In this guide

Here’s my quandary.

Over the summer break, I decided this was the year I would finally retire, with a tentative date of Christmas 2025. And then Donald Trump assumed the US Presidency.

Markets were bracing for his promised tariffs, but the extent of the universal tariffs announced on April 2 was worse than anyone predicted. Share markets quickly priced in the growing possibility of a global trade war and recession in the US and beyond, sending global share markets reeling.

Markets hate uncertainty, which is another way of saying people hate uncertainty, because markets are ultimately a place where people meet to trade, albeit at a digital distance these days. And despite our technological sophistication, the human brain still has a primitive fight or flight response to fear and uncertainty.

Market mayhem

As I write this, it’s three trading days after Trump’s tariff bombshell and Australian shares plunge 4.2%, taking 3-day losses to more than 7%. The US market is down 10% and the tech-heavy Nasdaq index is down 20%. A friend texts to ask if it’s too late to switch to cash. The headlines are screaming bloodbath.

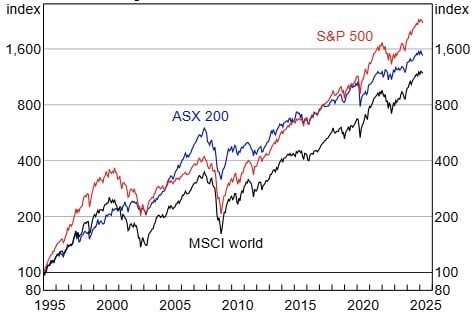

At this stage, it’s impossible to know if the current market turmoil will be short-lived or if this is the beginning of a longer, deeper descent. What we do know is that despite the occasional bloodletting – the 1987 crash, the GFC, Covid – share markets rise over the long term supported by growing economies and rising incomes.

As Warren Buffett’s mentor, Benjamin Graham said, “In the short run the market is a voting machine but in the long run, it is a weighing machine.” Today the market is voting ‘no’ to Trump’s tariffs out of fear and uncertainty about their economic impacts, but share market returns over the next 5-10 years will reflect economic fundamentals.

Share Price Accumulation Indices

Log scale, end December 1994 =100

Source: Bloomberg, RBA

Unfortunately, I don’t have 5 – 10 years to recoup what could amount to a Trump-sized hole in my retirement savings.

What to do?

The answer is don’t panic and stay the course. Which is good advice but easier said than done when your retirement clock reads one minute to midnight.

Not even professionals can reliably time the market. Buy switching to cash now you not only crystallise your losses but run the risk of missing the upswing when it inevitably comes. Not to mention the stress that comes with playing such a high stakes game of investment poker. It’s enough to give you a heart attack.

So, switching my super to cash is off the table. But if you, like me, were planning to retire within the next year to 18 months, then there are still decisions to be made.

Reviewing my retirement plan

Over the next few months, I plan to share my retirement plans and any adjustments I make as economic events unfold. Not as a template for others to follow, but as a case study of one person’s decision-making process.

First and foremost, I need to decide if I can still afford to retire as planned or continue working for longer. The calculations will be different for everyone, depending on your circumstances, so I’ll begin with a bit about me.

I’m 68 and have worked as a business journalist for 46 (!) years, the last 30 years as a self-employed freelance journalist and author working from home. Like many women (and some men), I chose self-employment because of the flexibility it offers to combine raising kids with an ongoing career. But that choice also means that, like many women of my generation, I don’t have as much super as I would like, and I worry it could expire before I do.

My sons are now independent adults so I’m an empty nester rattling around a large family home on my own. Two years ago, after finally paying off my mortgage, I wound back my working hours from five days a week to three. The plan was to put as much as possible into super in the final sprint to retirement.

In many ways I am representative of the large middle group of current pre-retirees who will rely on a combination of super and the Age Pension for my retirement income.

At the start of 2025 I calculated I would have enough in super to retire by the end of the year, but there wasn’t any room for error and those projections are now in doubt. Thank you Donald.

What I will be covering in the coming months

In a series of articles, I will start by taking a closer look at my super fund.

Even though I write about superannuation and retirement for a living, actively chose my super fund and investment option and check my account balance regularly, these latest share market ructions have made me realise I’m a little vague on details. So, I need to check how exposed I am to Australian and international shares, whether I’m still in the right investment option for my risk profile, and what to do if I’m not.

I will also review how I want to live in retirement, how much income I will need to live on and what effect delaying retirement could have.

Then I will calculate how much income my super is projected to generate using different retirement dates, and with what degree of confidence. And I’ll report back on which tools I find most useful.

With new retirement income products coming onto the market, I would also like to review my income stream options.

And let’s not forget about housing. I have big decisions to make about where and how I want to live in the next chapter of my life.

I also plan to consult widely, not just about my financial situation but my readiness for retirement emotionally and psychologically, and I’ll report back from the front. Even though I’m confident when it comes to managing my finances, there are times when seeking the advice of experienced, wiser heads can be invaluable.

Stay tuned.

Leave a Reply

You must be logged in to post a comment.