Retirement planning strategies

In this section you can learn about the most critical retirement strategies you should consider when planning your retirement.

There are tips and strategies to suit a range of age groups, whether you have many years left to save or need to get ready to retire in a hurry, including approaches that can help make your savings last the distance.

You’ll also find planning ideas if you’re thinking of retiring overseas or own a business.

See also our sections on Super tips and strategies, super investing strategies and strategies for SMSFs.

Fundamental retirement planning tips

Essential guides for everyone planning their retirement

Specific situations that may apply to you

Member Q&As about retirement planning strategies

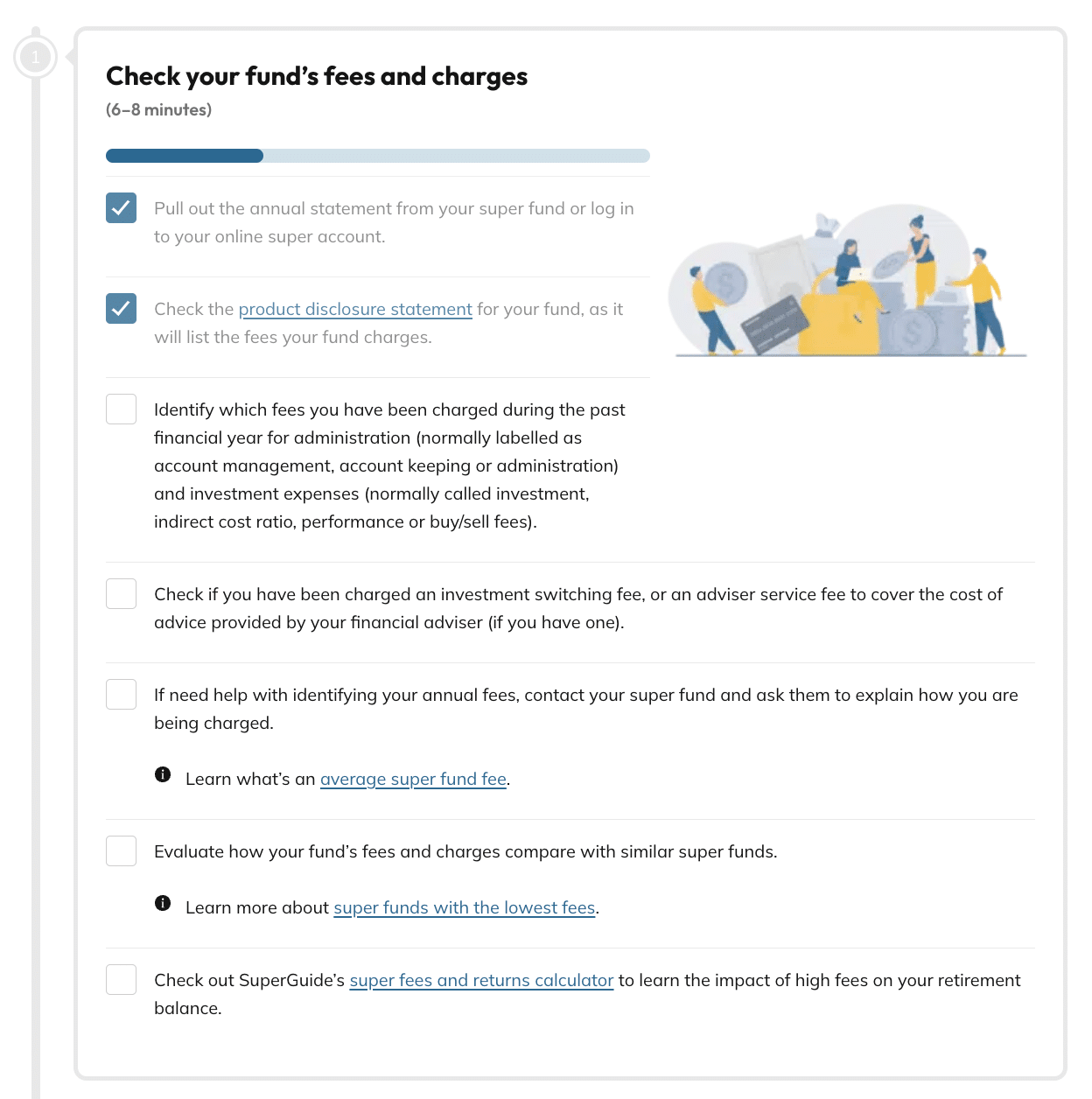

Try our step-by-step guides

It’s always easier to make progress when there are simple steps you can follow. Our step-by-step guides will give you clarity over what you can do to transform your super, as well as plan, prepare for and start retirement.