In this guide

If you have savings in a KiwiSaver account, you can voluntarily transfer them to an Australian super fund under the provisions of a Trans-Tasman Retirement Savings Portability scheme that was introduced on 1 July 2013.

KiwiSaver is a New Zealand savings scheme designed to fund the retirement of New Zealand citizens and permanent residents. The decision to transfer your KiwiSaver funds is not compulsory, but it is an option. Consolidating your funds in this way can help you avoid paying multiple fees on your retirement savings.

The reverse is also true. Australians can also voluntarily transfer their super funds to a KiwiSaver account under the same arrangement.

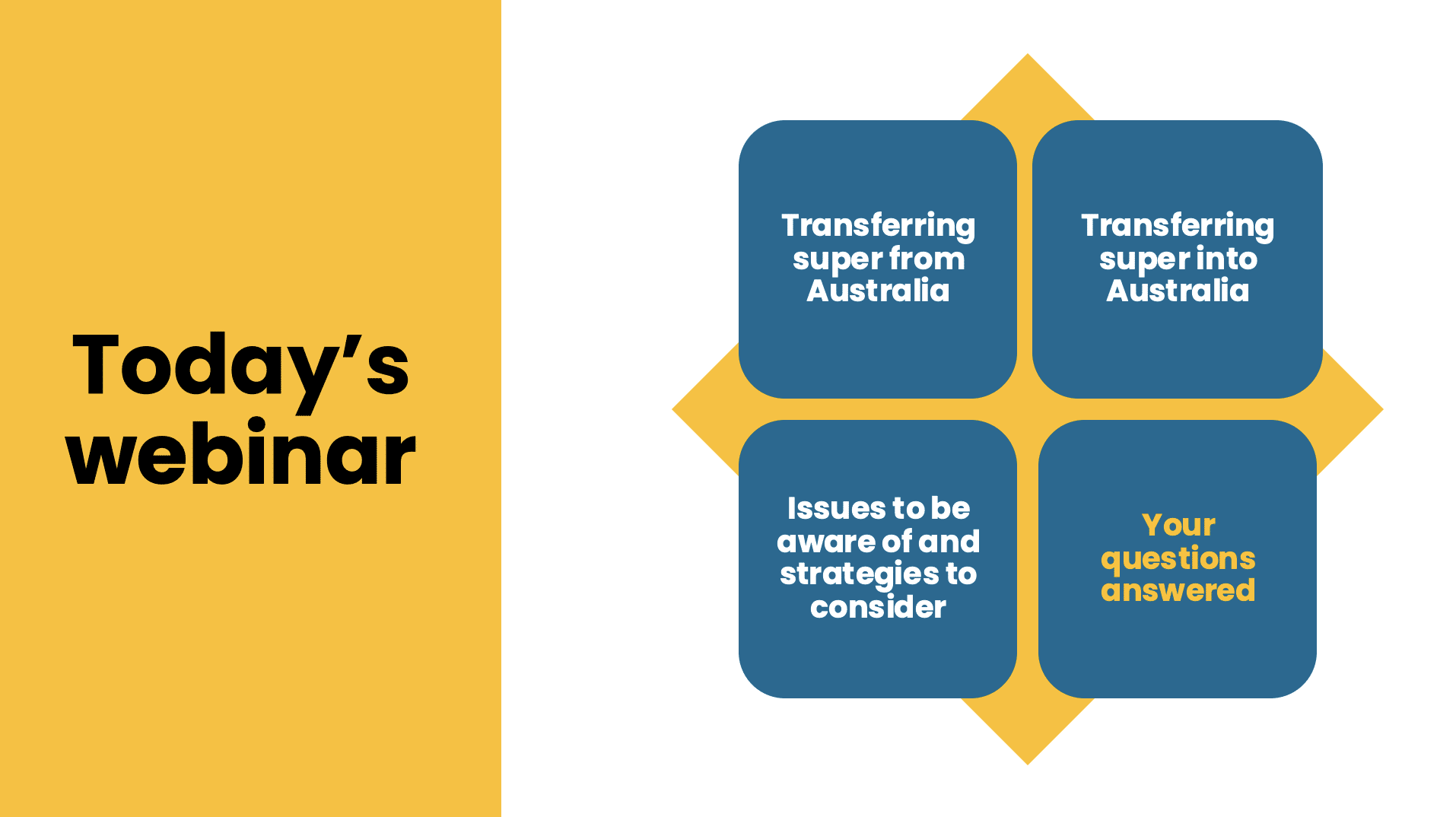

Overseas super transfers webinar

What are the rules around transfers from KiwiSaver accounts to Australian super funds?

