In this guide

At five minutes to dawn, so to speak, the Government’s Retirement Income Review has found that further increases in employers’ compulsory super contributions would come at the cost of wages.

What’s more, it argues that the current level of compulsory contributions is enough for most retirees to enjoy their pre-retirement standard of living, with one proviso. And it’s a big one. We need to be prepared to draw down more of our capital in retirement and tap into the equity in our homes.

Before we get into that, a bit of background.

Opposition to super increase mounts

As things stand, compulsory super contributions (called the Superannuation Guarantee or SG) are scheduled to increase from the current 9.5% of wages to 10% on 1 July 2020. Further incremental increases are scheduled to lift the SG to 12% by July 2025.

| Period | Super Guarantee rate |

|---|---|

| 1 July 2002 – 30 June 2013 | 9% |

| 1 July 2013 – 30 June 2014 | 9.25% |

| 1 July 2014 – 30 June 2021 | 9.5% |

| 1 July 2021 – 30 June 2022 | 10% |

| 1 July 2022 – 30 June 2023 | 10.5% |

| 1 July 2023 – 30 June 2024 | 11% |

| 1 July 2024 – 30 June 2025 | 11.5% |

| 1 July 2025 – 30 June 2026 and onwards | 12% |

Source: ATO

The increase to 10% has been hotly contested as the start date looms and the economy has been dragged into recession by the pandemic.

This year, modelling by the Grattan Institute, Treasury and the Reserve Bank has supported employer groups’ claims that any further increase in the SG would stifle economic and wages growth.

In one corner, the influential Grattan report found that 80% of each increase in the SG was at the cost of future wage increases.

In the other corner, studies funded by Industry Super found no trade-off in wages. In some cases, they argued wages actually rose following rises in the SG.

Now that the Retirement Income Review has weighed in on the side of enough is enough, the Government has the ammunition it needs to halt the increase to 10%.

So what did the Review find?

While stressing the importance of compulsory super, saying that without it many people would experience a reduction in their retirement living standards, the Review also acknowledges that there is a trade-off between the SG and wages.

2026 SMSF calendar

Our free calendar includes due dates for important documents plus suggested dates for trustee meetings and other strategic issues for your SMSF.

"*" indicates required fields

This should not come as a complete surprise. When compulsory super was introduced in 1992, the then-Labor government described the SG as ‘forgoing a faster increase in real take-home pay in return for a higher standard of living in retirement’.

New modelling by the Tax and Transfer Policy Institute commissioned by the Review analysed ATO data from individual tax returns from 2002-03 to 2016-17. It found that after increases in the SG (from 8% to 9% in 2002 and from 9% to 9.25% in 2013) companies passed on 71% to 100% of the cost to workers in the form of reduced wages growth.

As part of their analysis, they found that employees who receive super contributions above the legislated SG rate have persistently lower wage growth.

Worryingly, they suggest the impact of super increases on wages could be even higher in future. The rise in unemployment and underemployment during the COVID-19 recession will likely affect employees’ bargaining power for a while to come.

Longer term, the technological changes allowing the transfer of lower-skilled jobs offshore and the rise of the gig economy will also put downward pressure on wages.

Bringing income forward

The Review concludes that the weight of evidence suggests most of the increases in the SG come at the expense of growth in take-home wages. It estimates that lifting the SG to 12% would cut working-life incomes by 2%.

With annual wages growth a mere 1.4% in the year to September 2020, there is not much meat to cut.

In the current economic environment, younger workers may decide a bird in the hand in the form of wages is worth two in the bush in retirement. Longer term, they may not be quite so happy, but a lot depends on how much you earn during your working life.

Horses for courses

One of the issues with our retirement income system is that people find it difficult to work out how much money they will need at retirement to provide enough income to maintain their lifestyle. There are various rules of thumb to guide decision-making, with two main approaches:

- The ASFA Retirement Standard which estimates modest and comfortable annual budgets. Learn more in SuperGuide article What is the cost of living in retirement in Australia?

- Replacement rates that estimate the percentage of pre-retirement income retirees should aim for. Learn more in SuperGuide article Target retirement income: An explanation of the 66-80% rule of thumb.

To measure retirement income adequacy, the Review opts for a replacement rate of 65% to 75% of pre-retirement, after-tax income.

