In this guide

Making super contributions to build a nest egg for your retirement sounds easy but working out the best mix of concessional and non-concessional contributions for your particular situation can be difficult.

Luckily, there are some general principles you can use when working out your personal contribution mix.

To give you some ideas, we’ve also created a few case studies of typical Aussies of different ages, income levels, and work situations. These are designed to illustrate the impact of the different strategies you can use, rather than providing specific examples you should follow.

As the rules around the super system change constantly, your contribution mix should be regularly reassessed to ensure you get the best outcome for your current financial situation.

What types of super contributions can I make?

Before trying to work out your best mix of super contributions, here’s a quick reminder of the main types of contributions, plus some links to our articles explaining things in more detail if you need to refresh your memory:

1. Concessional (before-tax) contributions

These contributions are made from your income before you pay income tax.

Free eBook

Retirement planning for beginners

Our easy-to-follow guide walks you through the fundamentals, giving you the confidence to start your own retirement plans.

"*" indicates required fields

There is a 15% contributions tax payable on these contributions when they are added to your super account, which for people on medium or high incomes, is less than their marginal income tax rate.

The total amount you may contribute per financial year at this low tax rate is limited by the annual cap ($30,000 in 2024–25), but if you’re eligible to carry forward unused cap space from previous years you can contribute even more without attracting further taxes.

The main types of concessional contributions are:

- Your employer’s Super Guarantee (SG) contributions

- Award and additional employer contributions

- Salary-sacrifice contributions

- Personal contributions for which you claim a tax deduction.

2. Non-concessional (after-tax) contributions

These super contributions are made from your income after you pay income tax.

There is no 15% contributions tax payable on these contributions as you have already paid tax on the money. You may contribute up to the annual non-concessional cap in one financial year without triggering additional tax, and most people are eligible to contribute more using the bring forward rule.

In 2024–25, the annual cap is $120,000, or zero if your total super balance was $1.9 million or more on 30 June 2024.

The main types of non-concessional contributions are:

- Personal contributions from your take-home pay

- Spouse contributions.

3. Government contributions into your super account

These contributions are made by the government directly into your super account if you meet the eligibility criteria and they can provide a useful boost to your retirement savings (see following case studies):

2026 SMSF calendar

Our free calendar includes due dates for important documents plus suggested dates for trustee meetings and other strategic issues for your SMSF.

"*" indicates required fields

- Co-contributions

- Low income super tax offset (LISTO)

How do I work out my best mix of super contributions?

Working out the best mix of super contributions will differ depending on your personal situation, finances and retirement goals. Our step-by-step method can help guide your decision.

