SuperGuide – Superannuation and retirement planning information

Latest features

How super works

Super funds

What makes SuperGuide different

For the last 15 years we’ve been uniquely placed to help Australians make the most of their superannuation and achieve their retirement goals

We’re independent

We’re not funded by a financial organisation or the government, so have no hidden agenda. You can trust our unbiased guides to help you maximise your retirement savings.

We’re experts

Our team of superannuation and finance experts share insights and simple steps you can make to take control of your super and achieve your retirement goals.

We’re comprehensive

With an exhaustive library of over 500 fact-checked resources and articles, SuperGuide has everything you need to navigate the complexities of superannuation and retirement.

SMSFs

Retirement planning

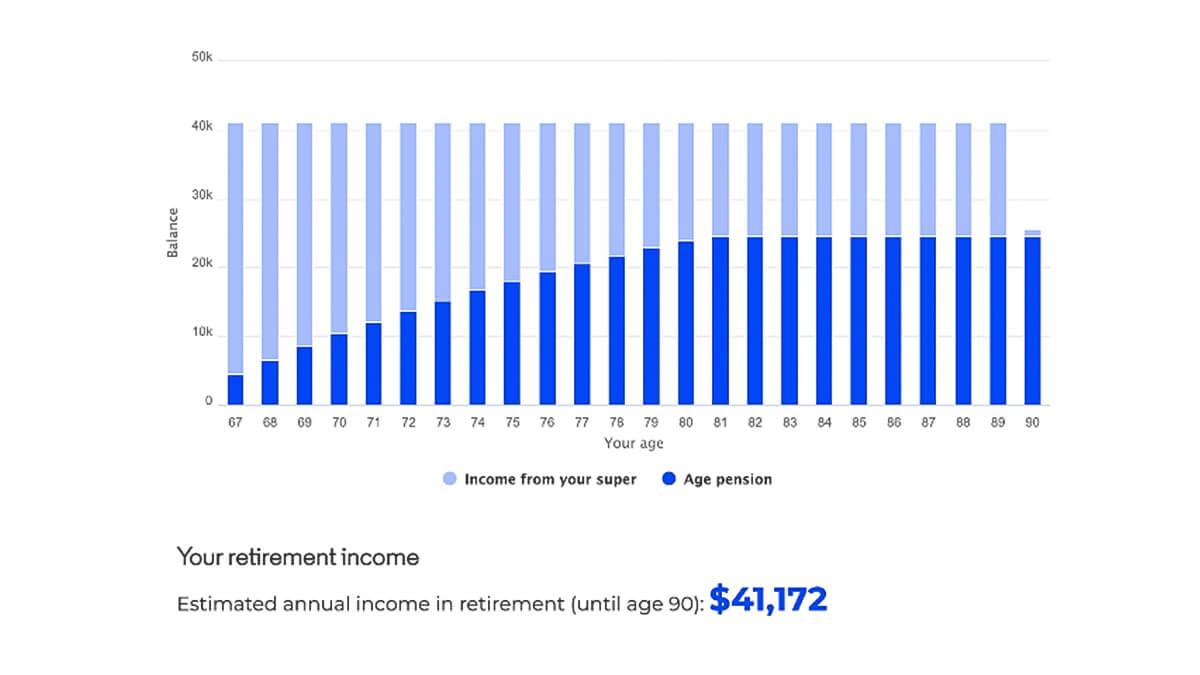

Make your retirement goals a reality

Join SuperGuide, Australia’s most trusted guide to superannuation and retirement planning

In retirement

Popular features