In this guide

If you’re one of the many Australians who have worked in the UK for a time, or a British expat now living in Australia, chances are you have money sitting in a UK pension fund. Unfortunately, transferring your UK pension into an Australian superannuation fund has been made more difficult in recent years due to changes in the rules.

Of course, you could always leave your money in the UK and withdraw it as a pension when you retire, but the pension will be taxed in Australia. Whereas accumulated savings in an Australian super fund can be withdrawn tax free once you turn 60 and retire.

So, the incentive is there to transfer your UK pension into super, but strict rules and limitations apply.

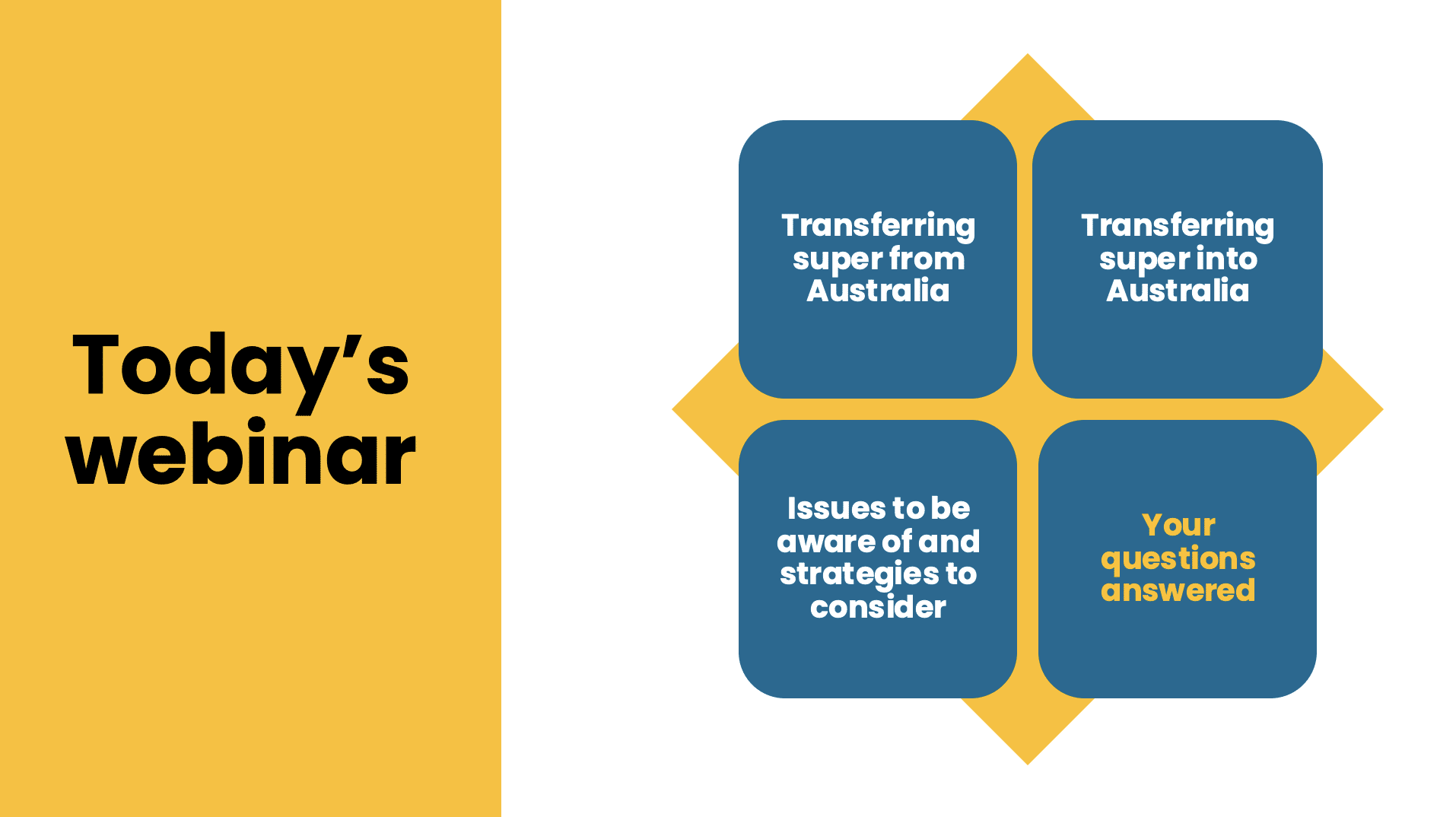

Overseas super transfers webinar

Who can transfer?

Changes to UK legislation in 2015 prohibit people from transferring their pension funds before they have reached the minimum UK pension age of 55. Previously, people of any age could transfer these funds.

Eligible Australian super funds can accept transfers from members up to the age of 75. Since the repeal of the work test for people aged 67 to 74, which came into force on 1 July 2022, one hurdle has been removed.

