In this guide

- Government urged to provide lifetime annuities to retirees

- APRA accepts enforceable undertaking from Cbus trustees

- How much do you need to retire?

- Many retirees paying more tax than necessary

- ASIC warns about fake Bunnings investment bonds

- Women need better retirement advice

- Get more guides like this with a free account

Government urged to provide lifetime annuities to retirees

A new report from the Grattan Institute recommends the federal government encourage retirees to use as much as 80% of their superannuation balance over $250,000 to purchase an annuity.

“Retirees should be guided into a simple lifetime annuity, which would provide a guaranteed level of income for the rest of their lives, and which should be offered by the federal government. The government should also offer a range of annuities, including an investment-linked annuity,” the Simpler super: Taking the stress out of retirement report said.

The report highlighted how many retirees, despite sizeable super balances in some instances, find retirement stressful. A recent survey by CHOICE, for example, found that four-in-five pre-retirees find retirement planning complicated, and 40% find it “very” or “extremely” complicated.

A compulsory government annuity could reduce some of this stress by removing concerns about running out of money.

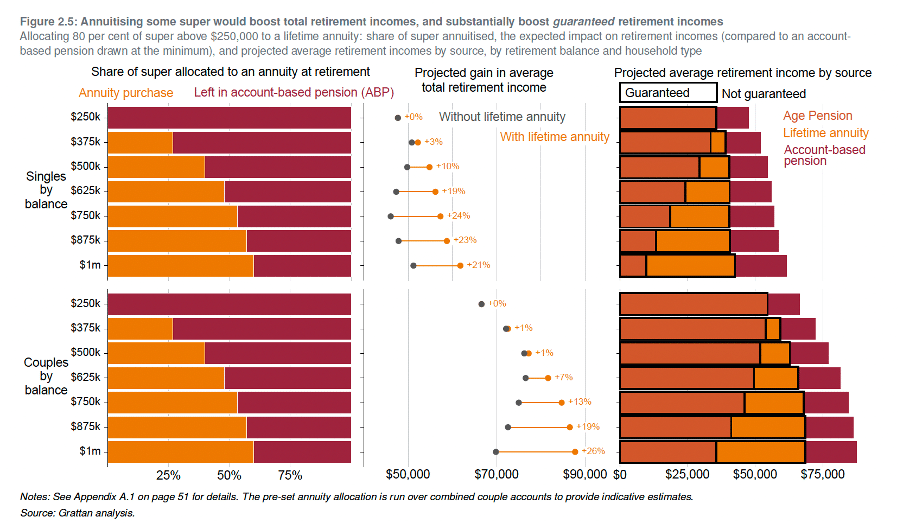

According to analysis by Grattan, allocating 80% of super balances above $250,000 significantly improves retirement incomes for balances above $500,000 where the projected increase in average total retirement income is 10% for singles and 1% for couples.

As the below table from the report highlights, it also improves the reliability of the income, ensuring that most of it is guaranteed, that is, immune from market fluctuations.

APRA accepts enforceable undertaking from Cbus trustees

The Australian Prudential Regulation Authority (APRA) has taken further action against the Construction and Building Unions Superannuation Fund (Cbus) following a prudential review and the independent expert report published in November 2024.

APRA has accepted a court enforceable undertaking (CEU) from Cbus to undertake a holistic risk transformation program to address concerns in relation to Cbus’ risk management and related issues.

Cbus will also publish a rectification plan it has prepared to address weaknesses in governance and expenditure processes identified by an independent review as required under the additional licence conditions imposed by APRA in August 2024.

The regulator said it is also exploring possible breaches of the Superannuation Industry (Supervision) Act 1993 (SIS Act) by Cbus through an investigation with a focus on expenditure management practices.

“APRA expects trustees to have robust governance, compliance and risk management frameworks in place to prevent, detect and/or mitigate potential adverse outcomes such as operational risk incidents. Where an entity’s practices are found wanting, APRA will not hesitate to take action to protect members’ interests,” APRA deputy chair Margaret Cole said.

How much do you need to retire?

