On this page

When it comes to your super, tax is always an important consideration – both when you make a contribution and when you finally get to take your money out of super on retirement.

As the super system offers special tax benefits designed to help you save for your retirement, there are strict rules in place covering when you qualify to withdraw your super savings and how much tax you need to pay on them.

The proportioning rule is one of these tax rules. It governs how the tax components of your superannuation withdrawals are calculated.

What tax do I pay on my super savings?

Before diving into the complexities of the proportioning rule, it’s worth briefly covering the basics about withdrawing your super and how much tax you pay at different ages.

In most cases, to withdraw from your super you need to have reached your preservation age and met a condition of release. Your super can only be accessed early in specific circumstances, such as becoming permanently disabled, being diagnosed with a terminal illness or if you face severe financial hardship.

If you’re eligible to withdraw your super, the tax rate you will pay on your savings depends on your age.

If you withdraw some of your super benefit before you reach age 60, you will generally pay tax on your super savings (there are exceptions if you have a terminal illness or the amount is a death benefit).

On the other hand, if you wait until you reach age 60, your withdrawal will be tax free.

No tax is payable on the tax-free component of your super, regardless of your age when you make a withdrawal.

What’s the proportioning rule?

The main idea behind the proportioning rule is to prevent super fund members from trying to lower their tax bill if they decide to withdraw some or all of their super benefit.

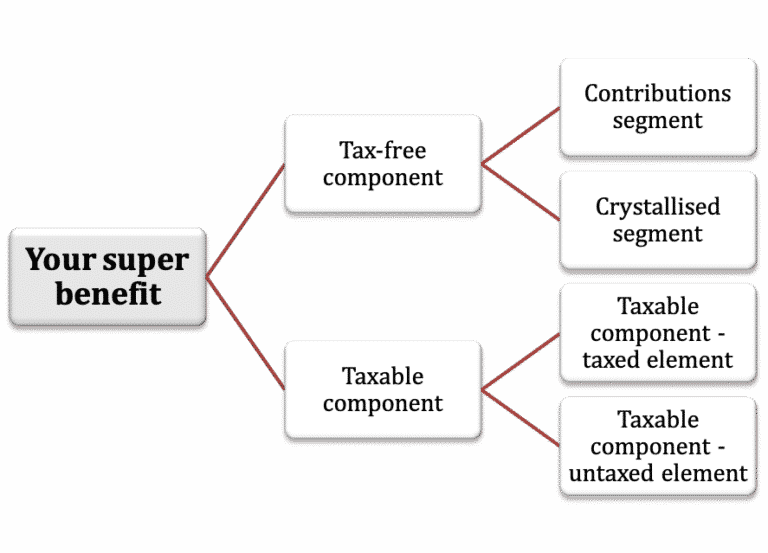

Your super benefit consists of both tax-free and taxable components (see explanation below).

As there is no tax payable on the tax-free components of your super benefit, the proportioning rule is designed to stop you from cherry-picking between the tax-free and taxable parts of your super benefit and taking more of your benefit from the tax-free component as a way to reduce any tax payable on your super withdrawal.

Under the proportioning rule, the amount you withdraw from your account will be considered by the ATO to have been paid to you in the same proportions as the tax-free and taxable components making up your super benefit.

Tax free or taxable: What are the different components of your super benefit?

Your super account is broken up into tax-free and taxable components depending on how the original contributions were made into your super account:

1. Tax-free component

- This mainly consists of your non-concessional (after-tax) contributions, as these come from income on which you have already paid tax. (If you were a member of a super fund before July 2007, you may also have other tax-free amounts in your super account.)

Within your tax-free component there are two different elements:

- Contributions segment – This is generally all contributions made into your super account after 30 June 2007 that have not been included in the super fund’s assessable income. These are mostly contributions where you have not claimed a tax deduction, such as non-concessional (after-tax) contributions.

- Crystallised segment – This is usually amounts that would have been tax free if they had been paid to you before 1 July 2007. Examples of these types of contributions are undeducted contributions made before 30 June 2007, CGT-exempt components and pre-July 1983 components. These amounts are now uncommon for most super fund members.

2. Taxable component

This typically comes from concessional (before-tax) contributions. These include employer contributions (such as SG contributions), salary-sacrifice contributions and any personal super contributions for which you claimed a tax deduction. It also includes the investment earnings, so the value of this component changes regularly.

Within your taxable component there are two different elements:

- Taxable component – taxed element –In most cases your super fund will have paid the 15% contributions tax on the super contributions or investment earnings making up your taxable component.

- Taxable component – untaxed element – If your super fund has not paid tax on the contributions or earnings making up your taxable component, those amounts are called the untaxed element of your taxable component. (This generally only applies to members of an untaxed super fund run by the Commonwealth, a state or territory government department, or members of constitutionally protected funds.)

Your annual statement from your super fund will normally indicate both the tax-free and taxable components of your super account. If not, call your fund and they will work it out for you.

Where does the proportioning rule come in?

Once you know the tax-free and taxable component percentages of your super benefit, the proportioning rule requires any withdrawals you make to be in the same pre-determined percentages. For example, if the total value of your super benefit has a 40% tax-free component and a 60% taxable component, your benefit withdrawal must also comprise a 40% tax-free component and 60% taxable component.

You can’t choose the component from which you would like your benefit withdrawal to be paid, which means you can’t choose to withdraw just from your tax-free component.

The proportioning rule doesn’t apply to the payment of super benefits consisting entirely of a tax-free or a taxable component. These include:

- Government co-contribution payments only made up of a tax-free component

- Superannuation Guarantee (SG) payments only consisting of a taxable component

- Contribution-splitting payments only consisting of a taxable component.

What impact can the proportioning rule have on super strategies?

The proportioning rule is important when it comes to your retirement income, as it can influence the effectiveness of many superannuation retirement strategies related to the tax-free and taxable components of your super benefit.

For example, if you have a significant tax-free component in your super, it may be better to start a super pension as early as possible, as this high tax-free component percentage is locked in when your pension commences.

Using a recontribution strategy is also affected by the taxable component of your super. With a recontribution strategy, the taxable component of the super benefit withdrawn from your super account is converted into a tax-free component when it is recontributed back into your account.

Leave a comment

You must be a SuperGuide member and logged in to add a comment or question.