In this guide

Downsizer webinar

- Lee (67) is retired with a current super balance of $250,000.

- Lee’s wife Mandy (66), also retired, has a current super balance of $150,000.

- They receive the full Age Pension from Centrelink – currently $38,709 per year – and withdraw the minimum super pension (5% of their account balance based on their age) from their super accounts, which is $20,000 per year combined.

- They want to know whether their super will run out soon if they continue withdrawing the minimum amount, leaving them completely reliant on the Age Pension. They also want to know if they have the capacity to increase their retirement income.

Lee and Mandy are currently spending all their annual retirement income of $58,709 ($38,709 in Age Pension and $20,000 super pension combined) on household expenses and small domestic trips. They had thought they could afford more and feel their income is not enough. They also want to travel internationally for a few years.

According to the Association of Superannuation Funds of Australia’s (ASFA’s) Retirement Standard, a couple around the age of 65 needs approximately $42,621 to live a modest lifestyle and $65,445 to live a comfortable lifestyle. Using this benchmark, Lee and Mandy feel they will need income of at least $62,000 a year to give them the freedom to travel overseas.

They have the following assets:

- Primary residence: $900,000 (4 bedroom – bought when they were 40)

- Home contents: $10,000

- Cars: $10,000

- Cash savings: $5,000

- Total superannuation: $400,000

It’s important for them to continue receiving their current income to support their basic expenses. If they withdraw extra from super to fund their travels, they’re afraid their super will run out quickly, making them rely on Age Pension.

Using MoneySmart’s Retirement Planner calculator, they discover that if they want to make their super last till at least Lee is 90, the most they can withdraw is approximately $20,349 per year. This is only slightly more than the $20,000 a year they currently withdraw.

Initial estimated annual retirement income until age 90

Source: MoneySmart Retirement Planner

Lee and Mandy want to explore other options to increase their retirement income otherwise they will be forced to shelve their travel dreams.

Now their adult children have left home, they don’t need such a big house and the maintenance costs that go with it. So they’re considering selling their home and buying a smaller one. They have made enquiries and found the following:

- Their current home could sell for around $900,000.

- They can buy a suitable new home for around $600,000 (including stamp duty and other costs).

The remaining $300,000 could then be used to make a downsizer contribution into Mandy’s super (it can be made into either spouse’s super or split between two).

What is a downsizer contribution?

From 1 January 2023, if you are aged 55 or older (previously 60) and meet the eligibility requirements, you can make a downsizer contribution into your super of up to $300,000 each ($600,000 for a couple) from the proceeds of selling your home (owned by you or your spouse for 10 years or more prior to the sale). You do not need to be working to make this contribution.

After making a downsizer contribution and effectively converting a portion of their home equity into super, this is what their asset position would be:

- Primary residence: $600,000

- Home contents: $10,000

- Cars: $10,000

- Cash savings: $5,000

- Total superannuation: $700,000 (current balance of $400,000 + $300,000 downsizer contribution)

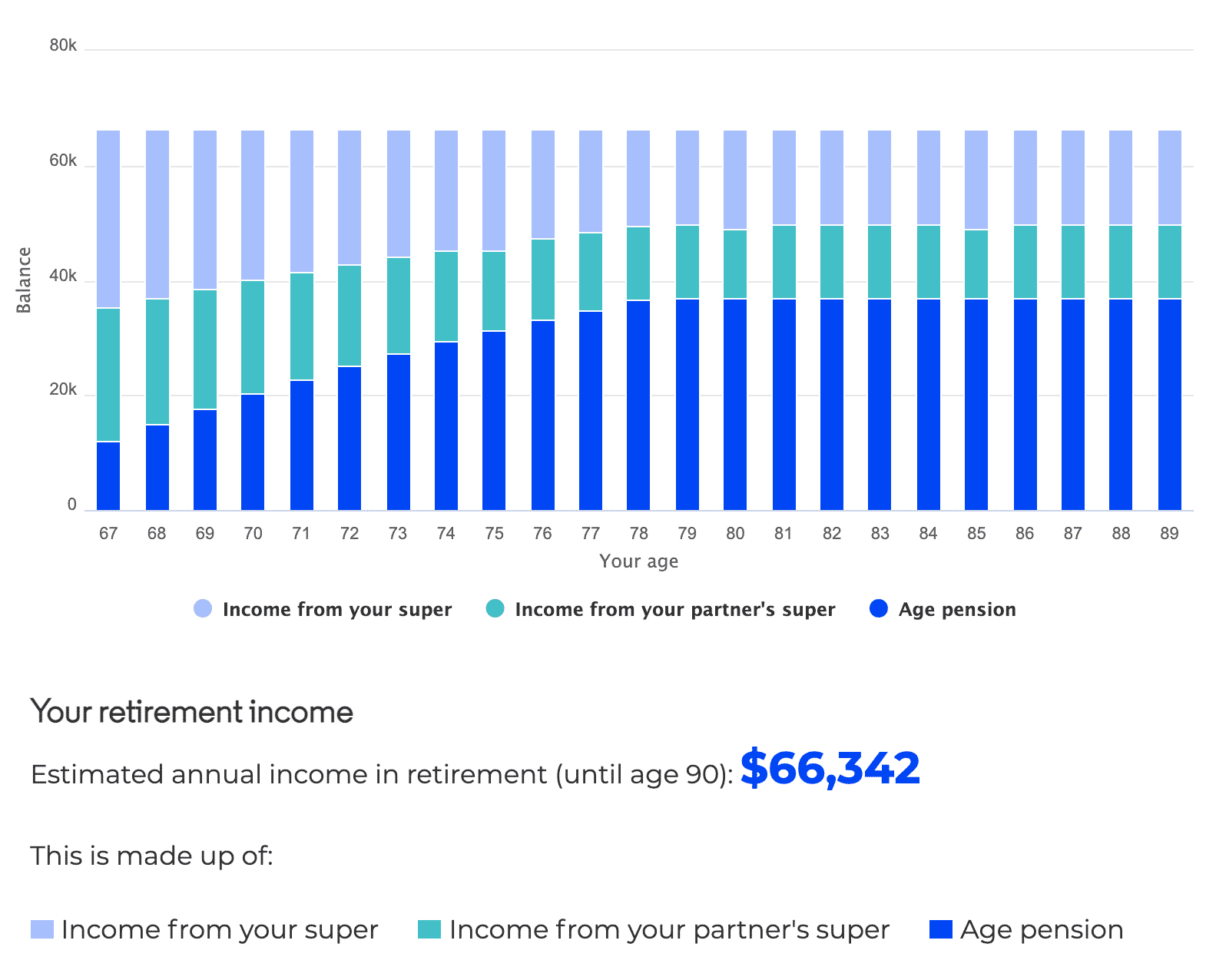

Lee and Mandy revisit the MoneySmart Retirement Planner calculator to see how much income they could afford to withdraw from super each year after boosting their balance with a $300,000 downsizer contribution.

Revised estimated annual retirement income until age 90

Source: MoneySmart Retirement Planner

As you can see, their super balance has increased and, even though Age Pension has reduced, they can still afford to withdraw more from super for their international travels. Their overall retirement income has increased by $7,694 a year to $65,057. They should continue to receive a part Age Pension till Lee is 78, after which they receive full Age Pension. Along with Age Pension, their super is estimated to last beyond Lee’s 90th birthday.

If their house sells for more than anticipated or they buy a house for less than $600,000, they can make a downsizer contribution into the other spouse’s super account, too, which will further increase their super balance.

Leave a Reply

You must be logged in to post a comment.