In this guide

As a first step in addressing the gender inequality in Australia, the 2022–23 Women’s Statement in the October 2022 Federal Budget provides an up-to-date snapshot of issues in which gender still plays a part in creating unequal outcomes for Australians.

Issues covered include health and wellbeing, employment opportunities and remuneration, and preparedness for life after work.

Many of these issues are interconnected, resulting in Australia ranking 43 out of 146 countries in the World Economic Forum’s Global Gender Gap Index, according to the Statement.

This article focuses primarily on issues with an economic dimension, particularly as it relates to superannuation and retirement planning.

What is the current disparity in superannuation?

The Women’s Budget Statement reiterates what numerous other studies have found, including Treasury’s Retirement Income Review of 2020.

When it comes to the accumulation of super, there is a sizable difference in outcomes between men and women. The Statement reported a median super balance for men of $56,000 and $45,000 for women, a gap of 24%.

And these are medians, meaning half of the 9.1 million men currently with super accounts had a balance less than $56,000, while for the 8.5 million women with super, half had a balance of less than $45,000.

When adjusted for different age groups (cohorts), median balances increase with age. According to the Statement, the median super balance at retirement (taken to be age 65) is now $189,000 for men and $167,000 for women, a gap of 13%.

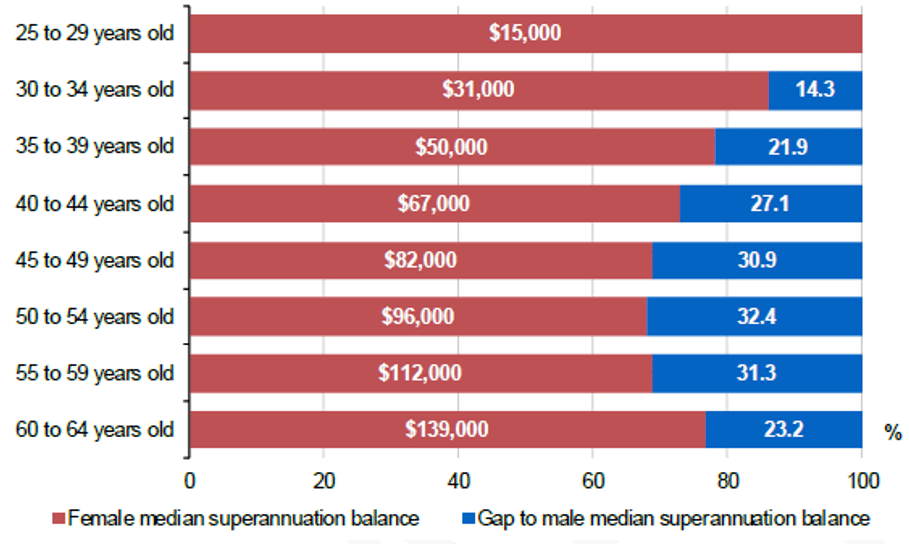

The chart below shows the median female super balance across different age cohorts, as well as providing the gap (in blue) to the equivalent male balances.

Female median super balances by age cohort (and gap to males as a percentage)

Source: Women’s Budget Statement 2022–23, Budget Papers (note the median balance is calculated based on those with a super balance)

The latest Intergenerational Report by Treasury, updated in 2021, projects that the gender gap in super balances will narrow slightly over time with the maturation of the super system and greater female workforce participation. By 2061 the gender gap in median super balance at retirement is forecast to be around 10%.

Why the gender disparity in super outcomes?

The Women’s Budget Statement identified a range of factors that impinge on women’s economic equality, and the ability of females to reach superannuation parity with males over the course of their working lives.

Women’s workforce participation

Despite the high levels of current employment, women lag men in the labour force participation rate, with a gap of 8.7 percentage points (62.3% for women and 71.0% for men).

Women also work fewer hours than men, with twice as many women in part-time employment. Further, the underemployment ratio (the percentage of workers who would like more hours) is greater for women (at 7.4%) than it is for men (5.2%).

Women’s participation also drops significantly from age 55, with women aged 55 to 64 less engaged in the labour market compared to men of an equivalent age.

Gender pay gap

The second factor driving superannuation disparity is the gender pay gap. The Workplace Gender Equality Agency (WGEA), the authority that measures gender pay, currently estimates the national gender pay gap in Australia at 22.8%. In dollar terms, women earn $25,800 per year less than men, on average.

