Jubilacion

- Autopilot is not a plan

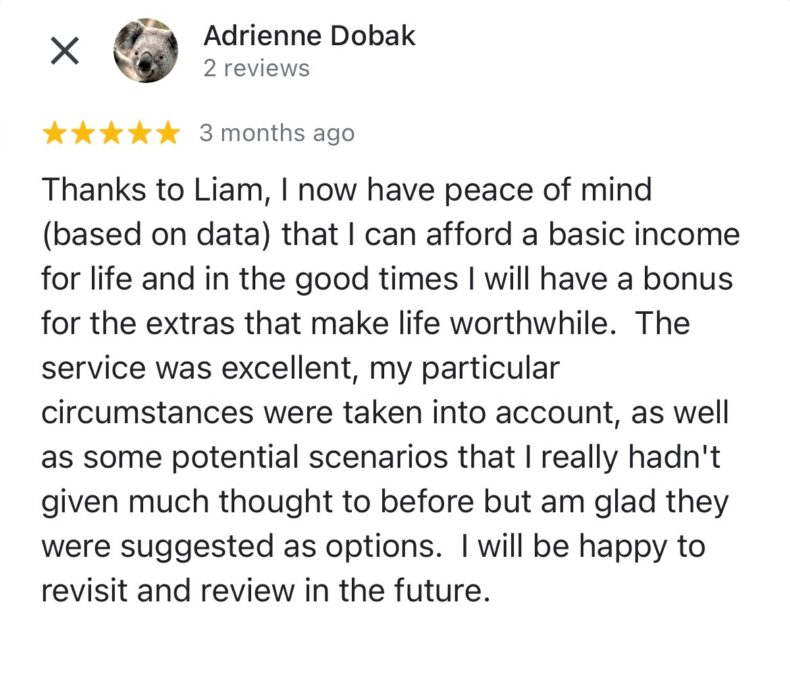

You want to retire well. You want to retire on your terms. You want peace of mind that you’re OK to live comfortably in your golden years. Retirement planning involves living off your nest egg and that requires careful consideration. It’s not something that can be put on autopilot and forgotten about. - Join others in achieving retirement confidence

Plan your future with confidence and focus on what matters most— your family, home, and desired lifestyle. Our impartial retirement plan modelling, trusted by Australians like you, not only secures your financial foundation but builds the trust you need to plan for your future confidently. - Safety in numbers

Our rigorous, modelling-based service is overseen by experienced actuaries. Each customer gets expert guidance and accurate financial projections without the pressure of investment product selling, so you can enjoy your retirement with confidence. We provide the answers you need to confidently plan for the lifestyle you desire in retirement.

Used by Australians like YOU

We help people enjoy their retirement with confidence

“Life on my own terms” – Lachlan, QLD

Lachlan was an Assistant Principal at a local school. He wanted to know when he could transition to part-time as he loved teaching but not the pressure his role also came with. He aimed to hit a super balance that would let him cut back his hours. Jubilacion calculated the super balance target he needed to secure the lifestyle he sought, with confidence. His consultant answered his questions about how different scenarios, such as working full-time for longer, would impact his plans. Lachlan confidently retired from his assistant principal role and now thoroughly enjoys part-time teaching, with a more balanced and satisfying lifestyle.

“It’s life on my own terms. I don’t see that I’ll stop working, but I am very, very keen to stop working as much. I just wanted someone independent and qualified to be able to make sure that I was on the right track, which gave me the confidence to back myself with when I could cut back on work.” – Lachlan.

Experience peace of mind and financial security with Jubilacion’s expert cash flow planning. Make informed decisions and look forward to retirement knowing your plan enables you retire on your terms.

Our approach to retirement planning puts your future first

Achieve financial independence

Our goal at Jubilacion is to fill a gap- helping everyday Australians retire comfortably and achieve financial freedom. Through expert retirement modelling, we determine the amount of money you need to retire comfortably and help you achieve the lifestyle you desire. It’s not about ‘picking winners’. It’s about making informed decisions and, potentially, making trade-offs. With our guidance, you can plan for a secure future.

Transitioning into retirement

Retirement doesn’t have to be a sudden change; it can be a gradual transition, and at Jubilacion, we understand that. Our professionals can work with you to ensure your plan safely allows a smooth transition into retirement. We’ll help you understand your options as you gradually reduce the amount of time spent working and ultimately reach full retirement.

