In this guide

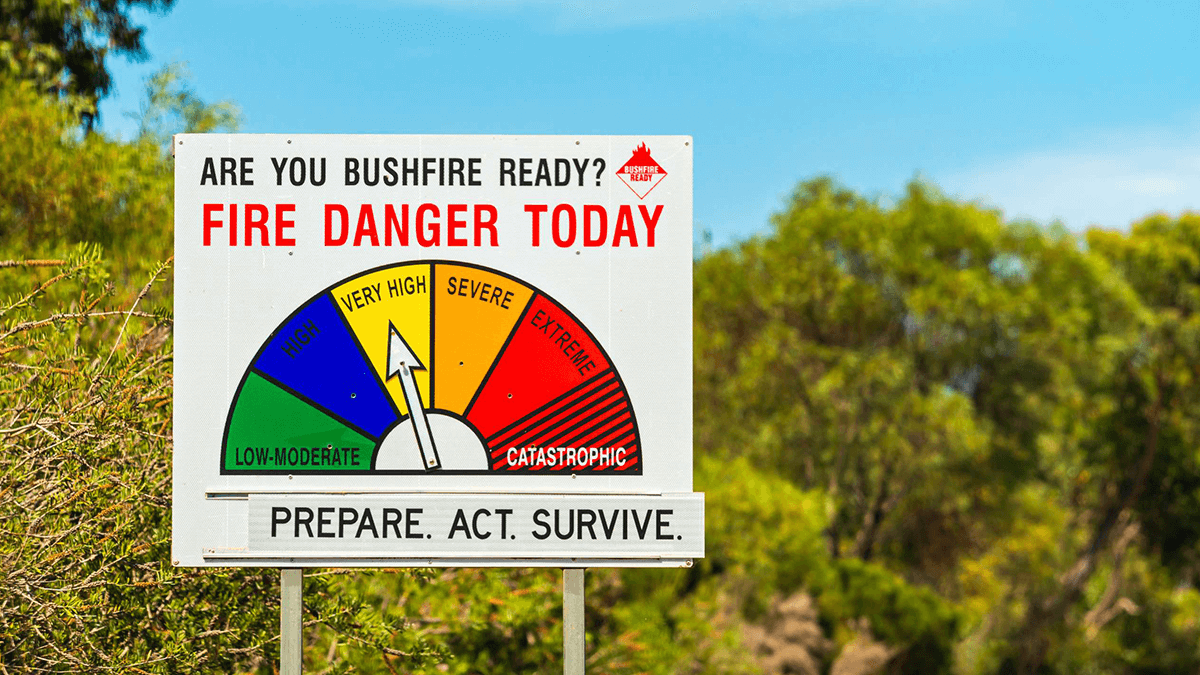

As Australia faces another extremely hot summer, the Australian and New Zealand National Council for fire and emergency services (AFAC) is warning of increased risk of bushfire for many regions of Australia.

“Almost the entire country can expect drier and warmer conditions than normal this spring, so it is important for Australians be alert to local risks of bushfire over the coming months, regardless of their location,” AFAC chief executive officer Rob Webb said when releasing the seasonal bushfire outlook in August.

It is four years since the Black Summer bushfires of 2019–20 but since then there have been 13 declared catastrophes and five significant events, according to the Insurance Council of Australia’s Insurance Catastrophe Resilience Report: 2022–2023. These catastrophes and events have mostly involved flooding and heavy rain.

One demographic group that is overrepresented in many coastal and mountain regions, which are particularly prone to natural disasters, is retirees. That’s because these areas are popular with retirees who relocate from urban areas for a sea change or tree change and a more relaxed and affordable lifestyle.

Along with a comprehensive bushfire or flood survival plan, retirees in these areas should ensure they have an appropriate level of home and contents insurance.

For bushfire survival tips and guidelines, see state agencies such as:

- NSW Rural Fire Service

- South Australian Country Fire Service

- Vic Country Fire Association

- Queensland Fire and Emergency Services

- NT Fire and Rescue Service

- WA Department of Fire and Emergency Services

- Tasmania Fire Service

- ACT Emergency Services Agency

The problem

Home underinsurance is a big issue in Australia, the extent of which is often highlighted during major disasters.

It is difficult to measure the real level of underinsurance in Australia but as a guide, in its Insurance Catastrophe Resilience Report: 2022–2023, the Insurance Council of Australia said there was a total $736 million in claims lodged with insurers for the October 2022 floods in Victoria, NSW and Tasmania. That represented 22,151 claims with an average claim size of $33,000. Although not all claims will be for complete loss and reconstruction, on anyone’s calculation $33,000 is hardly enough to rebuild a home or a business.