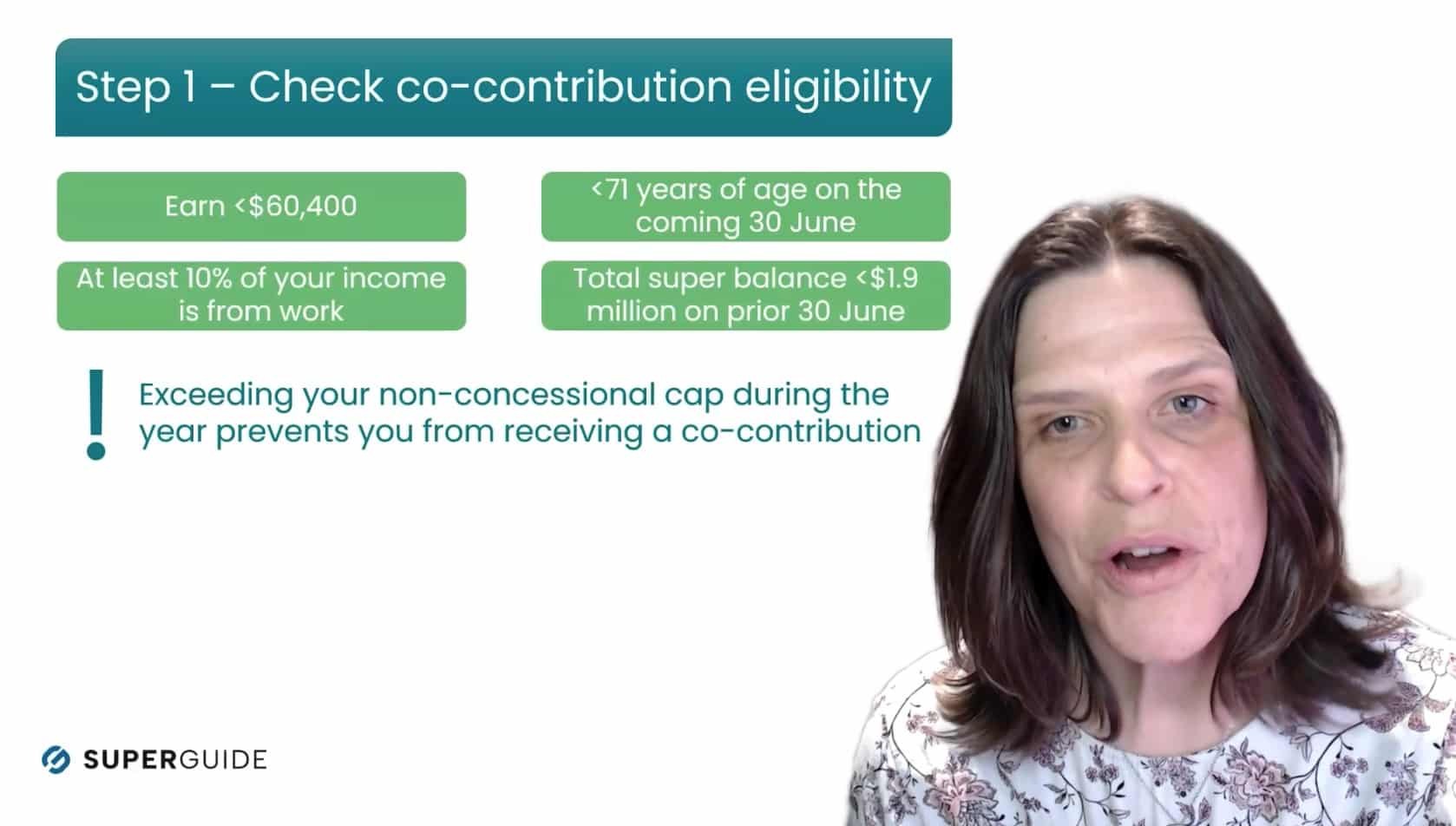

Step 1. Work out if you are eligible for a government co-contribution

Under the rules of the co-contribution scheme, if you are eligible, you will receive a payment of up to $500 when you make personal voluntary (after-tax) super contributions into your super account.

In 2024–25, your total income must be below $60,400 to qualify for any co-contribution. If your total income is above this threshold, you can skip ahead to step 3.

Step 2. Make voluntary super contributions to receive a co-contribution

If you meet all the eligibility rules for a co-contribution, consider making enough non-concessional (after-tax) contributions to maximise the amount of co-contribution you receive.

To make this type of contribution, transfer from your bank account into your super fund without claiming a tax deduction. Alternatively, have your employer make regular after-tax deductions for super from your pay (not salary-sacrifice deductions).

If you can’t afford the maximum contribution, adding a smaller amount to your super will still attract a co-contribution of 50c for every dollar you put in.

Step 3. Make salary-sacrifice or personal deductible contributions into your super account

If you have more you would like to contribute after maxing out your co-contribution eligibility, or you’re not eligible for a co-contribution, it’s time to consider concessional contributions. You can set up a salary-sacrifice arrangement with your employer or make personal contributions from your bank account that you will claim as a tax deduction. These contributions can reduce tax, leaving more to invest for your future.

