Articles by

Barbara Drury

-

Retiring overseas: Implications for your super and tax

Escaping to a dream location where the living is easy can be tempting for cash-strapped retirees, but there are some practical issues to be aware of before you make the leap.

-

How a transition-to-retirement (TTR) pension works

If you’re over 60 and not ready to retire but would like some extra cash to top up your super or wind back your working hours, then a TTR pension could help.

-

Super and pension fund performance: Where does your fund rank?

Have you ever looked at your super fund’s investment returns and wondered how your fund compares with similar funds? Is it a consistently high performer or an inveterate underachiever?

-

SMSF investment rules: Collectables and personal use assets

An ATO crackdown on asset valuations is putting pressure on SMSFs with collectables to take stock.

-

SMSF statistics: 1.2 million members with $1 trillion in super

The size of the self-managed super fund sector continues to grow in terms of members and assets, at the expense of all but industry super funds.

-

What type of people have SMSFs?

If you think SMSFs are just for old wealthy Australians, think again. Increasingly, younger people and women are also embracing the self-managed ethos.

-

How do ETFs compare to LICs/LITs and managed funds?

Managed investments offer instant diversification, but there are important differences between the types of funds on offer – from cost to legal structure.

-

Lifecycle super funds: What they are and how they perform

Lifecycle funds are designed to reduce risk as you near retirement without sacrificing returns; recent research shows many do just that but you need to know what to look for.

-

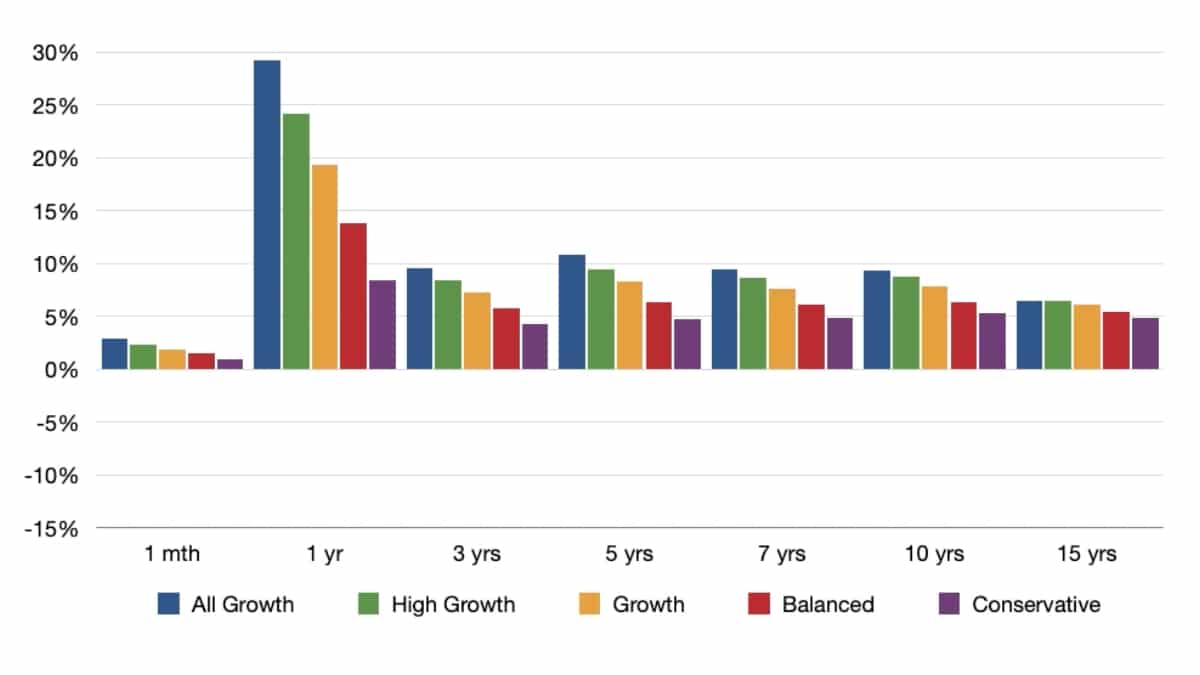

The big picture: Focus on super’s long-term returns

They say a picture is worth a thousand words, so we’ve created a visual representation of super’s value in the long run.

-

SMSF investing: 20 most popular LICs/LITs

Listed investment companies and trusts are facing stiff competition from cheaper ETFs and passive index funds, but have a place in many SMSF portfolios.

-

SMSF investing: 20 most popular managed funds

Traditional managed funds have been partially eclipsed by the rise of ETFs, but they remain core holdings for many SMSF investors looking to diversify.

-

SMSF investing: 20 most popular international shares

Direct holdings in international shares fell in 2024–25 due to volatile market conditions but perhaps also to the growing appeal of ETFs to access global markets.

-

SMSF investing: 20 most popular Australian shares

Australian shares remain the most popular asset class for SMSF investors, with portfolios dominated by the big banks and miners.

-

SMSF investing: 20 most popular ETFs

Gen X and Millennials are fuelling the rapid take-up of ETFs by SMSF investors, drawn to their instant diversification, global reach, accessability and low cost.

-

Deeming rates (2025-26) and calculator for the Age Pension income test

On 20 August 2025 the government announced the first change to deeming rates since 1 May 2020 when rates were frozen at artificially low levels during COVID.

-

MySuper funds: What they are and who offers them

Default MySuper funds have been undergoing a makeover in recent years, with performance under the microscope and fees falling.

-

How do I transfer a UK pension to an Australian super fund?

It can make sense to bring your UK pension funds home to Australia, but the process is far from straightforward. We explain how it’s done.

-

Which SMSF expenses are tax deductible?

The expenses associated with running your own super fund can add up, so it’s important to understand which expenses you can, and can’t, claim as a tax deduction.