In this guide

For the second year running, investors had a surprisingly good year in 2024 thanks to moderating inflation, economic growth holding its head above water, falling interest rates (just not in Australia) and buoyant share markets.

Despite escalating war in the Middle East and Ukraine, a cost-of-living crisis and fears of a market correction, shares streaked ahead. And as the table below shows, most major asset classes produced positive returns.

The shooting star award goes to cryptocurrency. Bitcoin went through the roof, up 123% on the promise of support from US President elect, Donald Trump. Back in the real world, Australia was a casualty of the collapse in the iron ore price due to China’s sluggish economic growth.

Against this backdrop, super funds had another excellent year. Ratings group Chant West estimates the median Growth fund gained close to 11% in calendar 2024, topping the strong 9% return in 2023 and more than making up for the 4% decline in 2022. It’s an impressive result and, given the wall of worries the markets scaled over the course of the year, further vindication for the benefits of holding your nerve and focusing on long-term financial objectives.

What could possibly go wrong? More on that later.

Calendar year returns to 31 December (% change)

| 2024 | 2023 | |

| Shares | ||

| MSCI World Index (excl. Australia) | +17.8% | +16.2% |

| S&P 500 | +24.2% | +24.7% |

| ASX 200 | +7.5% | +7.84% |

| Interest rates/Bond yields | ||

| Cash rate | 4.35% | 4.35% |

| Australian 10-year bond yield | +0.44% | -0.08% |

| US 10-year bond yield | +0.63% | +0.04% |

| Currency | ||

| $A vs $US | -9.1% | 0.0% |

| Commodities | ||

| Iron Ore | -23.0% | +23.4% |

| Oil (Brent Crude) | -2.9% | -10.2% |

| Gold | +27.4.3% | +13.1% |

| Australian residential property | ||

| CoreLogic Home Value Index | +4.9% | +8.1% |

Sources: Trading Economics, Reserve Bank of Australia, CoreLogic

The big picture

The Australian economy weakened in 2024 as high interest rates began to bite, denting consumer spending and business confidence.

In the year to September, Australia’s economy grew by just 0.8%, kept on life support by personal income tax cuts and increased government spending to ease cost-of-living pressures. A thawing in relations with China and the removal of trade embargoes on a range of Australian goods from wine to lobsters also helped Australia’s bottom line. When adjusted for booming migration and population growth, the economy was in recession on a per capita basis. By comparison, US growth was a healthy 2.7% and while China’s economy was sluggish, it still managed growth of 4.6%.