The tax effects of both salary-sacrifice and personal deductible contributions are the same, so you can choose the option that is more convenient. You may prefer to salary sacrifice if a regular automated contribution that reduces tax up-front is appealing. On the other hand, you could opt for personal deductible contributions if you’re happy to wait for your tax return to get a refund, if your employer doesn’t offer salary sacrifice, you’re self-employed or if you would rather choose how much to contribute and claim towards the end of the financial year.

Super knowledge is a super power

"*" indicates required fields

Remember that contributions are generally locked away in your super account until at least age 60, so it’s important you choose an amount that is affordable and keep the concessional contribution cap in mind. Contributions above your cap won’t create any tax benefit because they are added back to your taxable income to be taxed at your usual income tax rate.

If you have a partner and are happy to share finances, planning your concessional contributions together makes sense. If you’re not in the same tax bracket, the higher income earner can usually benefit more from concessional contributions because the difference between their income tax rate and the 15% contribution tax is larger. At the same time, they may have less space under their concessional cap to accommodate voluntary contributions due to the higher contributions from their employer and could be liable for the additional 15% division 293 tax. It is important to consider how much each partner should contribute so that together you can maximise the benefit.

Many people avoid reducing their taxable income below $45,000 per year using concessional contributions because income below this threshold is taxed at a maximum of 18% including Medicare levy, while concessional contributions attract at least 15% tax. The small difference in tax rates means only a small tax saving in return for contributing to super.

Step 4. If your spouse earns less than $40,000 per year, contribute to their account for a tax offset

If you have more you can afford to contribute to super, it’s worth considering if you’re eligible for the spouse tax offset. The maximum offset of $540 applies when your spouse earns $37,000 or less and you contribute $3,000 or more in non-concessional contributions to their account during the financial year.

If you’re eligible for the offset and the concessional contributions you planned in step 3 would bring your taxable income below $45,000 for the financial year, think about reducing your concessional contributions and using the money to contribute to your spouse’s account instead. The tax offset for spouse contributions is higher than the income tax saving for concessional contributions when your income is below this threshold, so it’s worth maximising your offset with spouse contributions first.

Step 5. Consider voluntary personal (after-tax) contributions for any additional amounts

If you have more you would like to contribute to super after taking all the previous steps, consider making a personal non-concessional contribution. Although it won’t generate an immediate tax deduction, this type of contribution can help you add more to super where investment returns are taxed at only 15%, or 0% after you use your money to start an income stream/pension for retirement. You can contribute to your own account, or to your spouse’s account.

The annual general non-concessional contributions cap is $120,000 in 2024–25 or a maximum of $360,000 over three financial years using the bring-forward rule. If you have a total super balance of equal to or more than the transfer balance cap (currently $1.9 million) on 30 June, your cap is zero for the following financial year.

Using the Moneysmart Super Contributions Optimiser calculator

As deciding the best contribution strategy can be tricky to work out, it may be worth using an online calculator such as ASIC’s Super Contributions Optimiser tool on the Moneysmart website. It’s free and can help point you in the right direction.

Make your super work harder – for free

Get practical, independent guidance to help you grow your balance, save tax and make smarter super decisions with a free SuperGuide account.

Find out moreTo use the Super Contributions Optimiser, simply enter information about your age, income and super contributions. The calculator assumes your employer contributes the current minimum Superannuation Guarantee (SG) rate to your super account, but if your employer contributes more than the SG minimum, simply increase the percentage amount.

If you are self-employed and not running a company that is required to contribute for you, reduce your amount of employer contributions to 0%.

Limitations of the ASIC calculator

It’s worth noting that any calculator has limitations. You will still need to do your homework before deciding on your personal contribution mix.

The ASIC calculator is very general and doesn’t take into account your particular financial circumstances and debts, or your lifestyle expenses and objectives. As these can vary significantly between individuals, you need to take these into consideration.

The calculator occasionally recommends lower income individuals salary sacrifice below a tax-effective level of income and doesn’t always effectively maximise contributions for a couple when one of them is liable for Division 293 tax.

