In this guide

The importance of timing has been emphasised by everyone from Shakespeare to modern day business leaders. When it comes to your nest egg, timing is not just important, it can have a major impact on how much you enjoy your retirement years.

If markets drop or prices are volatile, years of careful saving and investing can be wiped away just as you are ready to put your feet up for a well-earned rest.

Although we all hope it doesn’t happen, preparing for the worse is a key part of good retirement planning. An important part of that is learning about the somewhat nerdy concept of sequencing risk.

So, what is sequencing risk?

While it sounds complex, the underlying concept of sequencing risk is the risk your super savings will be subjected to the worst returns at the worst possible time – the years just before and after you retire.

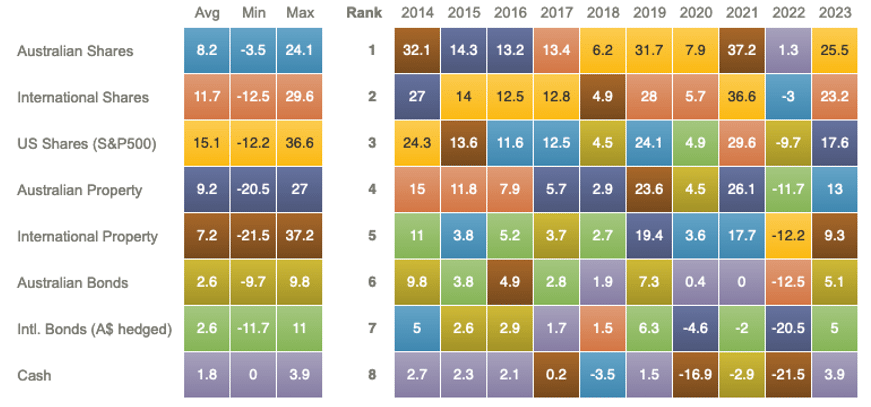

Sequencing risk arises because of the inherently unpredictable pattern of returns delivered by investment markets. You only have to look at the chart below showing the investment returns of different asset classes over the past decade to see this at work.

Annual returns for selected asset classes, ranked in order of performance in each year

Year to 31 December

Source: Vanguard Australia Asset Class Tool

As you can see, investment returns can vary wildly from year to year.

Your investment returns matter even more during the so-called retirement risk zone, which is the period occurring as you switch from building your nest egg to spending it in retirement. During these years your super balance is at its largest, so there’s the greatest amount of money in play. Poor investment returns at this time have an outsized impact on your accumulated savings pool.

Even when you move into retirement you’re not immune to sequencing risk. If you have started a super pension, you’re required to withdraw a fixed, minimum amount from your pension each year – even if financial markets are performing poorly. This means you are being forced to sell units even if the value of the underlying investment assets is low. This effectively locks in your losses, unless you have enough cash set aside in your pension account to ride out periods of volatility.

Why the order of your returns matters

The key issue with sequencing risk is the order – or sequence – in which your investment returns occur.

At the start of your working life you have many years ahead of you to smooth out the ups and downs in investment returns, so the long-term average return is what matters.

But when you’re close to retirement – or in early retirement – the sequence of your investment returns becomes much more important.

For example, if your super account records a negative 12% return early in your working life it’s easier to accept, as your account balance is small and the impact of a 12% reduction isn’t as painful.

But when you’re two years away from retirement that same negative 12% return is going to hurt a lot more. If your account contains 35 years of super contributions and investment returns, a negative 12% return will have a very significant impact in dollar terms. It may also make you think twice about whether you can afford to retire in two years, or whether you will need to work a little longer. This is sequencing risk.

Although Andy and Amal had the same average investment return over nine years and their contributions were the same, Amal retires with $77,985 more than Andy at retirement due to the order in which they received the investment returns. Andy experiences his biggest annual loss of 20% in the year before he retires, whereas Amal has a 20% loss in the first year of her nine-year plan.

