In this guide

Self-managed superannuation fund (SMSF) trustees should be familiar with their requirements to have an investment strategy in place, but it can be difficult to know where to start if you’ve never done one before.

One easy-to-understand approach, which many SMSF trustees use, is called a core and satellite investment strategy. It aims to stabilise returns and aid diversification while reducing risk by limiting the percentage of your portfolio you can invest in riskier investments.

Harnessing a universe of investment options

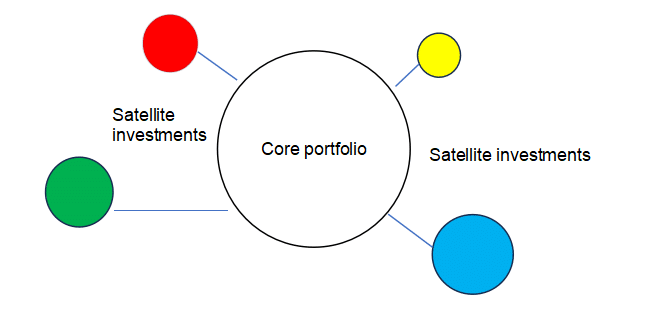

The core satellite approach involves investing in a core of low risk, usually low-cost stable investments, combined with investments in ‘satellite’ or riskier options that may deliver higher returns, as the diagram below illustrates.

Solar system approach

If you think of your portfolio as a solar system, then the sun is your core portfolio and the smaller planets orbiting it are your satellite investments.

How you allocate your portfolio to core and satellite investments will depend on your investment preferences and personal circumstances, but a common approach is to invest 80% in a core portfolio of equities, bonds and cash and 20% in satellite investments.

If you start with this kind of approach, and stick to it, you will make sure you don’t bet the house, that is, all your SMSF funds, on that ‘once-in-a-lifetime opportunity’ that Uncle Steve is recommending.

How it’s used

Many investors invest their core portfolio in index funds or exchange traded funds (ETFs) which can be bought and sold on the Australian Securities Exchange (ASX) like ordinary shares. These are low-cost funds that aim to mirror the returns of a particular index like the ASX/S&P 200. For better or worse, they deliver pretty much what it says on the tin – the same performance as the underlying market they are tracking.

Depending on your investment outlook, you might decide to invest your core portfolio in, say, 70% growth assets like equities and 30% defensive assets like bonds and cash. On a micro level that might look like 35% in Australian equities via a larger allocation to a broad-based Australian market ETF and a smaller allocation to an Australian small cap ETF. You could then invest 25% in global ETFs, also available on the ASX, with the remaining 10% in property or Australian Real Estate Investment Trusts (A-REITS). Your remaining 30% would be allocated to cash and fixed income – for which ETFs are also available.

Alternatively, you could invest in a diversified index fund with all of the SMSF moneys you allocate to your core portfolio holdings but then you are leaving the performance of your fund entirely in the hands of the portfolio manager.

One of the main attractions of using ETFs for this strategy is their low cost. For instance, the SPDR® S&P®/ASX 200 Fund has management costs of just 0.05% and the BetaShares Australia 200 ETF has management costs of 0.04%. They also allow the investor control over asset allocation.

The remaining 20% or satellite investments could be allocated to actively managed funds, ETFs that invest in particular market sectors or themes, direct shares, or even private equity like start-ups.

Using this approach, your investment portfolio might look something like this. (Note: the allocations below are for illustrative purposes only, you may have different requirements.)

Core portfolio: 80% of total portfolio

Growth assets

| Asset type | Split |

|---|---|

| Australian equities | 35% |

| International equities | 25% |

| A-REITS | 10% |

| Sub-total | 70% |

Defensive assets

| Asset type | Split |

|---|---|

| Fixed income | 20% |

| Cash | 10% |

| Sub-total | 30% |

Satellite portfolio: 20% of total portfolio

| Asset type | Split |

|---|---|

| Private equity fund | 50% |

| Direct shares | 50% |

| Sub-total | 100% |

Who is it for?

Anyone can use a core and satellite approach to investing but it can be particularly useful for SMSF trustees as it is easy to understand, implement and follow. As outlined above, it can reduce risk, something that retired SMSF trustees are often nervous about, and it is particularly useful for couples where risk appetites may be different.

If one half of a couple has a higher risk appetite, they can use their satellite allocations to invest in riskier assets, while the more defensive investor is comforted by the more conservative holdings in the core portfolio.

It’s also well suited to long-term investors like SMSF trustees as the broad underlying markets that core ETFs track deliver strong returns over time. For example, over the 53 years since the beginning of 1970 Australian shares have delivered an average of 9.6% per year, international shares have returned 9.9% per year and US shares have returned 11.7% per year.

2026 SMSF calendar

"*" indicates required fields

Pros and cons

Pros

- An easy-to-understand and implement strategy for the novice to experienced investor

- Reduces costs

- Reduces risk

Cons

- Requires regular oversight

- Satellite investments can still underperform and negatively impact your overall portfolio

- May be too simple for the more active investors.

The bottom line

The core and satellite investment strategy can be a useful approach for any SMSF trustee unsure of how to create and implement their investment strategy. It is easy to understand and helps trustees diversify their portfolio while balancing risk and return.

Leave a Reply

You must be logged in to post a comment.