In addition, the calculator doesn’t allow for carry-forward concessional contributions available from a prior year. If you do have unused cap space available, paycalculator.com.au can model concessional contributions. This tool can accommodate carry forward but only allows calculations for one person at a time, rather than a couple simultaneously.

Unfortunately, the contribution calculator doesn’t work for members of defined benefit super funds either, as these use fund-specific formulas to work out the super benefits for their members.

Many large super funds also provide contribution calculators for their members. It’s worth looking around to find a calculator that is user friendly.

Case studies: How to mix and match your super contributions

The following case studies show how using a variety of super contributions can substantially boost the amount in your super account by ensuring you get any co-contribution you are entitled to and benefit from available tax savings.

Pay for Min ($ per year)

| With super contributions | No super contributions | |

|---|---|---|

| Gross salary | $29,000 | $29,000 |

| Less salary sacrifice | -$2,162 | $0 |

| Less income tax + Medicare levy | -$766 | -$1,328 |

| Take-home pay | $26,072 | $27,672 |

| Less after-tax super contributions | -$1,000 | $0 |

| Net pay | $25,072 | $27,672 |

Min’s super ($ per year)

| With super contributions | No super contributions | |

|---|---|---|

| Employer contributions | $3,335 | $3,335 |

| Before-tax contributions (salary sacrifice) | $2,162 | $0 |

| After-tax contributions | $1,000 | $0 |

| Government co-contribution | $500 | $0 |

| Low income super tax offset | $500 | $500 |

| Less contributions tax | -$825 | -$500 |

| Net contributions | $6,673 | $3,335 |

Source: Moneysmart contributions optimiser using 2024–25 income tax rates. Note results are rounded to the nearest dollar.

Pay for Jason and Leigh-Anne ($ per year)

| With super contributions | No super contributions | |||

|---|---|---|---|---|

| Jason | Leigh-Anne | Combined | Combined | |

| Gross salary | $92,000 | $35,000 | $127,000 | $127,000 |

| Less salary sacrifice | -$7,353 | $0 | -$7,353 | $0 |

| Less income tax + Medicare levy | -$17,875 | -$2,688 | -$20,563 | -$22,916 |

| Take-home pay | $66,772 | $32,312 | $99,084 | $104,084 |

| Less after-tax contributions | $0 | -$1,000 | -$1,000 | $0 |

| Net pay | $66,772 | $31,312 | $98,084 | $104,084 |

Jason and Leigh-Anne’s super ($ per year)

| With super contributions | No super contributions | |||

|---|---|---|---|---|

| Jason | Leigh-Anne | Combined | Combined | |

| Employer contributions | $10,580 | $4,025 | $14,605 | $14,605 |

| Before-tax contributions (salary sacrifice) | $7,353 | $0 | $7,353 | $0 |

| After-tax contributions | $0 | $11,000 | $1,000 | $0 |

| Government co-contribution | $0 | $500 | $500 | $0 |

| Low income super contribution | $0 | $500 | $500 | $500 |

| Less contributions tax | -$2,690 | -$604 | -$3,294 | -$2,191 |

| Net contributions | $15,243 | $6,421 | $20,664 | $12,914 |

Source: Moneysmart contributions optimiser using 2024–25 income tax rates. Note results are rounded to the nearest dollar.

Pay for Nasir ($ per year)

| With super contributions | No super contributions | |

|---|---|---|

| Gross salary | $192,000 | $192,000 |

| Less deductible contribution | -$80,000 | $0 |

| Less income tax + Medicare levy | -$26,628 | -$56,378 |

| Take-home pay | $85,372 | $135,622 |

Nasir’s super ($ per year)

| With super contributions | No super contributions | |

|---|---|---|

| Before-tax contributions (personal deductible) | $80,000 | $0 |

| Less contributions tax | -$12,000 | -$0 |

| Net contributions | $68,000 | $0 |

| Total of take–home pay + net super | $153,372 | $135,622 |

Source: Moneysmart contributions optimiser using 2024–25 income tax rates. Note results are rounded to the nearest dollar.

Leave a Reply

You must be logged in to post a comment.