The less women earn, the less Superannuation Guarantee contributions their employers are required to pay. This compounds the economic gender disparity significantly over a working life.

The motherhood penalty

Another factor identified by the Statement in driving unequal economic outcomes between the genders is the division of unpaid work and parental responsibilities, known as the ‘motherhood penalty’.

Research by Treasury has found that women reduce their hours in paid work by around 35% across the first five years following the arrival of children. In contrast, men’s hours drop only during the first month of parenthood, before returning to previous levels.

Further, Treasury estimates women’s earnings are reduced by an average of 55% in the first five years of parenthood, and that this motherhood penalty remains significant even a decade into parenthood. This primarily reflects the disparity in new mothers reducing their paid work hours (or exiting employment altogether). Men generally experience no long-term impact on earnings following the arrival of children.

What are the government’s plans to address the gender discrepancy?

The Women’s Budget Statement highlights several measures, many of which were released as Budget announcements, aimed at reducing the structural barriers to economic equality between the genders.

Expanding the Paid Parental Leave scheme

The key Budget announcement, and one aimed at addressing the ‘motherhood penalty’, is an expansion of the Paid Parental Leave (PPL) scheme.

The PPL scheme, first introduced in 2011, currently provides two payments for eligible carers of a newborn or recently adopted child. PPL is available for up to 18 weeks for the birth parent, while Dad and Partner Pay is available for up to two weeks to fathers and partners.

The Budget announced an expansion of the PPL to families from 18 weeks to 26 weeks over four years, starting with a rise to 20 weeks in 2023–24.

Importantly for gender equality, the current requirement that the primary claimant must be the birth parent will be removed. Families will be able to decide which partner claims PPL first. Single parents will be able to access the full 20 weeks.

As a further incentive for men to consider PPL, the reformed scheme will reserve a dedicated ‘use it or lose it’ portion for each parent.

It should be noted, however, that PPL does not have to include super (although employers can voluntarily make Super Guarantee contributions) and there are no plans to change that with the Budget announcement. Many super funds, while welcoming the PPL expansion, have expressed disappointment at the scheme continuing to exclude an SG element.

More affordable childcare

In addressing the barriers to women’s participation in the workforce, the key Budget announcement is a package aimed at reducing the high cost of child care and early childhood learning.

The main element of this package includes $4.6 billion over four years from 2022–23 to increase Child Care Subsidy rates for families earning less than $530,000 with children in care.

From July 2023 the rates will lift from 85% to 90% for families earning less than $80,000. Subsidy rates will then taper down one percentage point for each additional $5,000 in income until the $530,000 threshold.

With 72,600 Australians reporting being out of the workforce due to the high cost of childcare, it is hoped this measure will help some of them reconnect with the workforce and improve their financial security in later life.

The gender pay gap

In tackling the gender pay gap, the government is focusing on data collection and transparency, making it easier to identify industries, sectors and companies that may be lagging in addressing the issue.

The public sector will be required to set targets to improve gender equity, reporting the results to the WGEA. Businesses with 500 or more employees will similarly be required to commit to, and report to WGEA, targets in their workplaces. The public reporting of gender pay gaps will be extended to businesses with 100 or more employees.

WGEA’s data collection remit will also be expanded to more accurately capture the pay gap that exists in workplaces for First Nations and culturally diverse women, as well as women living with a disability.

The Government is also aiming to include a right to super within the National Employment Standards. This will give workers, including women, the power to pursue their unpaid super as a workplace entitlement.

Ways women can improve retirement outcomes

The Women’s Budget Statement is an acknowledgement of a range of factors that currently result in women in Australia being at a relative disadvantage to men in saving for their retirement years.

It is therefore even more important that women are aware of, and access, every possible opportunity to level the playing field.

These will depend on individual circumstances such as age, income levels, relationship and/or parental status, and housing circumstances (particularly closer to retirement).

To help you understand the range of opportunities and strategies available to you, wherever you may be on your journey from first job to final retirement, we have prepared a comprehensive guide for women on how to beat the odds, shrink the super gender gap and maximise your chances of retirement security.

The super gender gap is real and persistent, but with SuperGuide’s tips and strategies above, you can bend the odds of closing it in your favour.

Get more guides like this with a free account

better super and retirement decisions.

Leave a Reply

You must be logged in to post a comment.