5 ways sequencing risk affects your retirement

1. Less money in super when you retire

If your super account experiences a run of poor investment returns when you’re close to retirement and your nest egg is at its largest, you are likely to have less super than you planned when retirement day rolls around.

2. More investment risk required

When you’re close to retirement, there’s less time for your super account balance to recover from a loss, compared to someone who has just started saving. As a result, you may feel compelled to take more investment risk to try and recoup your losses.

3. Enforced changes to your retirement plans

If investment returns are negative just before you plan to stop working, you may be forced to delay your retirement. Investment volatility due to the GFC and the COVID-19 pandemic reduced the retirement savings of many pre-retirees and they found they needed to continue working for longer than they had originally planned.

A significant market correction during early retirement can also force you to return to work to rebuild your savings. At the very least, you may need to reduce your spending, forgo travel or make different lifestyle choices.

4. Less money invested during retirement

With less money in your super account when you retire, you will have a reduced amount invested and earning compound returns in future. Some estimates are as much as 60% of every dollar of retirement income comes from the investment earnings you make after you retire and start a super pension.

5. Bigger chance of running out of money

If you’re unlucky and investment returns are poor when you begin drawing down retirement income, your super is likely to run out faster. With less capital available, your risk of outliving your savings increases.

Strategies for dealing with sequencing risk

Unfortunately, nobody can predict future investment returns with any certainty, so it’s impossible to eliminate sequencing risk entirely.

That doesn’t mean you can’t take steps to help reduce the risk of being hit with investment losses as you near retirement. Some strategies to consider include:

Minimise your exposure to volatility

Reducing the amount you have invested in volatile growth assets like shares in the years leading up to your retirement can limit the impact of negative returns on your super. Moving money out of growth assets and into more conservative assets can help reduce the volatility of your investment returns.

That said, it’s important to retain a meaningful allocation to growth assets well into retirement to benefit from higher long-term investment returns, even as you withdraw pension income.

Ensure your portfolio is properly diversified

Diversifying your super across a range of asset classes can help reduce the volatility of your investment returns and the impact from a fall in any one asset class. The aim of diversification is to provide a smoother ride from year to year and deliver more consistent investment returns.

Hold your first year of retirement income in cash

By holding a portion of your retirement income in cash, you won’t be forced to sell some assets at lower prices if investment markets drop. You’ll still be able to pay your bills without having to do so at a loss during the early years of your retirement.

If possible, consider holding several years in cash so you won’t need to sell shares or other assets if prices are low. This is where using a bucket strategy can be a sensible way to manage your retirement income.

Try to pay off your mortgage before retiring

Carrying a large mortgage into retirement is one way to leave yourself exposed to sequencing risk. As the government’s 2020 Retirement Income Review noted, if asset values fall significantly just before you retire, a larger proportion of your super will be needed to pay off your debt.

Use conservative assumptions when forecasting

If you plan to allocate your portfolio assets with the aim of achieving an annual average return of 7% return during retirement, try projecting a 5% return. That way if you have some bad investment returns early on, you won’t be in as much trouble.

Consider buying an annuity/lifetime income product

Placing a portion of your retirement savings in an investment that’s not affected by market returns when you retire can help safeguard against running out of money too soon.

Consider using a lifecycle investment strategy

Choosing a lifecycle investment option for your super account can help reduce your investment risk. These options gradually lower the percentage of growth assets as you age. Experts argue this can be a simple way to reduce your exposure to investment market declines prior to retirement.

The bottom line

Super is a long-term investment, so it’s inevitable there will be some bad years mixed in with the good. But the closer you get to retirement, the more important the timing of a big market fall becomes. Understanding the risk of this happening and planning for it is crucial.

In times of significant market uncertainty, anyone who is about to retire, or has recently done so, would do well to seek independent financial advice before making any major decisions.

Leave a Reply

You must be logged in to post a comment.