insurance in super

-

Income protection insurance inside super: Choosing the right level of cover

Your guide to selecting protection that fits your needs and budget.

-

TPD insurance in super: How much is enough? (including calculator)

Permanent disability insurance can provide financial security for you and your family if an illness or injury prevents you from going back to work.

-

SMSFs and insurance: Rules and considerations

Even if you have life insurance outside super or in a pre-existing fund, SMSF trustees are still required to consider their insurance strategy.

-

Should your life and disability insurance be inside super?

We know insurance is important, but choosing where to get the right cover is a minefield. Here are the pros and cons of holding insurance in super.

-

Insurance in super: What to know and how to manage your cover

If you have insurance inside super but you’re not sure how it works, it’s easy to take control once you learn the basics and how to assess your needs.

-

Super funds with the lowest income protection insurance premiums

Income protection premiums continued to increase at a significantly higher rate than death and TPD premiums in 2023, but the cost of cover varies widely.

-

Super funds with the lowest life and TPD insurance premiums

As the cost of living rises, life and TPD insurance premiums inside super have bucked the trend with little or no movement in 2023.

-

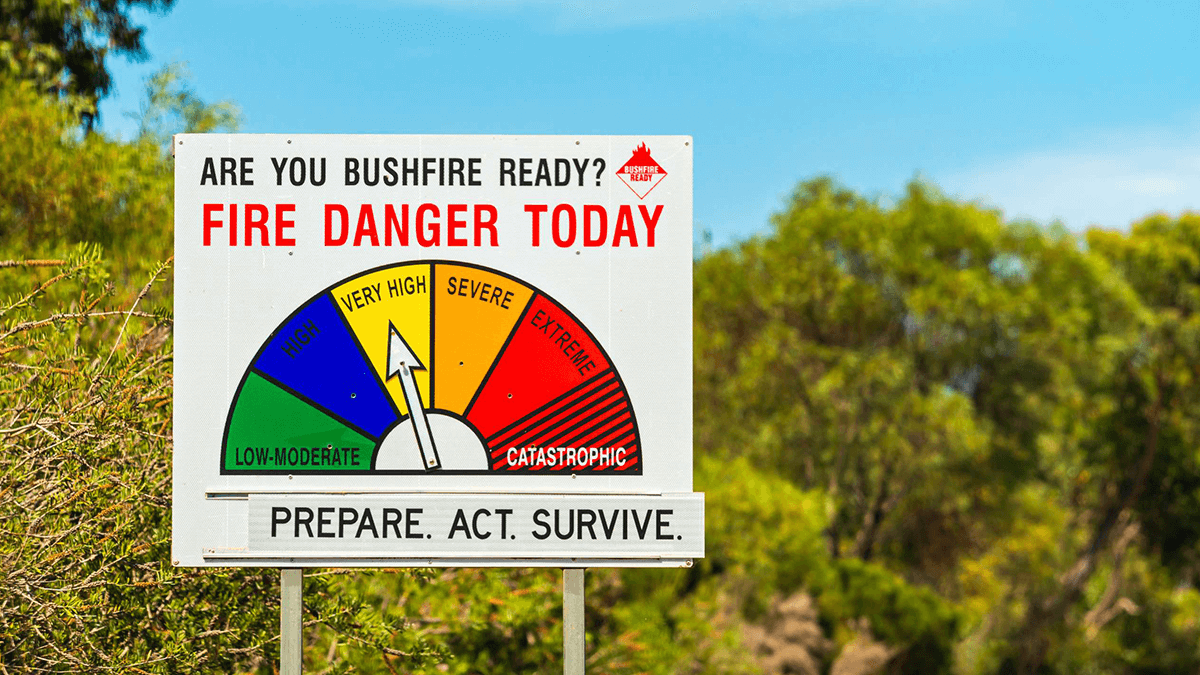

What retirees need to understand about property insurance

An increased risk of bushfires this summer means you need to make sure you have enough insurance in place to cover any losses.

-

Case study: How to reduce tax on your TPD payments from super

If you suffer a total and permanent disability, making the most of any TPD insurance you have in super is crucial.

-

Life insurance inside super: Choosing the right level of cover

Holding death cover through your super fund can be a cost effective way to protect your family and financial dependents and to help pay off your debts if you die.

-

Webinar: Insurance inside super: Is it time for a change?

The pros and cons of holding insurance in your super fund. A look at the requirements and the alternatives.

-

Protecting Your Super package: What you need to know

The Protecting Your Super Package of reforms start on 1 July 2019. These reforms are designed to protect your super accounts from being eroded by insurance policy fees and premiums that you may not require, as well as help to consolidate your low balance super accounts.