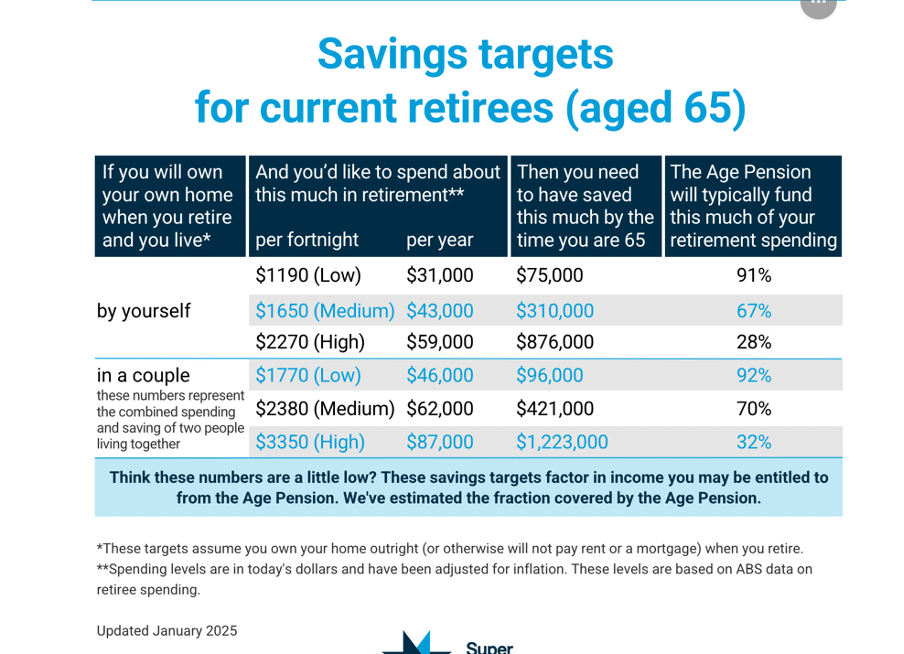

Super Consumers Australia (SCA) has released updated retirement savings targets, which suggest many people may not need as much super when they retire as previously thought.

These new savings retirement targets factor in any Age Pension income people may be entitled to.

For example, a single retiree expecting to spend a relatively low $1,190 a fortnight, would only need $75,000 in retirement savings at age 65. If they want a high standard of living and want to spend nearly twice that much, then they would need to have saved $876,000.

“Our savings targets may be lower than you are expecting because we assume you will receive any Age Pension you’re entitled to during your retirement. How much you receive from the Age Pension will affect how much you need to have saved,” SCA said when releasing the data.

But the new numbers still, like most suggested retirement savings targets, do assume individuals own their own home at retirement, something that is not always possible.

“Consumer advice to contribute more to super is often not realistic for retirees who rent. Much more needs to be done to create affordable housing if more renters are going to avoid poverty in retirement,” says SCA director Xavier O’Halloran.

Many retirees paying more tax than necessary

Up to 700,000 retirees are paying more tax than necessary because they haven’t shifted their super from an accumulation account to a pension account, according to the Super Members Council (SMC).

Income on earnings in pension accounts has a tax rate of zero but that income still incurs 15% tax in an accumulation account.

SMC found retirees still in accumulation could be paying an extra $650 in tax on average. A balance of $200,000 kept in an accumulation account, instead of being moved to a pension account, could cost a retiree an extra $9,000 in tax a year.

“Not knowing enough about super can lead to poor decisions, like leaving accounts inactive or withdrawing funds without proper planning,” SMC chief executive officer Misha Schubert said.

“Making simple information and advice available to more Australians is a big missing piece of the retirement puzzle. The coming financial advice reforms will help make advice more affordable.”

ASIC warns about fake Bunnings investment bonds

The Australian Securities and Investments Commission (ASIC) is warning consumers about scammers impersonating legitimate businesses, such as Bunnings, and offering fake investments.

The operators of these scams set up web pages, which include links to the real businesses’ websites, and are designed to confuse by seeming legitimate. Consumers can be targeted by these scammers via fake websites or direct email campaigns.

“Consumers are offered three investment options ranging between $50,000 and $250,000, with higher than market returns of up to 9% advertised. The scammers claim falsely that the investments are backed by Bunnings and protected under government finance regulations,” ASIC said in the warning.

ASIC says it’s important to remember to Stop, Check and Protect when it comes to investment scams. This entails stopping and not giving out personal information or acting on investment advice given out on social media; checking if you really know what you are investing in via internet searches and ASIC’s website; and protecting yourself by acting quickly if something feels wrong.

ASIC has also recently written to superannuation trustees, urging them to do more to protect their members from scams.

Women need better retirement advice

Women are especially concerned about running out of money in retirement, according to a recent survey by HESTA super fund.

The survey of approximately 1,800 health, aged care and community services workers found two-thirds were worried about running out of money and being able to afford basic needs in retirement, and 61% were concerned about potential health issues or medical expenses.

Half of those surveyed were concerned about not being able to maintain their desired lifestyle, while 30% were concerned about social isolation or loneliness.

“Almost 80% of our members are women and they have diverse needs as they approach or enter into retirement,” HESTA chief executive officer Debby Blakey said.

“Historically, financial advice has not targeted women, and this needs to change. Often, women discover they have more choices than they initially thought and can significantly improve their financial position.”

Blakey said that in the next five years, 14% of HESTA members are expected to retire. Around 47% of HESTA members also retired involuntarily, that is, forced to retire due to circumstances beyond their control.

“It’s crucial women recognise their super is there to support their retirement. Taking an early interest in your super is key to optimising the savings you’ve worked so hard to build,” she said.

Get more guides like this with a free account

better super and retirement decisions.

Leave a Reply

You must be logged in to post a comment.