In this guide

Each year, the Australian Taxation Office (ATO) puts together a list of the most common errors made by self-managed super fund (SMSF) trustees when compiling their annual returns.

This information is extremely valuable as it provides an insight into mistakes the regulator commonly sees and is on the lookout for. Avoiding these issues will help ensure your SMSF’s annual return (SAR) is processed without delay and hopefully with no added scrutiny.

Knowing what the regulator is focussing on also allows you to get on the front foot with the fund paperwork, before you meet with your fund accountant or administrator.

The following are the issues raised by the ATO relating to the 2024 SMSF annual return.

Incorrect member information and tax file numbers

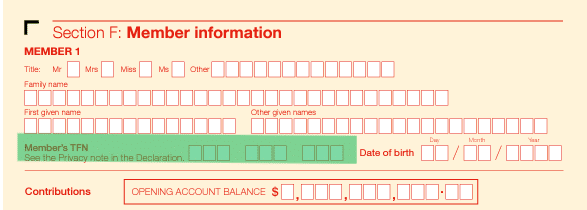

Section F of the annual return contains all the relevant fund member information, including the member’s tax file number (TFN).

When completing this section, make sure you input the members personal TFN and not the TFN of the SMSF.

The ATO uses the member’s TFN as an identifier within their systems to locate, identify and link the SMSF member’s records to other areas like contributions and total super balances.

It is not an offence to not provide your TFN, however it will cause a delay in processing your fund’s return and will usually result in further information requests from the ATO.

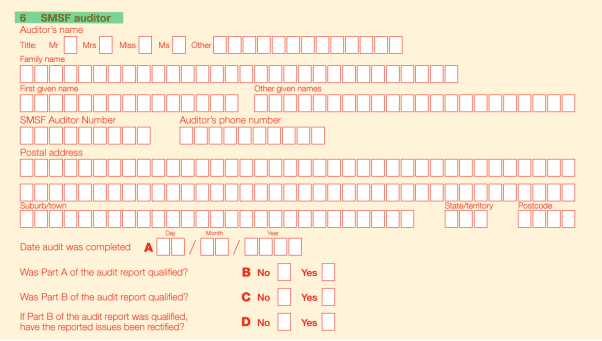

Incorrect SMSF auditor number and auditor details

It is a requirement to have an annual SMSF audit carried out before lodging the SMSF annual return. Details of the auditor who completed the annual audit must also be included in Part A of the SMSF annual return. This includes the auditor’s personal details, their auditor number (SAN), and their contact details.

Make sure you include the correct details for the current year’s auditor, especially if you have changed auditors from the previous year. In some instances, the old auditor details have been incorrectly left in the annual return instead of being updated with the correct, new auditor details.

Incorrect closing balances or missing balance information

There are two separate sections where member information needs to be included in the SMSF annual return:

- Section F: Member information: This is where you include information for all individuals who remained as a member of the SMSF at the end of the financial year, so on 30 June 2024.

- Section G: Member information: This is where you need to include member information for all individuals who are no longer members of the SMSF on 30 June 2024 but were members at any time during the financial year.

The information that needs to be reported is the same under both Section F & G, including:

- All contributions, both amounts and type of contribution

- Allocation of fund earnings or losses

- Inward or outward rollover amounts

- Lump sum and income stream payments.

It is important that all relevant information is included in these sections as these amounts are then used to determine the member’s accumulation phase value (APV), retirement phase value (RPV) and, eventually, the member’s total superannuation balance (TSB).

In situations where the member’s APV, RPV or TSB is zero, make sure to write “0” in the relevant box or boxes. Do not leave these blank.

Prior year issues raised by the regulator

It would also be worth keeping in mind the common lodgement errors and issues that have been raised by the regulator in prior years and make sure you have covered these off where relevant in the current year’s annual return.

The following are the five key issues previously raised by the regulator.

Not valuing the SMSF’s assets at market value

Providing the correct market value of your assets is an important responsibility of an SMSF trustee. Assets need to be valued as at 30 June each year. If you provide incorrect valuation information you may jeopardise your SMSF’s complying fund status and could incur penalties.