Even if a home is insured for replacement value, it could still be underinsured if it doesn’t factor in changes to local council building regulations, the cost of in-demand trades and materials following an event, or potential increases in Bushfire Attack Level rating of a location.

Compounding these issues has been rising inflation which has put upward pressure on insurance premiums.

“The proportion of households in Australia considered to be affordability-stressed increased from 10% in 2022 to 12% in 2023. While no information is available on whether these stressed households purchase adequate home insurance, this population is at risk of being either uninsured or underinsured,” the Actuaries Institute said in its August 2023 Home Insurance Affordability Update.

2026 SMSF calendar

Our free calendar includes due dates for important documents plus suggested dates for trustee meetings and other strategic issues for your SMSF.

"*" indicates required fields

What level of home and property insurance is enough?

Unlike life insurance, total and permanent disability (TPD) and income protection insurance, home and contents cover can’t be taken out via superannuation.

Retirees need to navigate this area carefully and for tree/sea changers it can be difficult estimating rebuilding costs in a new postcode. One of the most common mistakes is to calculate an amount to be insured based on the purchase price of a home. This will be woefully insufficient in bushfire prone areas because of changes to the building code – Building Code of Australia (2010) – which may require things such as bushfire shutters and ember guards to be installed on the house, and water tanks to be installed on the property, depending on the area’s Bushfire Attack Level (BAL) rating.

For potential tree changers, a property’s BAL rating should be an important consideration before purchase. Your state’s rural fire fighting service can help you find out if a property is in a bushfire prone area and you can then use a consultant to determine a property’s BAL rating.

Bushfire Attack Level

| BAL | Description of risk |

|---|---|

| BAL – LOW | Lowest risk from a potential fire. |

| BAL – 12.5 | Risk is primarily from potential embers during a fire. |

| BAL – 19 | Moderate risk, particularly from embers and burning debris. |

| BAL – 29 | High risk, particularly from embers, debris and heat. |

| BAL – 40 | Very high risk. Likely to be impacted by embers, debris, heat and potentially flames. |

| BAL – FZ | Extreme risk. Directly exposed to the flames of a potential fire front. |

Source: NSW RFS

There will be extra costs for rebuilding high BAL rated properties compared to properties with low or no risk, as these properties must be rebuilt with materials that can better evade, or protect against, fire.

Free eBook

How to maximise your Age Pension

Learn tips that help you make the most of the Age Pension so your retirement savings last longer.

"*" indicates required fields

There are also standards for building in flood prone areas that can increase the total cost of construction.

The Insurance Council of Australia has developed a calculator for appropriately valuing the cost of rebuilding your home. The calculator allows for fees associated with a rebuild, along with demolition costs, and is a useful tool for anyone looking to update their insurance.

Some insurers will offer a ‘safety net’ policy, which allows a buffer of up to around 30% if the amount insured is insufficient. A select few insurers also offer total replacement polices – both policy options that come at an additional cost.

How to increase your level of cover

Each year your policy renewal documents will come with an increased insured value for your property, but these values are usually based on inflation, not the extra rebuilding costs you might face. In many cases, you may need to increase your value insured by a much larger amount than the insurer suggests.

To do this, it should be as simple as calling your insurer and asking for the value insured to be increased. It’s a call most insurers will be happy to take, as an increased value insured also means increased premiums for them.

When you make the change, ask your insurer if there is a waiting period. While these usually apply for new policies, they may also apply for upgrades and may mean the extra cover doesn’t kick in until 48 or 72 hours after you increase it.

It is also crucial to read your policy’s product disclosure statement (PDS) to make sure it covers you for everything you need and doesn’t have any odd exclusions for things such as outdoor furniture.

Making a claim

If you are in the unfortunate position of losing your home, it’s important that you make a claim as soon as possible.

A claim can be made on a policy as soon as it is safe for you to return to that property to survey the damage and calculate what needs to be claimed.

Your policy may also provide for accommodation while the property is rebuilt (check the Product Disclosure Statement) and there may also be government allowances available that can help with immediate costs.

In some very limited circumstances you may be able to access superannuation on compassionate grounds if it looks like your property or land is going to be repossessed, but any funds made available would only be to cover a mortgage for a limited period of time. Unfortunately, if the property is still under mortgage, you may be required to use any payout to pay down your mortgage first.

The bottom line

If you haven’t done so already, take this opportunity to pull out your insurance policy documents, review the amount insured and increase it if you need to and can afford it. If you don’t have home and contents insurance, now would be a very good time to consider such a policy.

Free eBook

Retirement planning for beginners

Our easy-to-follow guide walks you through the fundamentals, giving you the confidence to start your own retirement plans.

"*" indicates required fields

Leave a Reply

You must be logged in to post a comment.