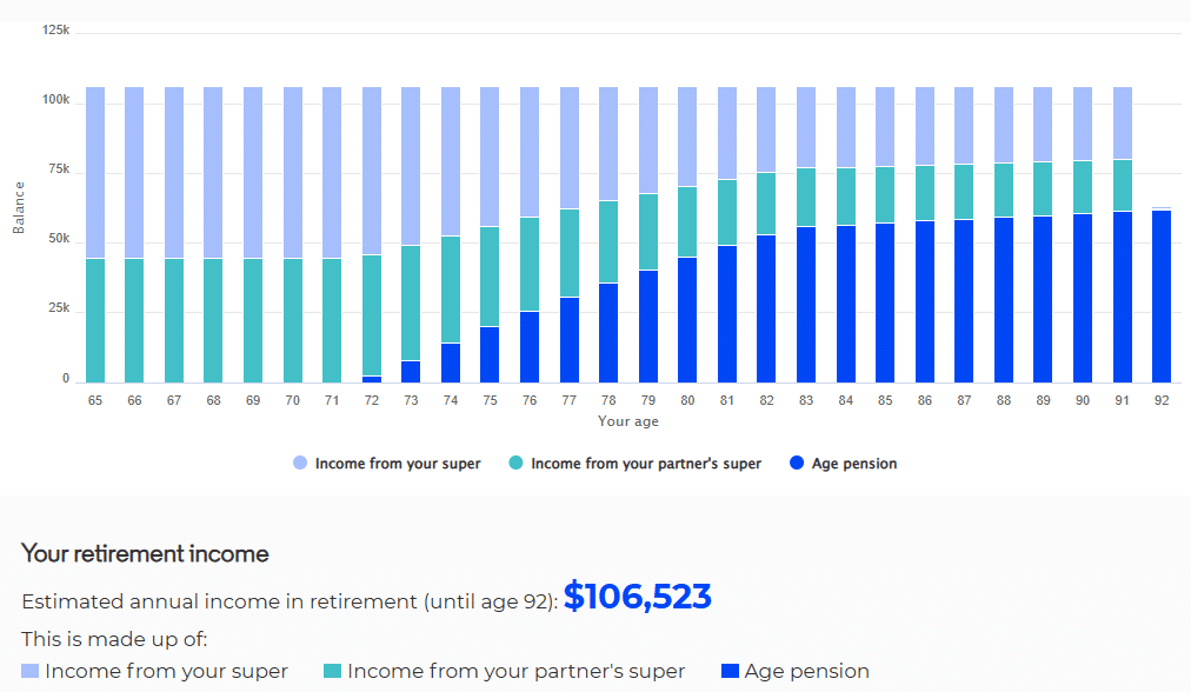

Scenario 2: Retire at age 65

Estimated super balance

| John | $874,099 |

| Mary | $624,271 |

Estimated combined retirement income

Based on the above super balances and assuming they want their savings to last until age 92, the estimated annual income in retirement for John and Mary is $106,523 per year. This is made up of income from super and the Age Pension from age 72, as you can see in the graph below.

