In this video interview David Williams from My Longevity talks about the concept of Personal Capital and why it’s important retirees don’t overlook it.

Transcript

What is Personal Capital, and why should retirees not overlook this?

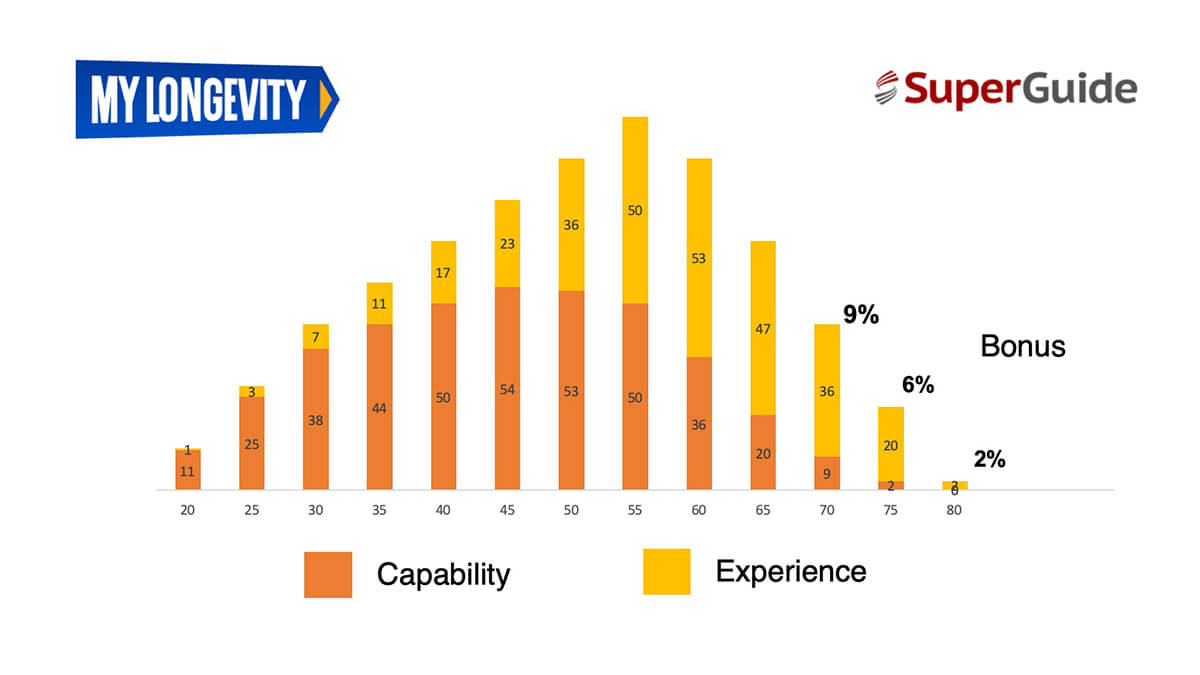

Personal capital is really made up in my mind of two things. It’s our capabilities and our experience and if we boil it down to that. Our capabilities grow as we leave school and we start to become employable and go to university or whatever we do.

So our capabilities grow and they probably keep growing if we’re interested, well into even our 60s. So at which point for some of us we might slow down a bit mentally or we may not be physically as capable of doing what we are doing, particularly if we have a very physical job.

So the capabilities tend to rise and then fall away in later life.

You can do as you’ll see from the Shape analyser work, you can do quite a lot to influence that and keep your capabilities in good shape, particularly in cognitive maintenance. There are things you could do, even the job you do can have a big impact on how well you maintain your cognitive skills.

So capability is one thing. Experience is the other, and of course at 20 we’ve probably got no experience much. It rises and experience is something that probably goes on increasing if we want it to, even past the period where our capabilities peak. So experience can be more valuable as we age and can be applied even though we might be less capable in some respects.

So attending to those two things separately helps us make decisions about whether we’ll stay in the work we’re doing now. Whether we want to engage with different things, maybe volunteer work that we’ve wanted to do, or grandchildren, grandparenting.

Grandparenting of course is increasing because grandparents are around for a lot more. And the studies that are done on grandparenting suggest that it’s very good for you. You actually try and keep your back in order so you can sit down on the floor with them or bend over or whatever. So it seems to have a positive effect on you. It’s not just “Oh my god, we’ve got the little nippers again”. It’s good for you, mostly.

Volunteering’s another one. Volunteering for one thing seems to have a more beneficial impact on us than volunteering for a number. I don’t know this, but I suspect it’s because if you’re volunteering for one thing, you’ll actually get out of bed to do it and get on with the day. If you’re volunteering for many, well they’re probably in themselves not individually as significant.

So even things like that can influence how well and how long even you might live. So that’s part of the approach to our capabilities and our experience. If we nurture both of them, we’re likely to have good outcomes down the track, and we might decide firstly not to stop the work we’re doing or to seek some changes. And so we play to our strengths and not worry about our weaknesses.

So to me, retirement becomes a non-issue. It’s a personal decision about how you redirect and rearrange your life and the notion of there’s a date or a day. Well, yes it might be important if you’re leaving a job you’ve been in for a long time, but other than that I think it falls away. You look at yourself and what you’re capable of, where you want to go and get on with it.

David Williams is the founder of MyLongevity, which helps you answer questions such as ‘how long could I live?’, ‘what can I do about it?’ and ‘what will be my quality of life?’. Click here to take a free SHAPE analysis.

Leave a Reply

You must be logged in to post a comment.