Posts

-

Where is technology for SMSFs headed?

Artificial intelligence (AI) is rapidly becoming a tool in many people’s lives and is already making inroads in SMSF investing and administration.

-

Pension fund of the year 2025-26: What makes a winner?

As the Baby Boomer bubble enters retirement, attention is shifting to the retirement phase of super and which funds offer the best pension products and member services.

-

Making super contributions after age 60: Even in retirement

If you have cash to spare or receive a windfall, there are many ways you can add to your super later in life, even if you are no longer working.

-

Super pension funds put to the test

A new consumer-friendly review of pension funds reveals which funds are ticking all the right boxes.

-

3 very different types of ‘retirement’

Today’s 60- and 70-somethings are reinventing retirement, easing into it with a focus on finding meaning and purpose in flexible part-time work, volunteering and new activities.

-

How new ‘best practice principles’ could improve your retirement income

Super funds are being urged to provide their members with retirement products that offer income for life, along with better retirement tools and communication.

-

Aged care: Guide to self-managing home care

A shake-up in the way aged care in the home is provided and paid for is designed to streamline the system, but the jury is still out.

-

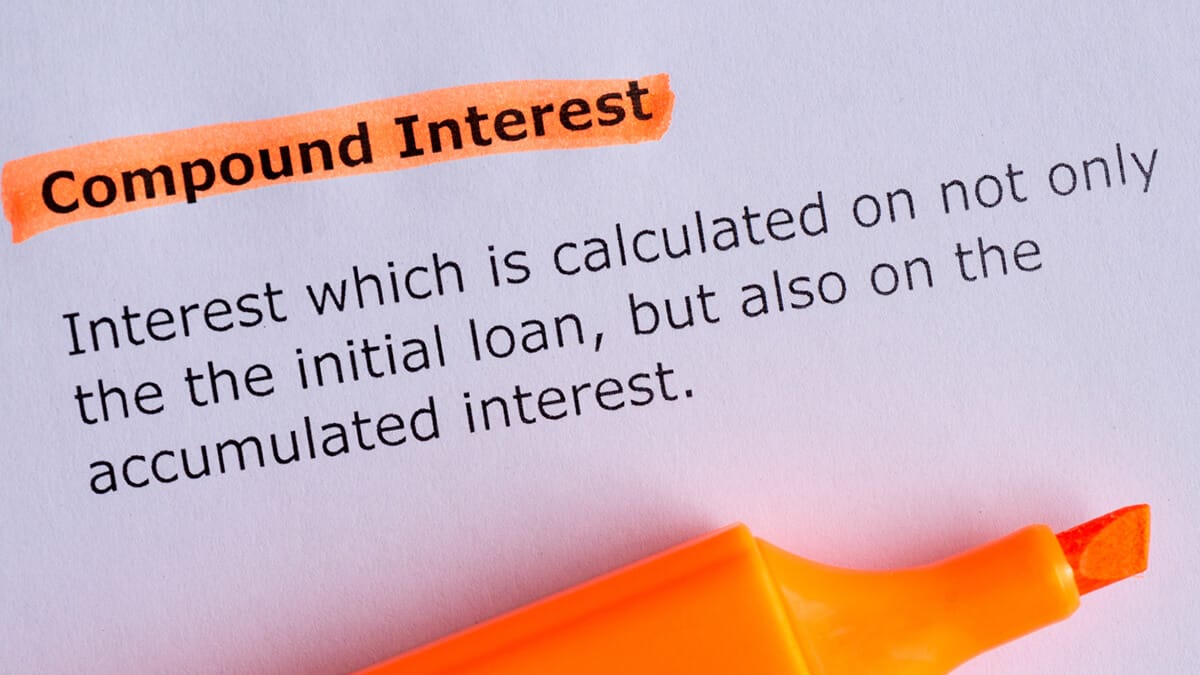

The power of compound interest

Even modest regular savings can grow into substantial nest egg, thanks to the combined effects of compound interest and time. Here’s how it works.

-

How much super should I have at my age?

If you’ve ever wondered how your super balance stack up against people your age, or your retirement income goal, read on.

-

Super news for November 2025

Payday Super, $19 billion in unclaimed super, Retirees missing out, Greenwashing fines, SMSF advice concerns.

-

How much super do I need if I don’t own a home?

Retirees who pay rent are likely to need more retirement income, and savings, to enjoy a similar standard of living to their home-owning peers.

-

What Payday Super means for you

From 1 July 2026, your employer will be required to pay your super at the same time as your wages.

-

Retiring overseas: Implications for your super and tax

Escaping to a dream location where the living is easy can be tempting for cash-strapped retirees, but there are some practical issues to be aware of before you make the leap.

-

How a transition-to-retirement (TTR) pension works

If you’re over 60 and not ready to retire but would like some extra cash to top up your super or wind back your working hours, then a TTR pension could help.

-

What is the value of financial advice when it comes to your retirement?

It’s easy to put off getting financial advice when your focus is on paying the monthly bills, but delaying or not getting advice can have huge financial and personal costs down the track.

-

SMSF investment rules: Collectables and personal use assets

An ATO crackdown on asset valuations is putting pressure on SMSFs with collectables to take stock.

-

SMSF statistics: 1.2 million members with $1 trillion in super

The size of the self-managed super fund sector continues to grow in terms of members and assets, at the expense of all but industry super funds.

-

Losing capacity: The issues for SMSF trustees and what you need to do

Have you considered the risk to your SMSF if you were to lose mental capacity due to accident or ageing? These are the steps you can take now to address this risk.