Empower yourself

Retirement planning doesn’t have to be overwhelming or intimidating; instead, it can be an empowering journey towards financial freedom. With our expert financial projections, we aim to give you the knowledge and tools needed to take control of your retirement and confidently make life’s decisions such as when you can end work and what lifestyle you can afford. We want you to feel empowered and secure in your retirement planning, knowing that you have a bullet proof plan in place for your future.

Take the guesswork out of Retirement Planning

How we work

Our rigorous approach provides the answers that online retirement calculators make you guess. E.g. how much money you need saved and what lifestyle you can safely afford taking into account your complete financial position, choices, and risk.

Why consider risk?

Because risk has the most significant influence on your long term cash flow. Nobody knows how long they will live or what markets will do. The industry as a whole is not using tools that adequately consider risk for retirees. As Actuaries, risk is at the core of what we do.

Here’s how our service works

We start with your current situation

- Your age and work status

- All current assets (including properties), income and liabilities

Then we model your life choices and likely plans

- Retirement age

- Saving level before retirement

- Cost of living in retirement

- Larger cashflow items like property and inheritance

We stress-test the model thousands of times

- Market scenarios

- Lifespan scenarios

- What-if questions or scenarios you want to explore

This gives you credentialed answers and confidence

- A presentation report

- Results that take probability into account.

- Insight into which decisions matter most for you.

- Confirmed safe-spending level: The amount we calculate you can spend per annum, indexed to living costs, to be 95% confident it can be sustained for life through all market conditions.

The difference between guesswork and rigorous modelling can be thousands of dollars each year

Jubilacion: What you get

A report that includes:

- a summary of your full, high level financial situation today

- explanation of the most important topics that will influence your retirement finances over the course of your life

- an overview of the techniques (actuarial) that we use to enable you to make safe decisions, confident your money will last for life – even if you life a long time and/or markets fall

- assessment of your life expectancy and possible range for how long you (and your spouse) could live

- projections of all your main cashflow sources in retirement (super, age pension, rent, interest, dividends, allowing for your various spending decisions over time) to make sure they last

- projections of your net wealth for life, and what bequest will remain under different scenarios

- this can all be done for several scenarios you might like to explore like working longer, retiring sooner or large spending/property decisions. We can also test the impact of different investment strategies (e.g. allocation to growth assets) on your results

Your video consultations with a specialist will include:

- getting to know you and understanding your financial position properly

- explaining key concepts eg about retirement risk and the most relevant superannuation/tax/age pension rules that apply to you

- sending you objectively ascertainable resources on key topics that impact you (eg links to the ATO website, ASIC Moneysmart site or Centrelink)

- helping you understand and interpret your results. Making sure you get the answers you need to your big questions like:

- Do we have enough?

- Can I afford to retire when I want to?

- How much do we need to save?

- What lifestyle can we afford?

- Discussing and interpreting any ‘what-if’ scenarios you are interested in or would like to explore and questions you may have. A common example is whether you need to work longer to secure a safer or more luxurious retirement. (But please note we do not provide any investment product recommendations, opinions or suggestions in any way. We focus on strategic modelling but we are not licensed financial product advisers – see our FAQ).

Frequently asked questions

A priceless investment in your future

The confidence and empowerment from spending a relatively low fixed fee for our service is invaluable. You’ll likely have a budget for maintaining your home and physical health. It’s crucial also to budget to help keep your finances in healthy shape.

SuperGuide members receive 15% off – you pay $1,657 (discounted from $1,950).

That includes:

- Three face-to-face meetings and a detailed report of your cashflow and projections throughout retirement.

- Meetings to discuss and explain your results with the ability to ask questions and get further information on the most critical topics to your situation.

- Answers to how much you need to retire and/or what lifestyle and spending you can achieve in retirement with confidence you won’t run short.

- Identify the ‘levers’ you have to control and improve your results.

Our Promise

- 30-day money-back guarantee. If you aren’t satisfied with our service, we will refund you in full.

- Qualifications you can verify here and staff profiles you can see here

- We use plain language. We explain and simplify the rules and encourage you to ask questions

- We carry out 1:1 meetings via secure video calls – in the comfort of your home or workplace, where you (and your spouse, accountant or financial planner if you wish) can attend

- We provide you with links to objectively verifiable sources of further information about topics that are relevant to you