how to plan your retirement

-

Retirement planning is about more than money

A healthy super balance helps, but living life to the full in retirement also requires a sense of purpose and meaning.

-

Map your retirement income with Moneysmart’s Retirement planner

The updated MoneySmart Retirement Planner includes a range of new features, which can take a little getting used to. This short video walks you through how the calculator works and how to use it to model your retirement.

-

Get clear on what you’ll need for retirement – and whether you’re on track

Planning for retirement can feel overwhelming, especially when every article seems to start with a different number. The good news is that you don’t need perfect predictions to make meaningful progress.

-

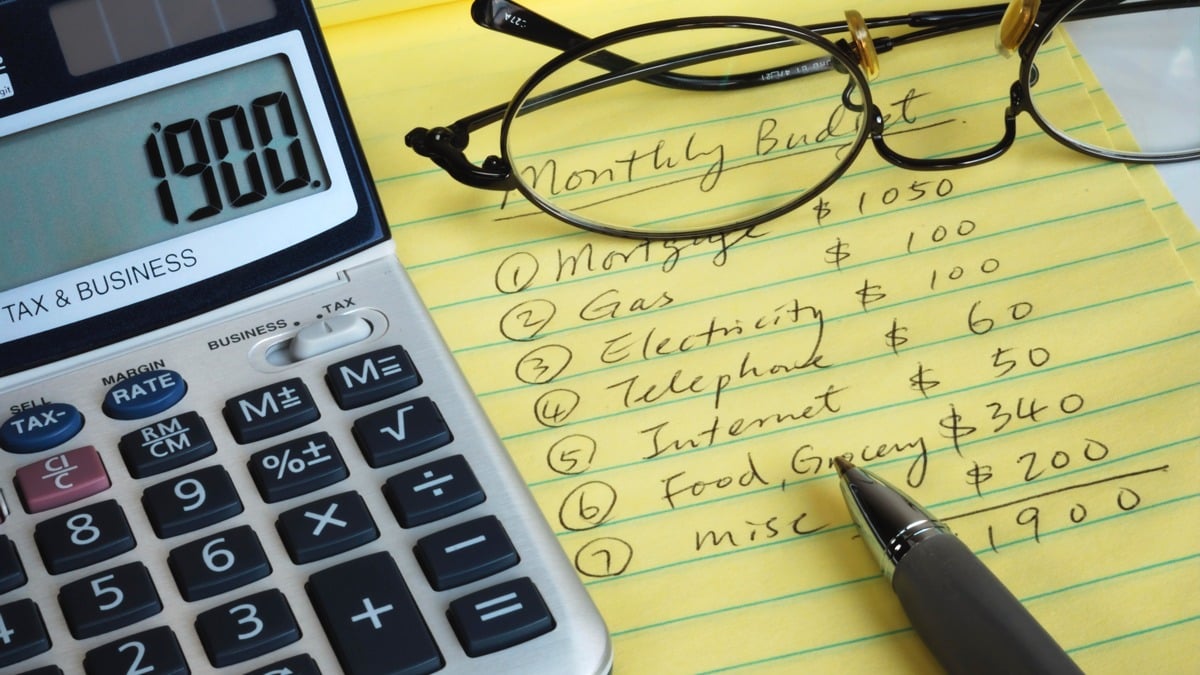

How to budget for retirement

Unsure whether you have enough saved to retire? First you need to work out how much you are likely to spend. Luckily, there are tools for that.

-

How to plan your spending through the 3 stages of retirement

Far from being one long holiday, retirement tends to be a tale in three acts, with different spending patterns along the way.

-

How to start a super pension and what to consider first

When you retire there’s more than one way to withdraw income from your super; we explain your options.

-

How to find a super financial adviser

There are times in life when the right financial advice could prove invaluable, but it’s important to know what you are looking for and where to find it. Here’s how.

-

How to plan for your retirement

It can be difficult knowing where to start when you are ready to think seriously about retirement, but working through these easy steps will help.

-

When can I access my super? All conditions of release explained

While super is designed to provide income in retirement, there are circumstances when you may be eligible to withdraw some or all of your savings.

-

Selecting a retirement income calculator

Most super funds provide tools to help you estimate your annual retirement income and how long it should last. But how reliable are they? It pays to know what to look out for.

-

Location the missing ingredient in retirement planning

When you start planning your retirement, where you live can be just as important as your super balance and have an even bigger impact on your quality of life.

-

What is the retirement age in Australia?

When (and if) you retire is up to you, but there are rules around when you can access your super and the Age Pension.

-

Planning to retire at 65? What you need to consider

While the Age Pension age has crept up to 67, the average age of retirement in Australia is closer to 65. Filling the income gap with super will require careful planning.

-

Planning to retire at 60? What you need to consider

Once you turn 60 it is easier to access your super provided certain conditions are met.

-

Planning to retire before turning 60? What you need to consider

If you want to retire early you will need sources of income other than super now that the super preservation age has increased to age 60.

-

Explore a transition-to-retirement strategy using Industry Super’s TTR calculator

Take a few minutes to find out if you can boost your retirement balance without compromising on your income, reduce your work hours, or generate additional income with a transition to retirement strategy.