2026 SMSF calendar

"*" indicates required fields

It’s reasonably easy to value listed market assets (that is, their closing value on 30 June each year). Providing values of non-listed assets such as real property, collectibles, private companies and private unit trusts can be more difficult.

Real property valuations need to be based on objective and supportable data and made by a competent person. Things to consider when doing so include the value of similar properties, the amount paid in an arm’s length market transaction, independent appraisals, whether the property has had improvements since it was valued for the previous year, and net income yields (for commercial properties).

The ATO says to consider getting an independent valuation (from a qualified valuer) if an unlisted asset represents a significant proportion of the fund’s value or the nature of the asset indicates that the valuation is likely to be complex.

In some instances, SMSF trustees are required to obtain an independent valuation. This would include where the SMSF is looking to sell a collectible or personal use asset to a related party of the fund.

Lodging a return without auditor details

All SMSFs are required to lodge an auditor’s report with their annual return. This needs to be done by a registered independent auditor (you can check whether an auditor is registered here) and the auditor must notify both the trustees and the ATO of any contraventions by the SMSF.

The trustees need to appoint the auditor at least 45 days before the annual return is due so they can complete the audit on time. Trustees also need to supply the auditor with any information they request concerning the fund.

If an SMSF fails to lodge an auditor’s details with the ATO the SMSF return will be suspended and the fund classified as non-complying until the auditor’s report is filed.

Don’t forget it’s illegal to audit your own SMSF or an SMSF of a relative no matter who you are.

Bank account not unique to the SMSF

One of the first things SMSF trustees must do when they set up their fund is open an account in the name of the fund which is separate to their individual or company bank accounts. The account will be in the name of the super fund and used exclusively for the fund’s transactions.

The SMSF bank account is there to accept contributions, rollovers, income from investments and to generally manage investments for the fund.

“If your SMSF does not have a unique bank account, then your member’s retirement benefits may not be protected,” the ATO says.

Trying to lodge with zero assets

This might be something many new trustees are unaware of. You may not need to lodge a tax return for your SMSF if it has zero assets. An SMSF is a trust and to be a valid trust it must have an asset otherwise it does not exist at law. If a fund has just been set up and is yet to receive contributions or rollovers from members, then it can apply to the ATO to flag the SMSF as ‘return not necessary’ (RNN).

In that case the fund must confirm (in writing) to the ATO that it has no assets and did not receive contributions or rollovers in the first financial year and that it will be lodging future returns. It also needs to provide documentary evidence of the date the SMSF first held assets and commenced operating (for example, a bank statement).

As the lodging date for annual returns is generally months into the following financial year, even if a new SMSF had a zero balance at the end of the financial year, it is likely to have received contributions before lodging date. It is evidence of those contributions or rollovers that the ATO is seeking.

Trustees written requests must include:

- The SMSF’s name, TFN or ABN

- Confirmation that it meets all eligibility conditions

- Documentary evidence of the date assets were first placed into the fund.

Tax agents can use online lodging services.

Providing an incorrect electronic service address (ESA)

For an SMSF to receive contributions from external employers (that is, those other than related party employers) it needs to be able to receive SuperStream data electronically. SuperStream is the national data standard through which employers must pay super contributions into an employee’s super fund.

SMSFs are not exempt from this data standard, which was introduced in 2015 as part of a series of reforms to standardise the delivery of money and data.

Any fund receiving contributions via SuperStream needs an electronic service address or an ESA. An ESA is a series of alphanumeric characters with a combination of upper and lowercase characters and is case sensitive. You can get an ESA from a SuperStream message solution provider, or through your SMSF intermediary, such as an SMSF administrator, tax agent or accountant.

The bottom line

Preparing an SMSF annual return is serious business and something you need to get right if you don’t want your fund to become non-complying. Get it wrong and you may be forced to pay tax at 45% on the total value of the fund, excluding non-tax-deductible contributions. So it pays to know what common mistakes the ATO is on the lookout for.

Leave a Reply

You must be logged in to post a comment.