Articles by

Barbara Drury

-

SMSF statistics: 1.2 million members with $1 trillion in super

The size of the self-managed super fund sector continues to grow in terms of members and assets, at the expense of all but industry super funds.

-

What type of people have SMSFs?

If you think SMSFs are just for old wealthy Australians, think again. Increasingly, younger people and women are also embracing the self-managed ethos.

-

How do ETFs compare to LICs/LITs and managed funds?

Managed investments offer instant diversification, but there are important differences between the types of funds on offer – from cost to legal structure.

-

Lifecycle super funds: What they are and how they perform

Lifecycle funds are designed to reduce risk as you near retirement without sacrificing returns; recent research shows many do just that but you need to know what to look for.

-

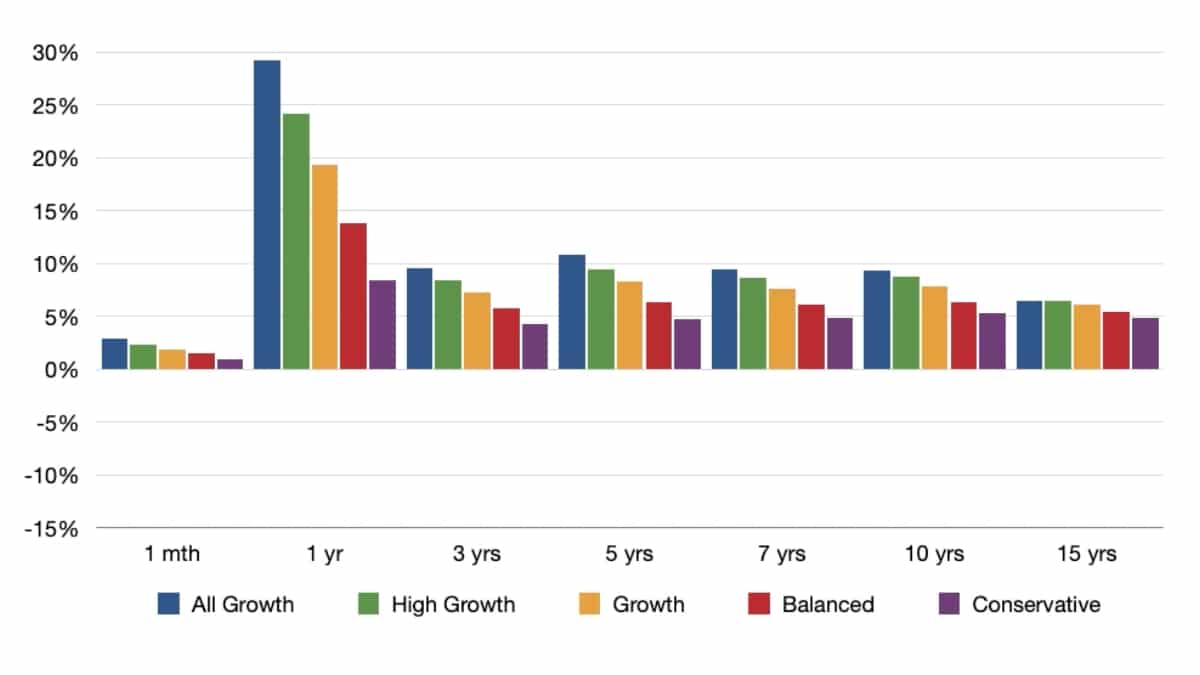

The big picture: Focus on super’s long-term returns

They say a picture is worth a thousand words, so we’ve created a visual representation of super’s value in the long run.

-

SMSF investing: 20 most popular LICs/LITs

Listed investment companies and trusts are facing stiff competition from cheaper ETFs and passive index funds, but have a place in many SMSF portfolios.

-

SMSF investing: 20 most popular managed funds

Traditional managed funds have been partially eclipsed by the rise of ETFs, but they remain core holdings for many SMSF investors looking to diversify.

-

SMSF investing: 20 most popular international shares

Direct holdings in international shares fell in 2024–25 due to volatile market conditions but perhaps also to the growing appeal of ETFs to access global markets.

-

SMSF investing: 20 most popular Australian shares

Australian shares remain the most popular asset class for SMSF investors, with portfolios dominated by the big banks and miners.

-

SMSF investing: 20 most popular ETFs

Gen X and Millennials are fuelling the rapid take-up of ETFs by SMSF investors, drawn to their instant diversification, global reach, accessability and low cost.

-

MySuper funds: What they are and who offers them

Default MySuper funds have been undergoing a makeover in recent years, with performance under the microscope and fees falling.

-

How do I transfer a UK pension to an Australian super fund?

It can make sense to bring your UK pension funds home to Australia, but the process is far from straightforward. We explain how it’s done.

-

Which SMSF expenses are tax deductible?

The expenses associated with running your own super fund can add up, so it’s important to understand which expenses you can, and can’t, claim as a tax deduction.

-

My retirement planning diary (Part 6): Light at the end of the tunnel

In the final instalment of my retirement diary, I review my progress and set the date.

-

What age should I retire?

There are no hard and fast rules around when you can retire, but there are practical issues to consider and money is just one of them.

-

How to plan your spending through the 3 stages of retirement

Far from being one long holiday, retirement tends to be a tale in three acts, with different spending patterns along the way.

-

What are the risks and benefits of getting financial advice?

Quality, affordable advice can make an enormous difference to your retirement outcomes, but it pays to know how to sort the good from the bad and downright ugly practices.

-

My retirement planning diary (Part 5): The psychology of retirement

With so much focus on having enough savings to retire, it’s easy to forget what it’s all for – living!