But there are still the usual hurdles around how much money you can get into super, including the total super balance rules and restrictions and the annual contribution limits.

Then there is the issue of which super funds can accept UK pension transfers.

What funds can you transfer to?

UK pension funds should only be moved into a fund that is recognised as a Qualifying Recognised Overseas Pension Scheme (QROPS) by the British government’s HMRC (Her Majesty’s Revenue and Customs) department. Where transfers are made to non-QROP style funds, tax rates as high as 55% can be levied.

To be eligible to receive UK pension transfers, Australian super funds must apply to HMRC and satisfy their QROPS requirements.

HMRC publishes a list of Australian super funds that have met these requirements on their website. It’s important to note that almost all these funds are self-managed super funds (SMSFs). That’s because most large Australian industry, retail and public sector funds do not meet the strict QROPS eligibility requirements that were introduced in 2015.

Under the 2015 UK pension legislation, a QROPS must not allow its members to withdraw funds before they reach the age of 55 unless they are forced to retire due to ill health. However, under Australian legislation, super funds can allow their members to withdraw prior to 55 in other limited circumstances, for example, if they are in severe financial hardship or on compassionate grounds. Australian super funds need to allow for early access to super in these situations, but this also makes them ineligible for UK pension transfers.

At the time of writing, there is only one retail super fund in Australia that is registered with the HMRC as a QROPS. This is the Australian Expatriate Superannuation Fund (registered under the name of its master trust, Tidswell Master Superannuation Plan) set up exclusively for the purpose of accepting UK pension transfers.

SMSFs are therefore the primary vehicle for UK pension fund transfers to Australia. These SMSFs are specifically set up to restrict membership to people over the age of 55 in order to qualify as a QROPS.

This is achieved by using specific trust deed wording, so make sure that your trust deed provider is aware that you need a QROPS-style SMSF trust deed.

What are the tax implications?

UK pension funds transferred to eligible Australian QROPS are not taxed in Australia, provided they are received within six months of the member:

- Becoming an Australian resident for tax purposes

- Having their foreign employment terminated.

The transferred funds within this six-month window are classed as non-concessional (after-tax) contributions.

Any earnings on pension funds received after the six-month tax-free window are taxed in Australia at the concessional superannuation rate of 15%. This is known as applicable fund earnings.

You will also need to consider the effect that any transfer will have on your contribution caps, which can differ depending on how long you have been a resident in Australia for tax purposes.

The steps involved

If you’re over 55 and considering transferring your UK pension fund to an Australian superannuation fund, you should take the following steps:

Step 1

Check with your UK pension fund to see if there are any transfer restrictions. For example, certain schemes may not be eligible for transfer, such as those currently in the payment phase.

Step 2

Check to see whether your existing fund is a QROPS via the HMRC website. It’s unlikely that it will be though. Other than the Australian Expatriate Superannuation Fund mentioned earlier, we could not find any other Australian retail or industry super funds on the list.

Step 3

If you already have your own SMSF, obtain legal advice to amend your fund’s trust deed to comply with QROPS requirements (specifically, so that your fund’s membership is restricted to people aged over 55). Then proceed to Step 5.

Step 4

If you don’t already have an SMSF, you should seek independent financial advice about whether you should set one up. Note that this is a decision that should not be taken lightly. There are considerable costs and ongoing regulatory compliance obligations involved. Whether it’s a worthwhile option will depend on your financial circumstances and goals.

If you decide to proceed with setting up an SMSF after obtaining this advice, continue to Step 5. Otherwise, unless you find an Australian public superannuation fund able to accept your UK pension, you will need to leave your money in your UK pension fund.

Step 5

Apply online to the HMRC to have your SMSF registered as a QROPS.

Note that there are ongoing HRMC reporting obligations involved with being a QROPS. The HMRC approval process typically takes up to eight weeks.

Step 6

Once your SMSF is registered as a QROPS, apply online to have your UK pension funds transferred. Again, it’s best to seek independent financial advice before proceeding, ideally from an adviser who is familiar with UK pension fund transfers.

Once you have received the funds into your SMSF, you may have the option of transferring them into another Australian fund if you don’t want to continue administering your SMSF. However, this process is not straightforward and will depend on factors such as when you originally transferred your UK pension, ten years of ongoing reporting requirements to HMRC and the intersection of UK and Australian tax law.

In some cases, you may need to wait five or up to ten years before you can roll over into another super fund, depending on your circumstances. Again, seek independent financial advice to evaluate any associated costs and benefits if you want to pursue this strategy.

The bottom line

Transferring a UK pension to an Australian super fund can be time-consuming and costly, but it may be worth considering depending on your personal financial circumstances.

The information contained in this article is general in nature. It’s best to seek independent financial advice to determine whether transferring a UK pension is a suitable strategy for you.

Get more guides like this with a free account

better super and retirement decisions.

Leave a Reply

You must be logged in to post a comment.