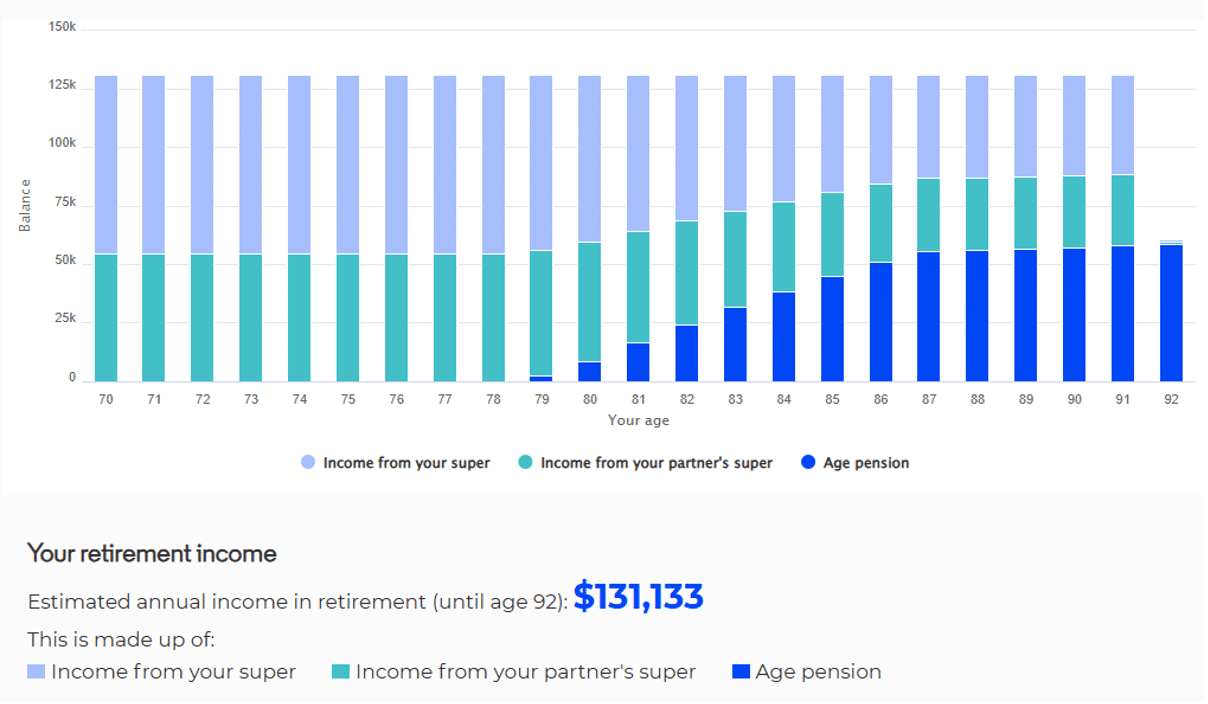

Scenario 3: Delay retirement until age 70

Estimated super balance

| John | $1,064,693 |

| Mary | $756,154 |

Estimated combined retirement income

Based on the above super balances and assuming they want their savings to last until age 92, the estimated annual income in retirement for John and Mary is $131,133 per year. This is made up of income from super and supplemented with a part-Age Pension from age 79, as you can see in the graph below.

It is now up to John and Mary to decide the lifestyle they want in retirement. As a guide, the Association of Superannuation Funds of Australia (ASFA) estimates that a modest lifestyle for a retired couple currently costs around $47,000 per year, while a comfortable lifestyle costs more than $73,000 per year.

Everyone’s situation will be different, so jump onto the Moneysmart Retirement Planner to kickstart your retirement income planning.

Other factors to consider

ASIC’s Retirement Planner calculator provides an estimated super balance at your selected age of retirement. It also calculates the estimated annual retirement income that super balance will provide until age 92 and factors in any entitlement you may have to the Age Pension.

Of course, it’s possible you may want to spend more in your initial retirement years and less in your 80s. So, rather than relying solely on a retirement planning calculator, you should also consider:

- By retiring early and starting an income stream from super before you reach Age Pension age, your super balance can drop sharply and the compounding returns on investment earnings will also reduce.

- If you retire before turning 60, you’ll generally need to rely on other sources of income until you gain access to super. Early release of super (prior to age 60) is possible in limited circumstances such as if you are permanently incapacitated or terminally ill.

On the other hand:

- Delaying retirement solely for financial reasons may impact your physical and/or mental health.

- You might consider working part-time to transition into the retirement lifestyle while preserving your savings for longer.

- You could make additional super contributions (such as salary sacrifice, non-concessional and downsizer contributions) in the lead up to retirement to boost your retirement savings.

Follow these steps to reduce worry about your retirement savings.

Leave a Reply

You must be logged in to post a comment.