Articles by

Kate Crawford

-

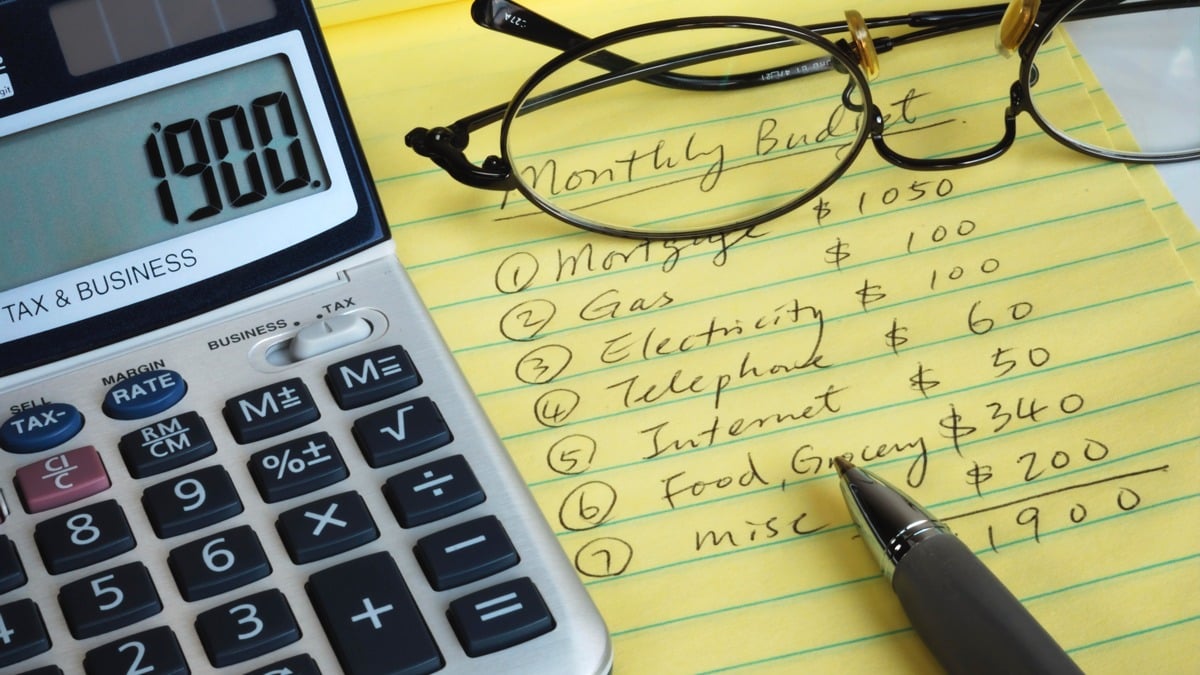

How to budget for retirement

Unsure whether you have enough saved to retire? First you need to work out how much you are likely to spend. Luckily, there are tools for that.

-

How can I top up my super pension?

Contributions can’t be added directly, so how do you get additional savings across into a pension? Find out your options and what to consider.

-

The sprint finish: How to boost your super before retirement

If you are ready to retire but your super balance isn’t, don’t despair. Here are some handy strategies to give your super a last minute cash injection.

-

APRA’s performance test: Platforms continue to miss the mark

For the second year running, all MySuper products passed APRA’s performance test. A few platform options fell short, while thousands more are not tested at all.

-

Case study: High earners near retirement aim for six-figure income and tax-free inheritance

Watch how John and Helen adjusted their retirement plan to secure a six-figure income, extend their savings, and leave a tax-free inheritance.

-

Home Equity Access Scheme (HEAS) explained

The government’s reverse mortgage (previously called the Pension Loan Scheme), helps older Australians convert property equity into retirement income without selling their home.

-

What to check on your annual super fund statement

Your annual super fund statement provides a useful snapshot of where you are on the road to retirement and if you’re on track to reach your destination – you just need to know where to look.

-

How to boost your spouse’s super balance (including calculator)

Couples who plan together succeed together. Learn how paying attention to your spouse’s super could maximise your opportunities.

-

Financial advice through super funds: What’s on offer?

Super funds have been expanding their financial advice services to members, but it’s important to understand the different levels of advice on offer, how it’s provided and paid for.

-

What to know before taking a lump sum from super

Cashing a chunk of your super tax-free is tempting, but make sure you look before you leap.

-

How the First Home Super Saver (FHSS) scheme works

Let low taxes and a generous interest rate do the heavy lifting while you save for your first home in super.

-

Reducing tax on capital gains with super contributions

If you’ve made a capital gain this year, the tax office is knocking at the door. A personal tax-deductible super contribution could keep them at bay.

-

Total super balance vs Transfer balance cap explained

The acronyms may be similar, but your total super balance (TSB) and transfer balance cap (TBC) are not the same thing. We clear up the confusion and explain how they affect what you can do with your super.

-

How much super do I need to retire on $50,000 a year?

Once you know how much retirement income you are aiming for, we show you how to calculate the amount of super you will need to fund it.

-

How much super do I need to retire on $80,000 a year?

Once you know how much retirement income you are aiming for, we show you how to calculate the amount of super you will need to fund it.

-

How much super do I need to retire on $100,000 a year?

Once you know how much retirement income you are aiming for, we show you how to calculate the amount of super you will need to fund it.

-

How much super do I need to retire on $60,000 a year?

Once you know how much retirement income you are aiming for, we show you how to calculate the amount of super you will need to fund it.

-

Converting super into retirement income: What are your options?

Choosing the best combination of retirement income sources for your circumstance can make a big difference to your overall retirement income.