An introduction to SMSFs

Thursday 27 July 2023 at 11:00 am AEST

What you need to know about setting up and running a self managed super fund. We will take you through the key issues that trustees face when managing their own super fund.

Q: My question is regarding voluntary concessional contributions. There are two ways to make the voluntary contributions: salary sacrifice during each pay period or at the end of year by converting non-concessional contributions into concessional contributions through the super fund. Will the annual net income (after tax) be the same if someone pays at the end of year rather than through salary sacrifice each pay period?

A: Yes, if an individual contributes the same total amount of concessional contributions, their after-tax income will be the same regardless of whether they make those contributions by salary sacrifice or as personal tax-deductible contributions.

The total super contribution tax paid will also be the same.

Some differences can however arise in the superannuation balance due to the timing of the deduction of contribution tax.

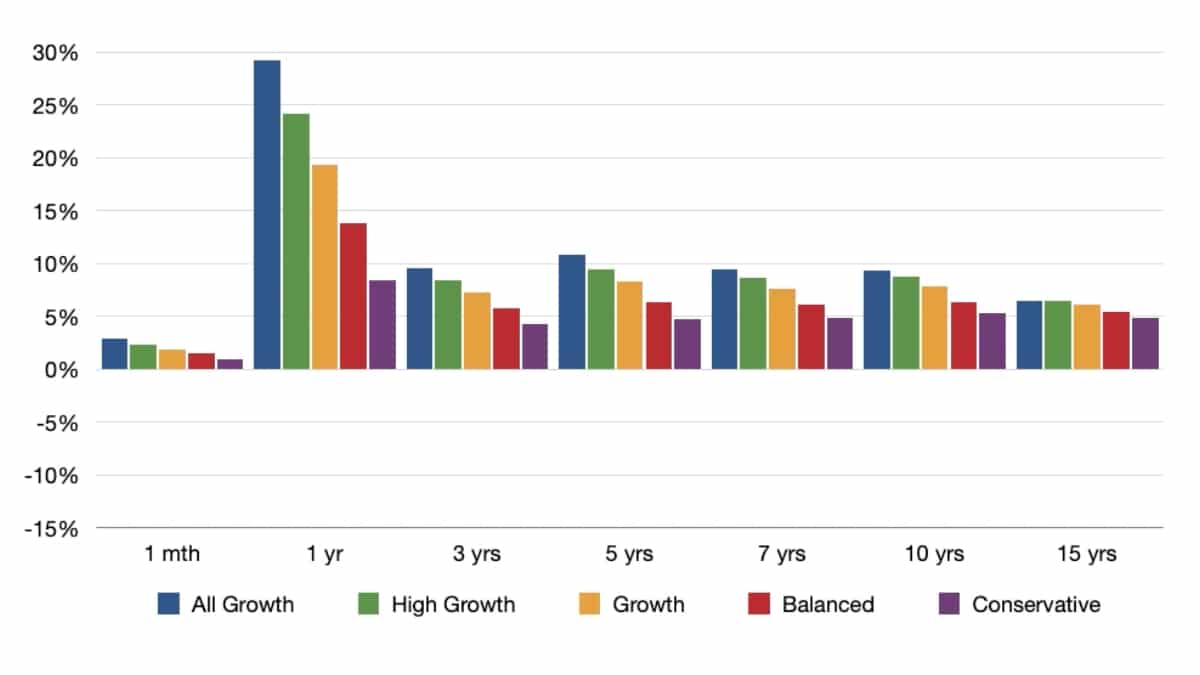

For example, if you contribute regularly by salary sacrifice, tax will be deducted from each contribution as the super fund receives it, often at the end of each month. If you instead contributed the same regular amount from personal savings and then notified the fund of your intention to claim a tax deduction for those contributions at the end of the financial year, the tax would be deducted in one lump sum at the time you provide the notice. In this case, the money that is eventually used to pay contribution tax remains invested in the super fund for longer. If returns for the year are positive, this means additional investment return has been generated via investment growth of the money that is eventually deducted to pay contribution tax, and your super balance will be higher than if the contribution tax was deducted regularly. If returns are negative the opposite is true.

The example generally only holds true for large super funds because self-managed super funds (SMSFs) do their accounting differently.

Read more about tax-deductible contributions and salary sacrifice.

If you’re married or in a de-facto relationship you might consider retirement saving a joint goal. Making contributions to your spouse’s account could get you a tax offset and transferring some of the contributions you made to your account last financial year may help equalise your super balances, which can assist you both to stay under the transfer balance cap or the upcoming $3M cap on super balances.

Learn more about how to boost your spouse’s super.

Important: All information on SuperGuide is general in nature only and does not take into account your personal objectives, financial situation or needs. You should consider whether any information on SuperGuide is appropriate to you before acting on it. If SuperGuide refers to a financial product you should obtain the relevant product disclosure statement (PDS) or seek personal financial advice before making any investment decisions.