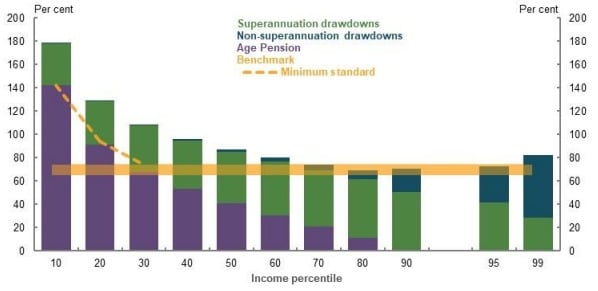

It found that even if the SG is held at 9.5%, lower- and middle-income earners will retire within or above the 65% to 75% replacement benchmark through a combination of the Age Pension and some super.

Far from being just a safety net, the Review says the Age Pension supplements the income of around 65% of retirees. It serves as a buffer to offset declining retirement income as a result of market downturns and also acts as a type of longevity insurance for those who outlive their retirement savings.

The top 20% of income earners will come close to the replacement rate using super and personal savings.

Chart 1: Projection of replacement rates

Source: Cameo modelling undertaken for the Retirement Income Review.

Note: Minimum standard is the maximum rate of Age Pension. Replacement rates are projected for individuals commencing work in 2020 and retiring in 2060.

But the Review goes further. It argues that many retirees would be better off in retirement with a SG of 9.5% if they used their savings more efficiently than they would with the SG at 12%.

Chart 2: Projected replacement rates by SG rate and drawdown strategy

Source: Cameo modelling undertaken for the Retirement Income Review.

Note: Minimum drawdown based on legislated minimum rates by age. Minimum drawdown rate scenarios do not include people purchasing a longevity product. Efficient drawdown based on review strategy where superannuation assets are fully consumed by age 92 and a longevity product.

Free eBook

Retirement planning for beginners

Our easy-to-follow guide walks you through the fundamentals, giving you the confidence to start your own retirement plans.

"*" indicates required fields

The report suggests three ways to use retirement savings more efficiently are:

- To draw down more than the mandated minimum annual amount from super,

- Select a super fund with better after-fee returns, and

- Access the equity in the home.

Fair-for-all, not a free-for-all

The Review points out that higher income earners not only achieve higher retirement outcomes in absolute dollar terms, but they receive the bulk of the tax concessions in accumulation phase. In August 2018, more than 11,000 people had more than $5 million in super.

This is not just a matter of income-envy, but fairness and sustainability of the system. Modelling for the Review shows that if future increases to the SG go ahead, and wages suffer, the annual budgetary costs of the super tax concessions will overtake the cost of the Age Pension by 2050. That is another reason younger Australians may prefer an increase in wages over an increase in super.

Our retirement income system is designed on the basis that people should draw down their savings, not as a vehicle for wealth creation or an intergenerational transfer of wealth. Yet most die with the bulk of their assets intact.

The Review argues that many middle-income earners are also saving too much for retirement, due to a reluctance to draw on their capital. But median- and average-income earners won’t meet the 65% to 75% benchmark if they work less than 30 years or retire at age 60. This is the case for more women than men who are not only more likely to have broken work patterns but retire around three years earlier than men, on average.

Not a super outcome for everyone

While the SG is doing its job, improving retirement outcomes for many Australians, there are big gaps in coverage.

Super knowledge is a super power

"*" indicates required fields

The SG currently covers around 90% of employees. However, it doesn’t reach low income, part-time workers, mostly women, who earn less than $450 a month. It also doesn’t cover 17% of the workforce who are self-employed and must either make voluntary super contributions or rely on their personal savings or the sale of their business to fund their retirement.

The Review points out that around 30% of retirees are worse off financially than they were during their working life, with “involuntary retirement” a major cause.

The SG is also likely to be inadequate for people who are forced to effectively retire early due to redundancy, ill-health or carer duties.

The bottom line

The much-anticipate Retirement Income Review does not make recommendations, but it does make a strong case for leaving the SG at 9.5% on the grounds of adequacy, equity and sustainability. Modelling commissioned for the Review finds that most retirees can expect to enjoy adequate retirement income or better, through a combination of super, the Age Pension and private savings.

Leave a Reply

You must be logged in to post a comment.