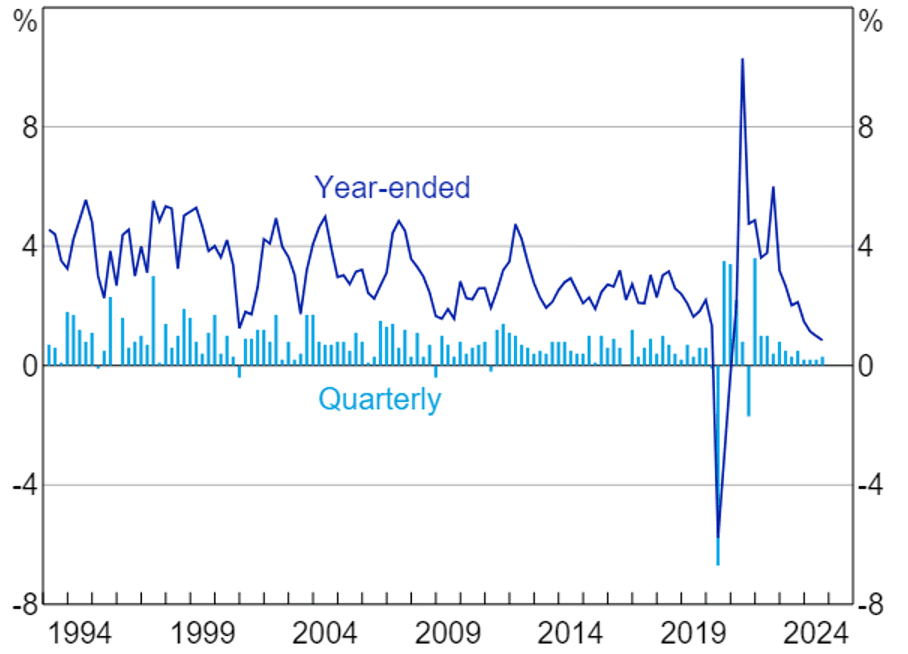

Graph: GDP Growth

Source: ABS

Inflation eases but not tamed

The main bugbear for investors and investment markets was and is stubbornly high inflation, interest rates and bond yields, although the worst appears to be behind us.

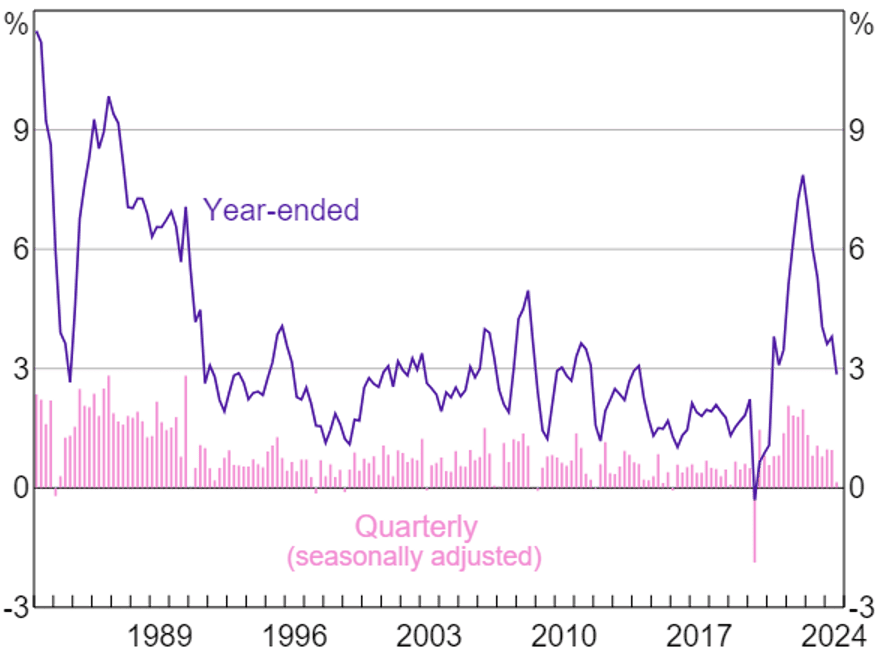

Graph: Australian Consumer Price Inflation*

*Excludes interest charges prior to September quarter 1998; adjusted for the tax changes of 1999-2000.

Sources: ABS; RBA

As a conga line of central banks including the US, UK and Canada began to cut interest rates in 2024, the Reserve Bank of Australia (RBA) held the official cash rate steady at 4.35%. This was despite inflation falling to 2.8% in the September quarter from a peak of 7.8% at the end of 2022 and within the RBA’s target 2-3% range. With unemployment holding steady at around 4% and wages growth of 3.5% finally outpacing inflation, the RBA is waiting for a clear signal that inflation is firmly under control.

The US Federal Reserve cut rates twice, although more cuts had been expected. This was due to resilient economic growth and inflation moving in the right direction.

As hopes faded for faster rate cuts, bond yields rose. Australian and US 10-year government bond yields finished the year higher at 4.41% and 4.58% respectively. As yields rise, bond prices fall, which reduces bond returns.

2026 SMSF calendar

"*" indicates required fields

The strong US economy pushed up the value of the US dollar against most major currencies, including our own.

The Aussie dollar closed the year on a low note at US61.9c, after touching US69c in late September. The differential between Australian and overseas interest rates has narrowed, but the Aussie dollar appears to be a victim of its status as a commodity currency. Commodity prices have fallen on the back of weaker economic growth from our major trading partner, China.

