In this guide

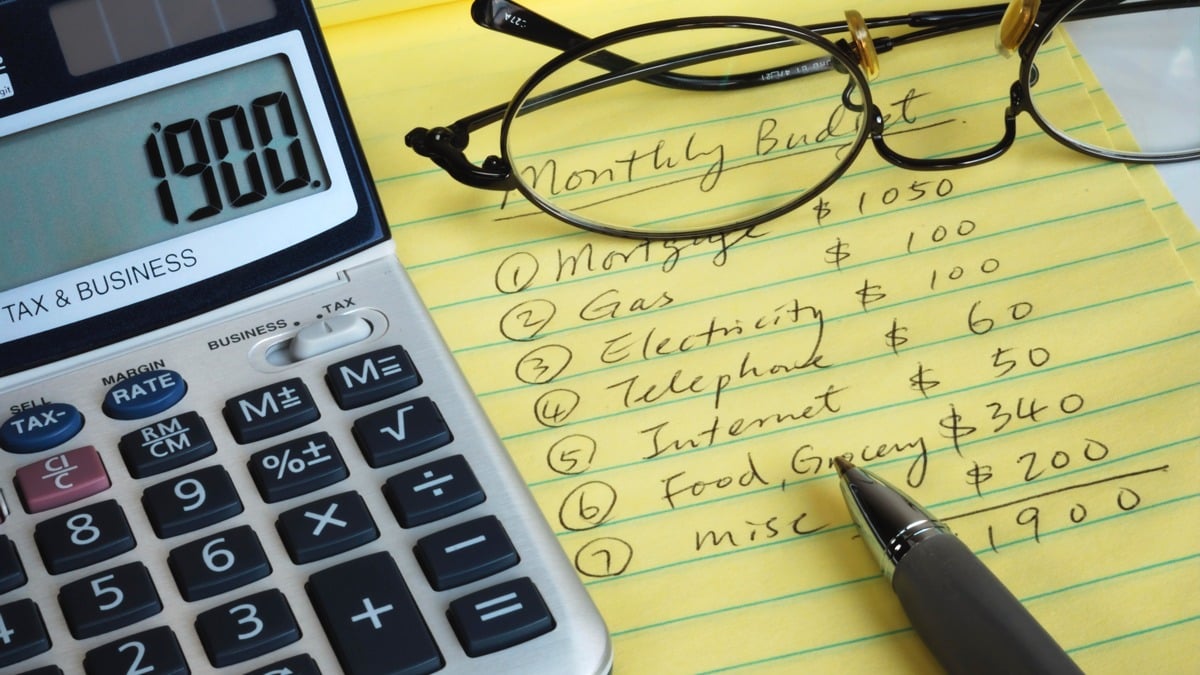

Thinking about it can send even the most financially savvy among us to sleep, but making a comprehensive budget is one of the most valuable steps in your retirement planning process.

Without delving into your spending habits, estimating the income you want to retire on can be like throwing darts at a dartboard – you may not land in the right place.

Happily, there are tools and resources available that can make the process simpler and set you on your way to understanding how much you are likely to spend.

ASFA retirement standard

You may be familiar with the Association of Superannuation Funds of Australia (ASFA) retirement standard, which updates the estimated cost of retirement every three months. But how many people drill down into the sample budgets ASFA uses to arrive at its estimates?

The retirement standard estimates the spending needs of retirees seeking either a comfortable or modest standard of living, with different figures for singles and couples. Originally, the budgets were only for homeowners, but in June 2025 ASFA expanded the standard to include a modest budget for renters.

The detailed budgets that accompany the standard are a good starting point to prompt you to think about your own needs.

For example, the comfortable budget for a homeowning couple provides around $100 a week to eat out and under $5,000 a year for domestic holidays. The budget for overseas trips is around $13,500 for an international holiday once every seven years.

While those numbers will feel like plenty for some, others will dream of much more when imagining what a comfortable retirement looks like.

Sample budgets for different age groups

The ASFA standard produces different figures for required income based on age. The first is for retirees aged 65–85, while the other covers 85+.

The detailed budget for over 85s includes a higher allowance for health costs and outsourced house cleaning, but makes a more modest provision for Australian holidays and doesn’t include overseas trips or owning a car at all. Think about whether this matches your expectation, or if you’re predicting good health and travel well into your later years.

Wherever you sit on the spectrum, a look at ASFA’s detailed budgets can get you thinking about all the categories of spending you should consider and whether the estimated figures are more or less than you personally aspire to.

Look at the ASFA retirement standard and scroll down to download detailed retirement expenditure breakdowns.

While the standard is great for getting you thinking, it’s unlikely to match your spending needs exactly. Maybe you have an expensive hobby or need a long list of medications. Perhaps you want to run more than one car or travel overseas every year. All these things influence your true retirement budget. This is where making a detailed plan for your unique needs and aspirations comes into its own.

Budgeting tools

There’s a range of handy budgeting tools available free of charge that can help you estimate your needs. Most of the big banks provide a version on their websites and the financial regulator ASIC also has a budgeting tool on the Moneysmart website.

Our video demonstration below walks you through how Moneysmart’s budget planner works.

Using a budget planner helps ensure you don’t miss any expenses and allows you to easily revisit your numbers later if you need to collect more information.

It’s a good idea to have your latest bills in front of you before you start. Remember annual items like car registration. If you pay most of your expenses with a credit card, your last few statements will be a great source of information. Your bank account’s app or website may also include graphs that break down your spending in each category for you.

Remember to adjust any expenses that will change after retirement, such as including more travel, lower registration, insurance and fuel costs if you plan to reduce the number of family cars, and higher energy use if you’re going to be at home more.

You may also become eligible for senior discounts on items such as council rates, car registration, public transport and medications.

Check if you’re on track and adjust

When your budget is complete, it’s time to plan how to reach the retirement income goal you’ve come up with. Your super fund may provide a retirement calculator, or you can try a publicly available tool like the Moneysmart retirement planner, TelstraSuper retirement lifestyle planner or Mercer retirement income simulator.

These calculators can predict your likely retirement income based on your current level of super contributions, predicted future investment earnings and fees. A good calculator should include your Age Pension entitlement too.

If the predicted income isn’t enough to cover the expenses included in your budget, it’s time to think about adjusting your investment option and super contributions to bridge the gap. Add what you can afford to contribute to the tool to see how much closer you can get to your goal and see how selecting an investment option with a higher allocation to growth assets could change the likely outcome.

What if my goal is unreachable?

If your budgeted income goal seems impossible, there are a few clear options:

- Adjust your expectations for retirement. Revisit the budget and assess where you’re prepared to compromise

- Consider working for longer

- Think about other sources of income for your retirement. Could you downsize your home and invest the proceeds? Are you prepared to consider a reverse mortgage?

Leave a Reply

You must be logged in to post a comment.