Articles by

SuperGuide

-

Market volatility and super: How to resist the itch to switch

You’ve probably heard the saying that successful investing is about time in the market, not timing the market. It’s easier said than done when markets are volatile, but it’s worth holding your nerve in the long run.

-

Quiz: Super for beginners

Does super bamboozle you? Take this quick quiz to learn some of the super fundamentals.

-

What should the federal government’s super and retirement planning priorities be?

As we see the dawn of a new government, we asked some of Australia’s top experts in superannuation and retirement planning what they think the government should be focusing on.

-

Planning for cognitive decline

Dr Jane Lonie from Autonomy First discusses some of the key aspects of cognitive impairment that retirees should be aware of, and why it is prudent to have a plan for cognitive decline.

-

SMSF pensions: Planning your pension properly

Tim Miller from SuperGuardian discusses the most important considerations when planning a pension, potential traps to look out for, and what often can be overlooked.

-

Quiz: SMSFs for beginners

Take the following 10-question quiz to test your knowledge on the fundamentals of self-managed super funds (SMSFs).

-

Video: Explainer on the legacy retirement income products amnesty

John Maroney, CEO of the SMSF Association explains the amnesty on legacy retirement income products that was announced in the 2021 Federal Budget.

-

Key observations from the Retirement Income Review

It’s quite a challenge to succinctly summarise the 233,117 words of the Retirement Income Review, and the report itself will be dwarfed by the coverage it receives in the coming weeks, months and years.

-

Video: What is Personal Capital?

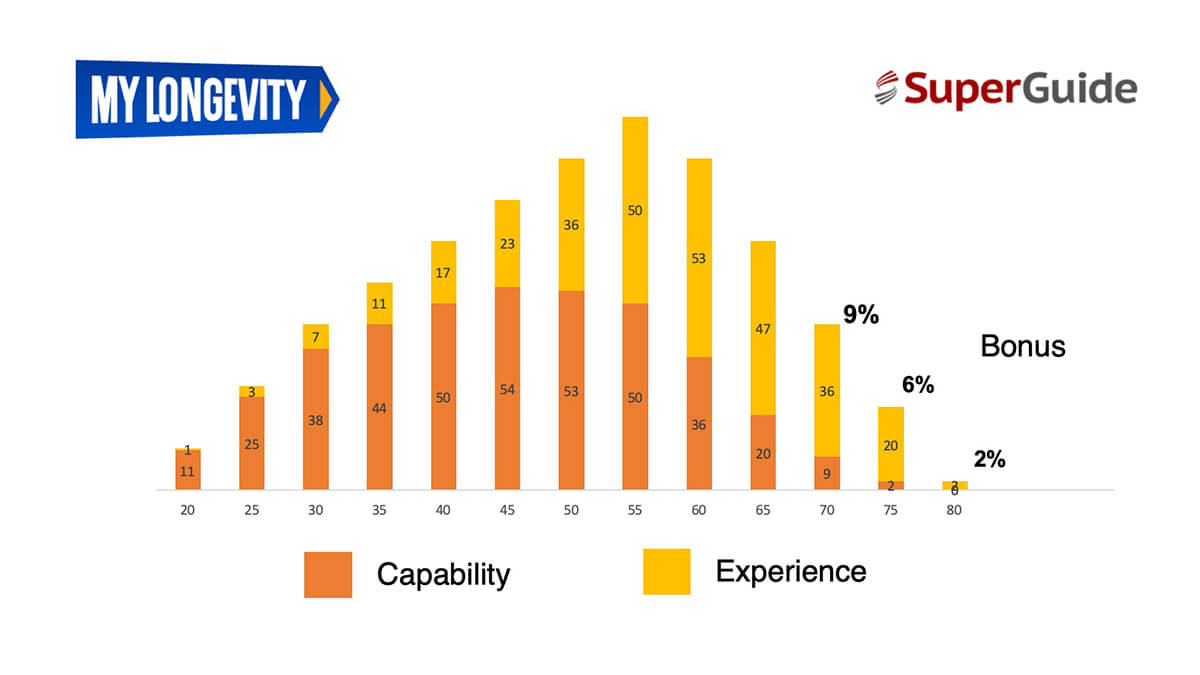

David Williams from My Longevity talks about the concept of Personal Capital and why it’s important retirees don’t overlook it.

-

What is a Longevity Plan, and how do they work?

In this video interview David Williams from My Longevity talks about the benefits of having a Longevity Plan and how to create one.

-

How can you plan your income needs in retirement?

How to plan your income in retirement can be one of the most confusing aspects of retirement planning. In this video members of the Profession of Independent Financial Advisers provide some insights into how they approach it.

-

Financial advisers give tips on preparing for retirement

Preparing for retirement can be daunting for many Australians. In this video members of the Profession of Independent Financial Advisers help you understand the important things to consider.

-

Protecting Your Super package: What you need to know

The Protecting Your Super Package of reforms start on 1 July 2019. These reforms are designed to protect your super accounts from being eroded by insurance policy fees and premiums that you may not require, as well as help to consolidate your low balance super accounts.

-

Adjusting to retirement: 8 factors that can help

This article presents findings from a research program that analysed the retirement experience of 200 Australians, and identifies eight specific factors that had helped those that had best adjusted to retirement.