Graph: Australian dollar to US dollar

Source: Tradingeconomics.com

Shares leap all obstacles

The US market was the main driver of share market returns for diversified investors in 2024, with the broad S&P 500 Index up 24% and the Nasdaq up 30%, driven by enthusiasm for artificial intelligence (AI) and tech giants. The US Nasdaq 100 Index is home to the top 100 technology stocks including the so-called Magnificent 7 – Apple, Microsoft, Alphabet (Google), Amazon, Meta (Facebook), Tesla and Nvidia.

The re-election of President Trump boosted sentiment with the promise of deregulation and tax cuts, benefiting stocks like Tesla. A succession of rate cuts by the US Federal Reserve (100 basis points since September) also raised hopes of future economic growth.

Australian shares lagged the US market but still managed a solid performance, up 7.5% amid cost-of-living pressures and stubbornly high interest rates. Tech stocks got a boost from advances in AI, while the banks continued their remarkable rally. Despite their flatish profits and high share prices, the big banks are seen as a safe bet in a geopolitically charged world. Mining companies were among the worst performers in 2024 as China’s economic malaise and the strong US dollar weighed heavily on commodity prices.

When dividends are added, the total return from Australian shares was a healthy 11.4% (as measured by the ASX 200 Accumulation Index).

While Australian share returns put a smile on the dial of local investors, returns from global shares made them positively beam. The MSCI World Index (minus Australia) was up almost 18% on the back of the optimistic mood on Wall Street.

Graph: ASX 200 Index

Source: Tradingeconomics.com

Commodities roller coaster

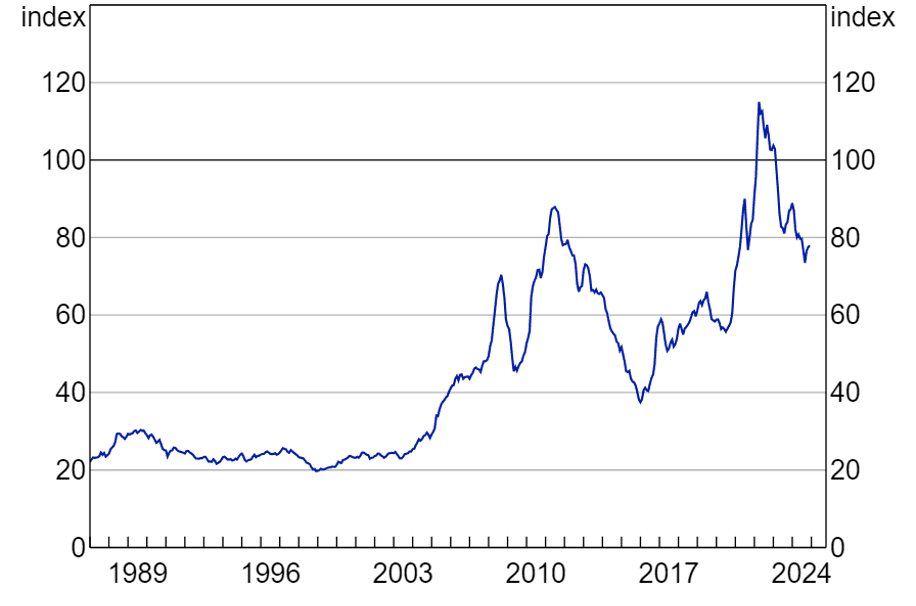

The price of Australia’s major export earner, iron ore, fell 24% in 2024 to US$103.78 thanks to reduced demand from China and the strong US dollar.

This puts Treasurer Jim Chalmers’ 2024-25 Budget on course for a deficit after two surpluses, a difficult position for the Labor government heading into an election year.

The RBA’s index of commodity prices dropped by 10.7% year on year in December, driven largely by iron ore and coking coal prices. In $A terms, the index fell by 7.4%.

Graph: RBA Index of Commodity Prices

SDR, 2022/23 average = 100

Source: RBA

Elsewhere on commodity markets, gold was up 27% for back-to-back annual gains. The yellow metal hit record highs as central banks began cutting interest rates and geopolitical tensions in the Middle East intensified. Gold is traditionally viewed as a safe haven asset in times of political and economic turmoil.