If you want to transfer your KiwiSaver retirement savings to an Australian super fund, you must:

- Have emigrated to Australia (you will need to sign a statutory declaration confirming this and provide evidence that you have departed New Zealand and are living at an Australian address)

- Have an Australian tax file number

- Apply to your KiwiSaver provider

- Transfer your entire KiwiSaver balance to an Australian super fund that is regulated by the Australian Prudential Regulation Authority (APRA). You cannot do partial transfers, nor transfer KiwiSaver retirement savings to a self-managed super fund (SMSF).

Please note that you will not be allowed to make the transfer if your KiwiSaver funds transfer would exceed the Australian non-concessional (after-tax) contributions cap. This cap is currently $110,000 a year or $330,000 in any three-year period under the bring-forward rule. Transfers under this amount will be treated as contributing to your non-concessional contributions cap.

In addition, you can’t transfer your KiwiSaver funds into an Australian super account if your total superannuation balance is $1.7 million or more.

Your Australian super fund will request the following information about your KiwiSaver transfer:

- Whether it includes any Australian-sourced amounts (and, if so, any tax-free component)

- Any restricted non-preserved component

- Any unrestricted non-preserved component.

This information will affect the tax treatment of your future super benefits. Your KiwiSaver provider will need to supply your Australian super fund with all this information before it will accept the transfer.

Your funds will then be transferred tax free, which means you won’t be able to claim a tax deduction for them. KiwiSaver transfers are also not classed as a contribution for the purposes of determining eligibility for a super co-contribution from the Australian government if you’re a low-income earner, nor for the spouse contribution tax offset.

You may not be able to use any transferred KiwiSaver funds to access Australia’s First Home Super Saver Scheme either. The decision is up to the Australian Taxation Office (ATO), which will provide a ruling based on your individual circumstances.

Once your KiwiSaver funds are transferred to an Australian fund, they are subject to Australian super legislation, except for the age at which you can access your funds. Any New Zealand-sourced transferred funds cannot be accessed until you reach the New Zealand superannuation eligibility age, which is currently 65.

Any Australian-sourced funds can be accessed when you meet a condition of release. Except for special early access circumstances, you can only access Australian super once you’ve reached your preservation age and met a condition of release (such as retiring or turning 65). Your preservation age in Australia is between 55 and 60, depending on your date of birth.

Which Australian super funds accept transfers from KiwiSaver?

Unfortunately it’s not compulsory for Australian super funds to accept KiwiSaver transfers and very few do.

Not even the industry regulator APRA keeps a list of super funds that accept KiwiSaver transfers. APRA’s advice is to contact you super fund and ask.

Super funds we know of that do accept transfers from KiwiSaver include:

- AMG Super (previously Emplus)

- Brighter Super (previously Energy Super)

- First Super

- Telstra Super

- Verve Super

- Vision Super

Feel free to contact us if you know of any other funds that do and we’ll add them to this list.

Both KiwiSaver and your chosen Australian super fund may charge fees for the transfer and acceptance of the funds.

Any KiwiSaver transfer will also always be labelled as such in your Australian super fund. You won’t be able to roll them over to another Australian super fund later on unless that fund also accepts KiwiSaver transfers. If you return to live in New Zealand, you can re-join KiwiSaver if you’re aged under 65 and a New Zealand citizen or a permanent resident.

What should I consider first?

You should consider your potential future income needs and both Australian and New Zealand super legislation before deciding whether to transfer your KiwiSaver retirement savings to an Australian fund. There are different early access eligibility requirements in place in both countries in areas such as:

- Buying your first residential home

- In cases of severe financial hardship or a serious illness, injury or disability that affects your ability to work (or threatens your life).

The bottom line

We do not claim to be experts on New Zealand superannuation. You should do your own research and seek independent professional advice about whether transferring your KiwiSaver retirement savings to an Australian super fund is appropriate for your individual financial circumstances and goals.

The information contained in this article is general in nature.

Get more guides like this with a free account

better super and retirement decisions.

Leave a Reply

You must be logged in to post a comment.