Fears of an oil shock failed to eventuate, despite the ongoing conflict in Ukraine and the Middle East. The price of Brent Crude fell almost 3% to US$74.80 a barrel following the previous year’s 10% slide. Although bad for investors, lower oil prices are good news for motorists who haven’t yet made the switch to an electric vehicle.

And despite its use in batteries for electric vehicles and electronic devices, the lithium price fell about 22% in 2024 on a global surge in supply.

Australian housing market slowdown

Reality finally began to bite Australia’s residential property market as 2024 ended, with high interest rates, cost-of-living pressures and lower borrowing capacity dampening demand and boosting supply. National home values fell 0.1% in December, for an annual gain of 4.9%, according to CoreLogic, down from 8.1% in 2023.

As the table below shows, prices were patchy. Three capital cities – Melbourne, Hobart and Darwin – recorded a decline in values over the year, with Melbourne now Australia’s third cheapest capital city! At the other end of the spectrum, mid-sized capital cities – Perth, Adelaide and Brisbane – recorded double digit annual growth.

Regional housing markets finished the year on a stronger note, with values up 6% compared with 4.5% for capital cities combined, as buyers left the city in search of more bang for their buck.

The heat is also coming out of the national rental market, with rents up 4.8% over the year compared with a hike of 8.2% in 2023. Investors earned a gross rental yield of 3.7% nationally, although yields ranged from 6.7% in Darwin to less than half that in Sydney (3.0%).

CoreLogic Home Value Index as at 31 December 2024

| Annual | Total return | Median value | |

| Sydney | 2.3% | 5.5% | $1,191,955 |

| Melbourne | -3.0% | 0.7% | $774,093 |

| Brisbane | 11.2% | 15.6% | $890,746 |

| Adelaide | 13.1% | 17.3% | $814,430 |

| Perth | 19.1% | 24.5% | $813,016 |

| Hobart | -0.6% | 3.7% | $651,043 |

| Darwin | -0.8% | 7.4% | $496,871 |

| Canberra | – 0.4% | 3.8% | $844,277 |

| Combined capitals | 4.5% | 8.3% | $896,372 |

| Combined regional | 6.0% | 10.6% | $657,652 |

| National | 4.9% | 8.9% | $814,837 |

Source: CoreLogic

The road ahead

There’s an air of uncertainty as 2025 begins, with the world watching and waiting to see what impact the 20 January inauguration of President Trump will have on the global economy and entrenched conflicts in the Middle East and Ukraine.

Trump has vowed to slap tariffs of 60-100% on a host of imports. If he follows through there are fears it could prompt a trade war with China, fuel inflation and prompt central banks to pause interest rate cuts. While his promised tax cuts for individuals and business and a focus on de-regulation and AI could boost US economic growth, they could also be inflationary.

Australia is not expected to be a target of US tariffs, but we could suffer collateral damage from the impact of tariffs on our biggest trading partner, China. Any further slowdown in demand for our commodity exports would put pressure on the federal budget.

All this is taking place as Australia gears up for a federal election which must be held by May this year. The election outcome could depend in part on whether the RBA starts cutting interest rates sooner rather than later, easing the financial pressure on households and businesses. An increase in government spending ahead of the election could support economic growth, but it could also risk fuelling inflation.

And then there’s the local housing market. Any interest rate cuts would improve affordability and bring more buyers into the market, although a shortage of new housing remains a challenge and should keep a floor under housing values in 2025.

That’s the known unknowns. With Donald Trump back in the hot seat, and his business and political allies installed in key administration posts, change and unpredictability is a given.

Even so, if the last few years have taught us anything, it’s to expect the unexpected. One thing we can predict with some certainty, though, is that market volatility and uncertainty are likely to persist in 2025. And that investors with a diversified portfolio tailored to their needs, who maintain a long-term focus and stay the course, are likely to weather whatever conditions come their way.

Leave a Reply

You must be logged in to post a comment.